One year after ChatGPT’s public launch, generative AI is probably still the hottest topic in the world of business—and with good reason. Research suggests gen AI could add almost $7 trillion to global GDP.

So what, exactly, will gen AI mean for banks?

Much of the conversation today around the technology generates more heat than light. Our “Meet the Experts” session at Sibos 2023—“How Gen AI Will Rewire the Banking Industry”—included a presentation of our new research and analysis, which aims to bring some data to the discussion and move past the hype and speculation.

These are key takeaways from our talk.

Gen AI will not change banking, but will change how banking gets done

The headline of our analysis is that gen AI will change banking—but banking itself will not change. The technology will transform not the work of banking itself but rather how that work gets done.

Banking will always consist of the fundamentals: taking in deposits, lending money and managing payments. But gen AI is going to fundamentally rewire how that work gets done.

While there is general acceptance of the importance of gen AI across banking, there is also trepidation about how and where it should be used. But any bank that sits on the sidelines for long will risk being left behind.

In fact, early adopters are already using it to drive dramatic efficiency gains. One global bank, for example, has implemented an email routing system that uses AI and machine learning; it eliminated 40% of email traffic in its first year. GitHub’s generative AI Copilot coding tool, meanwhile, can help a bank’s programmers write code up to 55% faster (and create 46% of the required code itself). And Morgan Stanley has deployed a gen AI tool that gives its financial advisors improved access to the bank’s “intellectual capital” of around 100,000 reports and documents during client conversations.

But use cases like these are only the beginning.

