Commercial banking customers value the human relationships they have with bank employees, who provide advice, support and warnings about potential problems. Customers are looking for relationships based on empathy, responsiveness, customer focus and efficient service. Advances in artificial intelligence (AI) and tools that analyze data from multiple sources to provide valuable insights can endow bank employees with “superpowers” to help them provide their customers with service that goes far beyond a traditional one-size-fits-all approach. But as we identified in our report on Commercial Banking Top Trends for 2022, for this to happen, employees need to have those AI-powered tools at their fingertips, and they need to be easy to use.

Powering faster decisions and proactive monitoring

AI insights are transforming loan origination processes for banks that implement the latest tools. Using customer data and autonomous credit decisioning can significantly speed up the decision-making process and provide customers with loans faster. Automating much of the process using AI also frees up employees to focus on more complex tasks, which will improve both customer service and employee satisfaction as paperwork and routine tasks take up less time.

Relationship managers (RMs) are a key connection between the bank and its customers. Without robust insights, RMs are left reacting to their customers’ requests when they need something, or when something has already gone wrong. With the right data analysis tools, and the knowhow to use them, an RM can see problems on the horizon before the customer is even aware of them. The proactive RM can then alert their customer to the potential problem and propose a solution or a way to avoid the problem. As opposed to saying, “I think you’ve got a problem,” the RM says, “let me help you solve for a problem that may be emerging.” It’s a fundamental shift in the relationship. When the customer is not facing problems, an RM equipped with the right insights can anticipate which products and services will help the customer’s business grow and thrive.

More than 60% of SMEs value their RM’s understanding of their business and their personal relationship with them.

Using AI insights, credit monitoring doesn’t have to be an annual or quarterly event based on financial statements. Instead, it can leverage data that’s accessible out in the marketplace: industry-level data, macroeconomic drivers, scenario analyses, specific information around customer sentiment and customer reviews.

The same AI advantage applies to ongoing portfolio management, which can replace time-consuming regular reviews. Bringing all that data together in a usable form can help drive a whole new way of looking at proactive monitoring that can be event-driven. This way, the bank stays on top of the situation at all times, and can respond quickly and thoroughly to customer enquiries.

Commercial Banking Top Trends in 2023: Explore the 6 critical trends every commercial banker should consider as they plan for the year ahead.

LEARN MORETwo-way communication

As anyone who has been stuck in an endless voicemail loop can tell you, automation doesn’t always improve service levels. Customers need to know that their bank is listening and interested in their individual needs. Customer expectations have changed, and two-way communication is absolutely fundamental to building a strong relationship.

Technology cannot replace the human touch. Rather than replacing employees, AI tools should empower them to better serve their clients. Customers are looking for high-value conversations that support their business needs, faster delivery of services and more personalized offers and assistance.

There are now tools and techniques, often provided by third-party cloud operating systems like nCino, that allow bank employees to sharpen their focus on the two-way value exchange they’re having with clients (for example, throughout the loan approval process). Lisa Frazier, COO at Judo Bank, explains how Accenture’s delivery of the nCino system has helped their employees gain valuable insight into their customers. She says, “We’re a young company with an ambitious agenda to support SME customers. We didn’t want to get caught up in bureaucracy that didn’t deliver. Having the right partner was key. Accenture has been important for us—we needed that capability.”

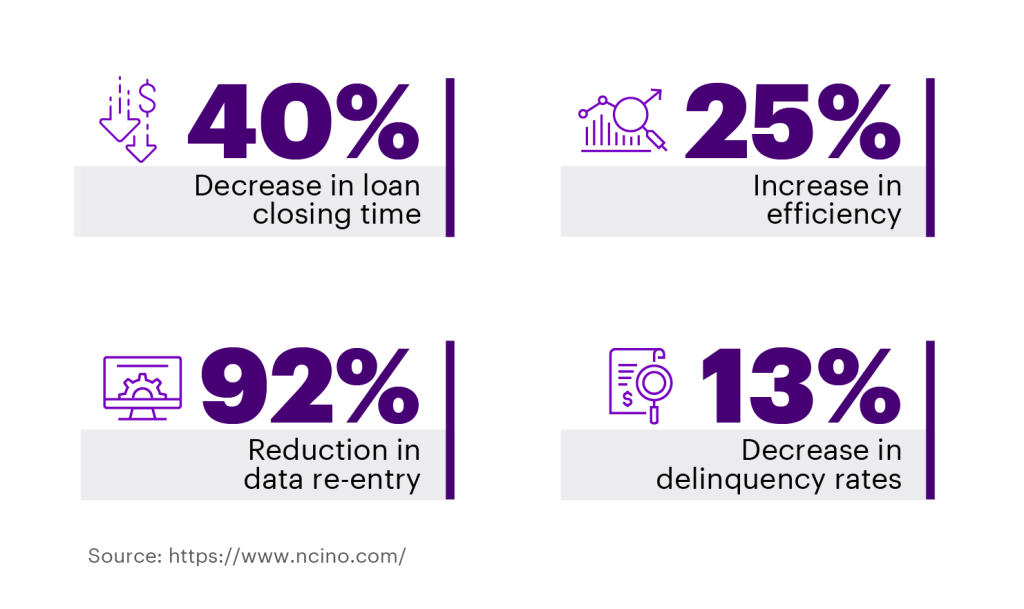

Banks that implement nCino see impressive results

Good for customers, good for banks

This is an exciting opportunity for commercial banks—one we’ve all been talking about for a while but is now becoming a reality. Banks are starting to think about data as a product that can be consumed by various applications and employees in many different ways. More personalization and empathy for customers are becoming very attainable goals. Some of banks’ most predictive data is either underused or not used at all today, because the tools that bring it together and make it meaningful have not been implemented. We’re only scratching the surface of what we can actually do with the available data. Banks that make the most of the AI tools at their disposal can lead the way when it comes to empowering their employees and raising the bar in customer service.

I’ll host a discussion with bank executives on maximizing your nCino investment at the nSight 2022 conference on June 8th. Read the following brief summaries of our conference sessions, then reach out to our subject matter experts for more information.