Printer paper, baseball news and nice restaurants. What do these things have in common? They were the three predictors of a high performing relationship manager (RM) at a Japanese commercial banking client. That is, successful RMs were printing out information to understand their clients and keeping up with baseball so they could make small talk during meetings. As for the restaurants, while papers would eventually be signed in the office, RMs did the ‘hard yards’ on key relationships and large deals at nice restaurants in Tokyo. (That last detail has always struck me as an interesting cultural nuance about doing business in Japan.)

Those seemingly disparate things were predictive of spending time with clients and providing proactive, relevant client service. Those RMs made a point of understanding their clients and providing support at the moments that mattered—maybe sometimes, even before the clients themselves realised it. They were engaged in their clients’ lives and positioned themselves as strategic partners to their clients’ business.

That’s clearly good for the client, the RM and the bank. Those strategic partnerships strengthen the customer relationship, drive loyalty and improve the customer’s lifetime value.

Now, that shouldn’t be a surprise to anyone. But many RMs are still in the position of being order-takers and paper-shufflers, at a time when commercial clients really need their help.

Now, that shouldn’t be a surprise to anyone. But many RMs are still in the position of being order-takers and paper-shufflers, at a time when commercial clients really need their help.

In particular, small and medium enterprises (SMEs) are bearing the brunt of the pandemic’s economic impact. In the US, 75 percent of small businesses have less than three months’ cash on hand; in the UK, 42 percent of businesses had less than six months of cash reserves. The Economist expects a tidal wave of bankruptcies to occur by the end of 2020.

‘In their struggle to stay afloat and emerge stronger after COVID-19, small and mid-size companies want, and desperately need, attention from their bank’s relationship managers right now—along with competent advice, hyper-relevant ideas, actions and solutions.’

—Jared Rorrer, Managing Director – Global Commercial Banking Lead

In times of crisis, there is opportunity. Some entrepreneurial small and medium-sized businesses are flourishing in the disruption and adapting to new consumer habits during COVID-19. Think of restaurants pivoting to meal kits or grocery delivery, or apparel companies making face masks.

Commercial banks that step up and meet that their customers’ needs—by positioning the RM as the cornerstone of a customer-for-life approach—will create their future in commercial banking.

Why banks need to empower the RM to become a strategic advisor

A new report from Accenture outlines three steps to help RMs be more strategic in the way that they relate to and support their clients. Digital technologies and predictive analytics can help RMs understand how and when customer needs are changing—and identify the best and most relevant time to engage.

Banks that enable new digital servicing and relationship management approaches will make it easier to engage with customers in smarter, more meaningful ways. The challenge is two-fold: enabling more efficient ways of working that free up time for RMs, and providing the new skills, insights and tools for RMs to use that new capacity in high-value ways.

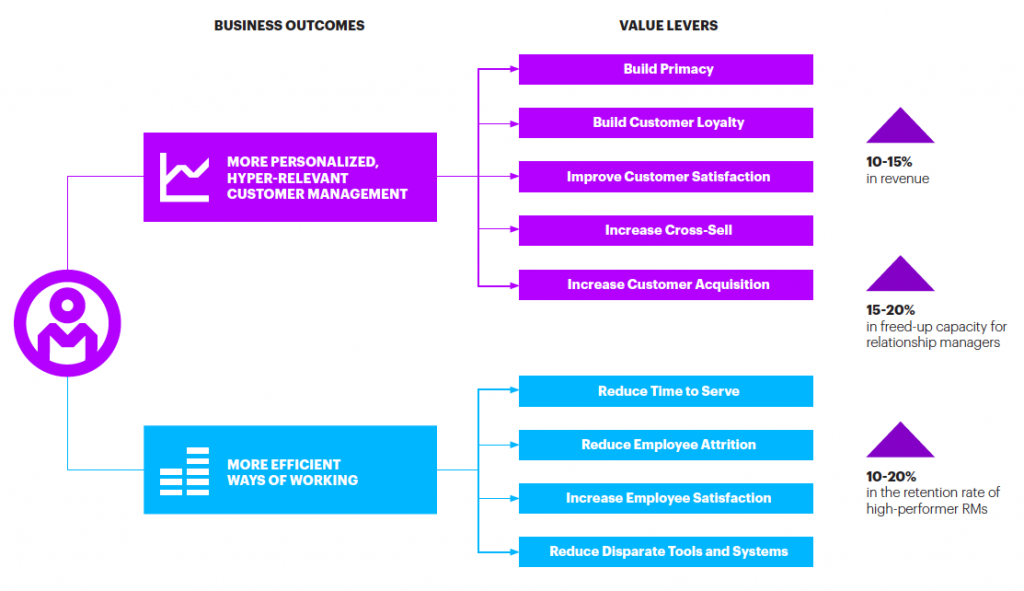

We estimate that by transforming the role of the RM, banks can:

