Unless you’ve been living under a rock for the past few years, you’re aware that global trade and supply chains have been facing a series of challenges, from lockdowns to inflation, from geopolitical upheaval to the transformational power of generative AI. Are these short-term challenges for the industry, or is there a need for permanent evolution to adapt to a new reality? And what role should banks be playing to keep global trade moving efficiently?

Accenture undertook research on trade finance by surveying 675 global trade and supply chain finance clients. Our report, “Find Your Competitive Advantage in Trade Finance,” details the breadth of challenges that are causing businesses—especially newer and smaller businesses—to look for modern, efficient financing solutions from banks, and to turn to fintechs where their banks are falling short. Banks still play a dominant role in trade and supply chain finance. Addressing today’s challenges in innovative and targeted ways will help sustain this dominance and keep customers satisfied.

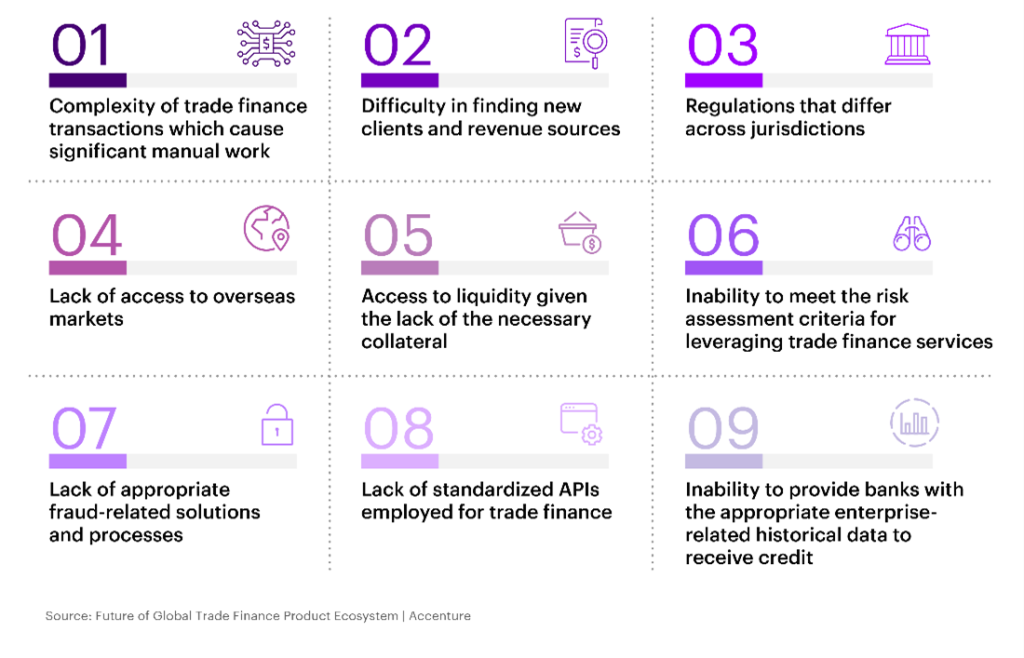

Top pain points in trade and supply chain finance

Last year, I participated in a panel discussion at the Global Trade Review conference in New York, where we talked about today’s key challenges, what the future of trade might look like and what the industry needs from financers and banks. Here are some of my thoughts on the actions that could make the biggest difference for banks in this area.

Digitalization and automation

When we surveyed businesses about their business practices, only 16% of respondents said that their processes are fully digital. Manual paperwork is a major pain point, and global trade is far behind most industries when it comes to digitalizing their processes.

The complexity of trade finance transactions has made them difficult to automate, but as technology becomes more sophisticated, solutions are emerging to eliminate some of the manual work—and the risk that comes along with it—from trade finance. Cloud, blockchain and artificial intelligence are among the tools that are beginning to enable banks to scale operations and transform their trade finance business. In fact, our recent research shows that the banking industry has the highest potential for transformation from Generative AI.

As Open Finance and Open Banking continue to expand in more markets, more automation and straight-forward processing will be possible, along with better use of multiple data sources.

Ecosystem partnerships

Nine out of ten businesses in our survey are willing to consider new trade finance products and services. Two-thirds of them said they are planning to change their roster of partners in the next 12 months and 76% said they will change the number of partners they work with.

This might sound like bad news for banks, but these same businesses were overwhelmingly satisfied with their banks: 82% said their expectations were either being met or exceeded.

62% of the businesses surveyed use more than 5 banks for their trade and supply chain financing needs.

– Accenture research

The takeaway is that banks should find it easier to retain customers if they expand their partnerships throughout the trade finance ecosystem. Trying to be everything to everyone is a very expensive proposition, but finding innovative and dependable partners that offer products the bank doesn’t is a smart way to expand your services without a huge upfront investment. To make these ecosystems work efficiently, the industry and its financial partners will need to standardize APIs to make systems compatible wherever possible.

Innovation and sustainability

Sustainable business practices are becoming increasingly important to businesses of all sizes, banks included. Almost 80% of the borrowers we surveyed have at least one environmental policy in place that applies across their supply chains. It may seem unlikely that banking is on the radar for companies worried about their carbon footprint from shipping goods around the world, but more companies are looking at every link in the chain—including their financial partners. In fact, more than two-thirds of borrowers said that sustainable financing is very important to their business.

One challenge that banks can help with is providing robust data to track the sustainability of their financial solutions. As more processes go digital, data should be easier to collect and analyze. Banks are already developing, and partnering with fintechs to implement, innovative products that reward environmentally friendly practices with preferred rates and other benefits.

And that’s not all…

Trade finance is facing so much disruption right now that I’ve only been able to touch on a few aspects in this post. For more, read our full report, Find your competitive advantage in trade finance. And for more on our view of the current economic environment and how it is likely to unfold, read our Commercial Banking Top Trends for 2023 report. In it, we look at the six trends we believe will have the greatest impact on commercial banking in the year ahead.

Thank you to Steven M. Nocka, Venkat Ramaswamy, and Kevin Torno for their contributions to this article.