Generative AI: what’s in it for me? Everyone, including auto and equipment finance providers, wants to know. The way I see it, it’s a technology that will have far-reaching impacts on the lending and leasing business, bringing efficiencies and better experiences for those organizations that incorporate it across the value chain.

A few weeks ago, I put ChatGPT to the test myself. I needed to write a new bylaw for the board of a non-profit I sit on, and I was curious to see what ChatGPT would come up with. Did it generate a perfectly formed bylaw that I could use as-is? It did not. But it did give me an excellent starting point and significantly reduced my time on the task—by my estimate it saved me several hours. With some finetuning and the addition of details specific to our situation, it helped me write a very usable document that I was able to take to the board.

By now, auto and equipment lenders and lessors have probably heard hundreds of anecdotes like this. But you’re probably still wondering whether it’s worth implementing generative AI or if it’s just the latest flash in the pan that will quickly be replaced by some other cool new technology.

To answer this question, let’s look at four areas of the auto and equipment finance value chain where my colleagues and I see generative AI being invaluable.

Pre-originations and originations

In Michael Abbott, Jess Murray and Keri Smith’s recent post on the Accenture Banking Blog, Breaking Barriers: Exploring How Banks Scale Generative AI for Growth, they noted that early adopters are already exploring the use of generative AI for marketing. The idea is to use it to scale hyper-personalized marketing content, so that every customer communication is more relevant.

My Specialty Finance Center of Excellence colleague Abhishek Rastogi agrees that generative AI could be a huge boon for auto and equipment financiers’ marketing campaigns. He suggests using data and AI to better target marketing campaigns by analyzing customers’ preferences and wants—for improved conversion rates and higher revenue.

Generative AI could also be used as a sales assistant. With human-sounding interactions combined with its analysis capabilities, it could help answer customer questions directly, or score and segment leads to help sales reps prioritize their efforts. It could also point out opportunities for cross-selling.

Recently my colleague Bailey Carrigan helped one of our clients, which has an equipment leasing portfolio, identify proactive marketing and cross-selling opportunities. Using AI to assist with data analysis, her team was able to recognize patterns that the client could use as a foundation for enhancing the marketing of equipment finance products—launching the next decade of growth and profitability.

Underwriting

Auto and equipment lenders and lessors are always searching for ways to make underwriting better, faster and cheaper. I think generative AI could play a large role in helping financiers view and analyze credit in new ways.

When Abhishek and I were speaking about this, he suggested that generative AI could become an underwriter’s assistant. What would that look like? The AI would verify the customer’s information, analyze their repayment history, earnings / financial ratios, employer details, credit ratings and exposure, and consider marketing information and news reports before auto-generating a credit assessment report. It could also interact with the underwriter to perform additional checks and auto-update the credit assessment report based on those findings.

Generative AI could also be used for pricing analysis. Based on similar credit scores, loan to value, financial performance, previous loans written and closed, and risk, it could provide the optimal pricing for the current contract. This would free considerable bandwidth in terms of time spent by a human underwriter or investment in a separate pricing system.

Servicing

Variable workflow management is another common challenge faced by auto and equipment lenders and lessors. Because of the cyclical nature of this business, and the need for monthly and quarterly reporting, financiers experience resourcing bottlenecks several times a year. Our clients often ask for our help in streamlining workflows and finding ways to backfill positions with resources from other parts of the organization to help during these exceptionally busy times.

Generally, we work together to implement a combination of technology and cross-training strategies to fill the gaps. But with generative AI, I expect variable workflow management to be less of an issue. AI can support the human workforce by performing the repetitive manual tasks significantly more quickly, thereby reducing the staffing variability and freeing up people for higher-value work where the human connection is a priority.

As more and more leases are bundled with a contract for service and maintenance of the asset, we know generative AI will also become an invaluable tool for predictive maintenance. AI models can predict when an asset is likely to fail and schedule its maintenance accordingly. This will reduce downtime costs for the financier as well as protect the resale value of the asset—and improve the experience for customers.

Generative AI will also be useful for fleet management. It can be used to monitor and manage driver behavior, track the location and status of vehicles, check insurance policy expiry dates, file claims and follow their progress. Further, it can generate reports on fleet and claims management, analyze data and recommend opportunities for improvement and increasing profitability.