- Increase revenue by 10–15 percent

- Free up capacity for RMs by 15–20 percent

- Improve retention of high performing RMs by 10–20 percent

In other words, banks have an opportunity to unlock value through the combination of automation and augmentation. Our Workforce 2025 research found that for the North American banking sector, banks could unlock up to $12 billion in cost savings through automation and up to $59 billion in productivity gains through augmentation.

We worked with a European multinational bank to use natural-language processing to create a virtual assistant for RMs. RMs use the voice-to-text AI tool to narrate their business customer contact reports, rather than filling them out manually. What did we see after a pilot study with 200 RMs and managers? An 83 percent reduction in the time people spent on reports—a potential savings of one month a year per RM.

The empowered RM plays a valuable role in improving the customer experience. As part of a continuous feedback loop between customers and the business, the empowered RM is a strategic advisor to clients, augmented with insights to offer more personalised timely and relevant advice. The empowered RM also feeds customer-driven input to new-product and proposition development teams to refine and innovate SME offerings.

And what about timing? In response to COVID-19, banks have drastically accelerated their digital transformation—in our estimation, by about five years. RMs have transitioned from an intensely in-person job to working from home. And SMEs desperately need help right now.

Business transformation is people transformation

But business transformation is people transformation. When it comes to enacting big changes, here are a few keys to success.

- Leadership. During times of uncertainty, people are reassured when their leaders have and articulate a clear vision. That includes the C-suite and also managers throughout the organisation. And by ‘clear vision’ I don’t just mean a rational business case. It needs to be something that an actual person can engage with, believe in and work with. For example, instead of focusing on the bells and whistles of new technologies and tools, you could emphasise the insights that RMs will get, which can help them better serve their clients.

- Trust and psychological safety. Even before COVID-19, fear and anxiety were running high in financial services. Now, given the added layer of uncertainty due to the pandemic, trust has to be part of the equation. The key dynamic behind high performance in teams is psychological safety, a term coined by Harvard professor Amy Edmondson. In short, it’s a group environment where people feel they belong, communicate without fear of judgment, take risks, learn (and sometimes fail) and speak up. And psychological safety is strongly linked to performance: higher employee engagement, team performance and company performance.

- Culture. It’s difficult to create change without addressing the underlying culture of an organisation. If banks want to empower RMs, they need to work with them to shift behaviours and enable more personalised, relevant outcomes for customers. That means examining RMs’ working practices, especially their daily and weekly routines, to look for ways in which their work inhibits change and find ways to shift their focus to enable new ways of working.

- Technology adoption. Empowering RMs with new tools and technologies is a first step, but it’s not enough. Driving adoption is crucial for unlocking the full value of investing in those new tools and technologies. As I shared in this blog post on unlocking more value from technology platforms, there are two key steps to driving adoption: designing for users and designing from a blank slate.

- New skilling. High-performing RMs are connected with their clients and in tune with their needs. Success in the role requires empathy, client insight and relationship development skills, and banks need to support RMs to achieve those skills.

A leading commercial bank in Asia aimed to expand its lending business within the SME segment, with a focus on increasing cross-sales. We used the Accenture Applied Intelligence Platform to integrate, process and analyse more than two terabytes of external data at scale. A pilot program generated more than four million leads, identified 40 percent more cross-sell opportunities and saw a 46 percent increase in loan applications.

New skills need to catch up with technology

With those pieces in place, the question becomes: How do we empower RMs to still perform their role with clients while working alongside new technologies?

The answer: By helping them develop new skills, both digital and human. That means digital skills like working alongside artificial intelligence (AI), which could be leveraged in cross-sell propensity models or retention models, or tools to gather and validate information in preparation for client meetings. Equally important are human skills like relationship building, empathy and creative problem solving.

For some RMs, the transition will be seamless. For others, it will be more challenging. Banks’ success relies on helping RMs, whatever their propensity for change, to transform their skills and get up to speed.