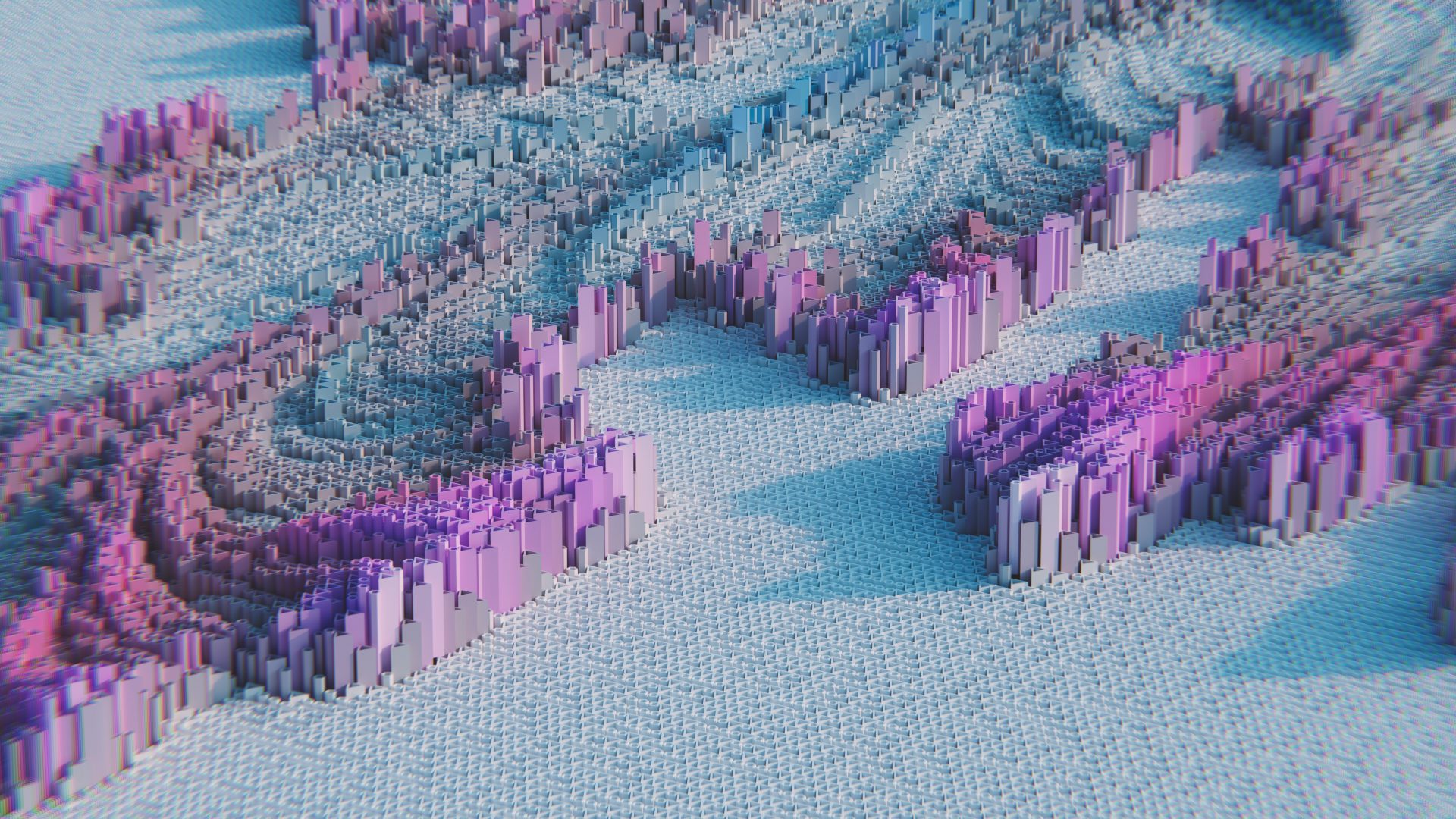

Our research on the potential impact of generative AI on different industries, based on data from the US Bureau of Labor Statistics and the Occupational Information Network, found that 61% of working time across 19 different industries could be transformed by new technologies including large language models (LLMs) like ChatGPT. In banking that portion jumps to 73%, which is the largest of all industries in our analysis. We found that 39% of all the work done at banks had a high potential to be automated (done without interpersonal or cognitive skills) and 34% could readily be augmented (requiring interpersonal communication, proactive reasoning, or expert validation).

Figure 1. The potential of US workers’ time that could potentially be automated or augmented by technology such as LLMs.

As early adopters leverage these gains for efficiency and to deliver superior customer experiences at scale, the impact of the technology will ripple out to transform the industry.

That impact will heighten the need for banks and other users of gen AI to build the right guardrails around these new tools. Maximizing the impact of gen AI on banking can only happen if the tools are used in a responsible, secure manner that complies with regulation.

We trace this wave of generative AI change across three major areas of impact. Gen AI will allow banks to:

1. Innovate and differentiate

Generative AI creates many new ways for banks to boost revenue with insight-driven decisions and better customer experiences. The Morgan Stanley example we mentioned above is one early use case here.

Another comes from a large North American bank, which is using gen AI to scrutinize customer data and financial history to assess credit exposure. This helps its analysts make better lending decisions and reduce the risk of loan defaults.

2. Transform mid- and back-office operations

Generative AI is going to significantly contribute to how banks manage their mid- and back-office operations. This will both lower operational costs, as in the email routing example mentioned earlier, and free up intellectual capital for innovation by automating repetitive tasks like reporting, data entry and transaction processing. This will allow bank staff to spend more time on creative tasks and personalized customer care.

We already have an idea of what this looks like, thanks to early adopters like the European bank that is today using an LLM to support customer service reps on customer calls. The model automatically takes notes for the rep and brings up relevant information, allowing the human to concentrate more on helping the customer.

The extent of this impact will, of course, vary by role across the organization. Our research found that 37% of customer service rep time in banking right now could be automated by generative AI (think of the notetaking in the above example), while 28% could be augmented (surfacing relevant information during the call).

3. Embed gen AI into operations and tools to supercharge productivity

The ecosystem of software partners that power banking today are incorporating gen AI into every aspect of what they do. This will radically boost productivity for employees across the bank.

For example, Microsoft began integrating LLMs into its Microsoft 365 suite of apps back in March 2023 with the launch of Copilot. Adobe’s Firefly tool can generate images from simple text prompts. Salesforce, likewise, offers a gen AI-powered CRM assistant called Einstein right now, and Workday recently announced plans to integrate gen AI into its tools.

These offerings are all early efforts in the field. Vendors will iterate, improve and compete on them in time. The only decision for banks here is which gen AI features are worth the additional cost.

Generative AI as a growth multiplier

Our analysis also found that within three years, generative AI could magnify a bank’s operating income by two to three times compared with existing consensus forecasts by driving revenue growth and reducing costs.

On the revenue side, we see most of the gains coming from generative AI’s impact on client-facing activities. We anticipate that it could create a 17% increase in time allocated to client interactions and advice, which are responsible for around 80% of banking revenue. This additional time could translate into a 9% surge in revenue.

For the cost side, we predict a 9 – 12% reduction in mid- and back-office costs achieved by a productivity increase of 7 – 10% in corporate functions.

Generative AI could result in a 17% increase in time allocated to client interactions and advice, which are responsible for around 80% of banking revenue.

Compounding the impact of the technology across both areas, we find that generative AI’s potential uplift on a bank’s operating income stands at 25 – 40%. This is more than double or triple the existing growth forecasts for banks up to 2026.

No bank can afford to ignore growth like that.

If you’re not sure where your bank’s generative AI journey should begin, our top piece of advice is to form a generative AI SWAT team today. This should include leaders from both the business and tech sides of the bank, and its mandate should touch on strategy, policy, talent, technology and data.

For more detailed insights on your bank’s path forward, we would love to hear from you. You can find Mike here and Keri here.