End of term

End of term is one area of leasing where I see another gap that could be filled by generative AI. I’m always surprised at how few—if any— lessors take advantage of the wealth of information at their fingertips to make data-driven decisions at this critical time in the financing life cycle. In many cases, financiers don’t even use a spreadsheet to optimize their end of term, let alone sophisticated analytics tools.

Think about the case of a copier leased to a customer for 36 months. At the end of the term, as a lessor, how do you maximize the return?

- Do you make an offer to the customer to keep the copier in place?

- Do you bring the copier back and sell it?

- Do you extend the term or accelerate it?

With the help of generative AI, you could answer these questions and make the optimal choices for your business.

Another data point that could have a huge impact on end-of-term decisions for auto financiers is how the color of a vehicle affects its depreciation and resale value. A survey by iSeeCars.com found that yellow, beige and orange bring the most money when it’s time to sell, although with some variance depending on the vehicle segment. Generative AI could use this information in combination with other factors—like mileage, wear and tear, geography and time of year—to determine the best time to sell an off-lease vehicle and whether it’s worth repainting it before selling.

AI could also help with end-of-lease inspections. It could analyze vehicle photos to assess charges for excess mileage, damage, and wear and tear, and auto-generate vehicle inspection and damage estimation reports. It could even interact with the customer to negotiate the charges and assist them in the vehicle return process.

The technology could also help lenders and lessors focus their retention efforts by predicting which customers are most likely to churn. And it could personalize offers for customers based on their individual needs, and their preferences for cars with more space or lower monthly payments, for example.

The use cases for generative AI at end of term are so numerous that my prediction is the whole end-of-term process will be automated in the next few years.

The bottom line

These are just a handful of examples out of hundreds that illustrate how generative AI is going to change the way auto and equipment finance companies work. It’s like Paul Daugherty and team say in their report, A New Era of Generative AI for Everyone: “The technology underpinning ChatGPT will transform work and reinvent business.”

Another point from our new report that hit home for me: “We’re at a phase in the adoption cycle when most organizations are starting to experiment by consuming foundation models ‘off the shelf.’ However, the biggest value for many will come when they customize or fine tune models using their own data to address their unique needs.” For auto and equipment lenders and lessors that have decades of data to mine, customizing generative AI’s foundational model and training it to finetune its analysis based on your own datasets will be a key competitive advantage.

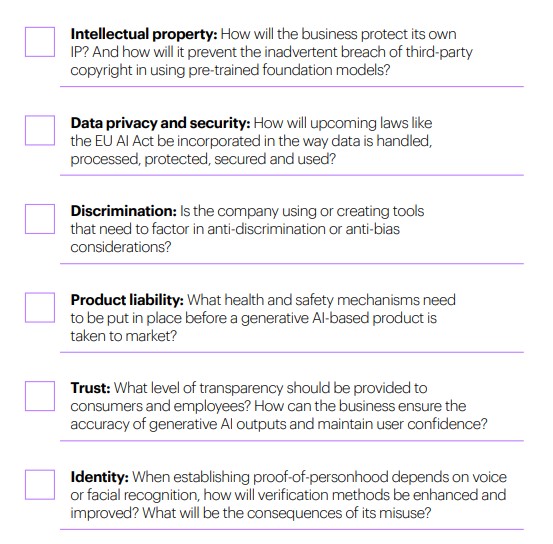

Of course, using generative AI is not without risk. In that same report, the authors identify the following six key risk and regulatory questions for potential users of generative AI:

My banking colleagues add three additional risks to this list: model hallucinations (credible-sounding answers that may not be accurate), black-box thinking (no way to know how the generative AI came to its answer), and biased training data (output quality is only as good as the source material).

Nevertheless, it’s my opinion that generative AI will bring untold advantages to auto and equipment finance organizations, especially those with the foresight to use it in combination with their vast stores of underutilized data.

Early adopters are already exploring use cases in these areas of the finance value chain. Will you be one of them?

If you’d like to discuss how your finance business could uncover new efficiencies across the value chain by incorporating generative AI, please reach out to me.

Also, I highly recommend reading this Accenture report written by Paul Daugherty and colleagues: A New Era of Generative AI for Everyone.

Special thanks to Bailey Carrigan, Accenture Equipment Finance Senior Manager, and Abhishek Rastogi, Accenture Auto and Equipment Finance Business and Integration Manager, for their generous contributions to this post.