Some key principles to keep in mind through the transformation:

- Co-create the future RM role. People are more apt to change when change happens with them, not at them. Engage RMs to co-create their future roles and drive adoption. After all, they know best what’s needed to be successful in their roles: key skills, top priorities and where to spend their time. They also know what fuels successful teams and optimal client portfolio composition. Co-creating the RM role also helps you design products that they’ll actually use. Designing technology with people in mind is a critical way to avoid tech-clash.

- Invest in learning. When people work in an environment that values learning then—surprise!—they’re more likely to learn. Some of this can be driven centrally, through investments in the right learning platforms and aligning incentives and promotion with new skills development. But it’s important to remember that each individual and team goes through a learning journey differently. Rather than a one-size-fits-all approach, try a more subtle approach that acknowledges where each team is starting from, what they’re experiencing through the change and what they need to be successful. Read more about how to create learning that sticks.

- Find the fuel and friction. Change is hard, but people can and do change. At Accenture, we use behavioural science to find what fuels new behaviours—and what friction might hinder progress. First, know that you can only change so much at one time. Prioritise the behaviours that will provide the greatest value and start there. We use structured experiments using randomised control trials or A/B/n testing to identify what works and what doesn’t. Open experiments encourage people to spark new behaviours through microchallenges and grassroots change, simply by nudging people to act out or try on new behaviours. Finally, large-scale analytics can identify patterns in behavioural data to help scale successful interventions. Learn more about using behavioural science to create change in your organisation.

New skilling in action: Driving digital tool adoption to improve customer-centricity

Here’s an example of how these pieces work together. We partnered with a major retail and commercial bank that knew a new CRM platform across sales and service would enable digital and data-driven ways of working—critical capabilities to create a great customer experience.

But historically, it had been a challenge to get relationship managers (RMs) to adopt new tools. The bank wanted us to design the right tool and ensure that it got adopted.

How did we do it? By using behavioural science and keeping end-users at the centre of the transformation.

- First, we used behavioural science to identify what was hindering RMs’ adoption of new digital tools and other customer-centric ways of working.

- Then, we co-created the CRM system with RMs, using a human-centred design approach, which enabled the desired behaviours.

- Finally, we used microchallenges and gamification to turn desired behaviours into habits, which increased tool adoption across the wider RM population.

That approach paid off. We successfully drove adoption of the CRM platform across 3000 users and saw a marked increase in the bank’s NPS scores in just six months—putting it well on its way to achieving its ambition of being number one for customer service.

Connecting with customers—virtually

Relationship managers—now doing from home what was an intensely in-person job—need to be more strategic in the way that they relate to and support their customers in hyper-personalized ways.

- Be real. Empathy and human connection are more important than ever, and taking a few minutes at the beginning of each call to check in with how customers are doing, both in business and as people, can go a long way. (Recall how high-performing RMs in Japan used baseball as a way to ease into shop talk with clients.)

- Meet customers where they want to be. Some may want plain old phone calls, while others may prefer video (in which case, make sure you’ve got good lighting, a decent backdrop and that your camera is well-positioned).

- Allow more time. One challenge of working virtually is that it can be harder to discuss and make hard decisions. Consider sending documents in advance of a client meeting so they can arrive with comments and ideas for the discussion. And allow ample time for calls. Discussions and decisions will take longer, and customers may need time to get comfortable before they really share what’s going on with them—and where they need help.

Benefits of transforming the RM role

As I highlighted above, transforming the RM’s role can increase revenue, create extra capacity for RMs and improve retention of your highest performers. Augmenting RMs with digital tools also starts to close the gap between employee expectations and the current state of affairs. For example, three out of four insurance and banking executives agree their employees are more digitally mature than their organisation—that is, the workforce is waiting for the organisation to catch up.

It also plays into how your business will attract new talent. For example, research from Dell and Intel found that 42 percent of employees would leave their current position because of substandard technology and 82 percent said technology plays a part in where they decide to work.

Investments in the employee experience pay off with more engaged, committed employees who deliver higher levels of productivity and are more supportive of innovation and change. And they also contribute significantly to superior customer experiences.

Which brings us full circle. Right now, SMEs are struggling with the economic fallout of COVID-19. And banks have an opportunity to find ways to help SME customers stay in business and grow—and equip RMs for the future of work while they do it. The customers that get the help they need will likely be a customer for life.

This is a pivotal moment for commercial banks. Will you rise to the occasion?

Download our latest report with three actions to evolve the commercial banking RM.

To learn more:

- Hear how commercial banks can ensure RMs are engaged in the change agenda.

- Learn how to unlock people potential with behavioural science.

- Contact me here, or @andyyoungACN on Twitter.