The payments industry has undergone unprecedented transformation in recent times given the global pandemic, geopolitical shifts, recalibration of supply chains, accelerating digitalization and significant economic turbulence. The fascinating conversations around payments at the recent Sibos conference highlighted just how fast things are changing.

The conference was attended to the same level as pre-pandemic and some key payments trends clearly resonated in the week’s sessions and conversations. These are my thoughts on what is sure to be a fascinating year ahead and where banks and other payments players might focus.

Payments modernisation is the name of the game for 2023, with the continuing change in the payments market in all dimensions. Customer intimacy continues to be front of mind for banks, and an emphasis on friction-free payments and ‘always on’, ‘always safe’ payments will become even more vital in maintaining customer trust.

I spoke about payments’ transformation—and the opportunities it creates for banks—from our booth at the conference. The video below captures the takeaways from my talk. You can find some extra detail on key points below.

Payments modernisation remains top of mind

While modernisation may currently be driven by numerous mandatory changes like ISO 20022 or real-time payments, the business fundamentals around rising costs, declining revenues, and increasing competition are the real reasons why payments modernisation is needed now.

At Sibos, the broad consensus among financial institutions was that modernising their payments estate is a top priority right now. In addition to modernising the core technology, organisations are assessing the costs of operations, technologies like cloud, and building innovation capabilities to enable the product propositions of the future.

Payments providers are turning the focus on their own efficiencies. Some organisations have embraced the power of working in the cloud. Banks are looking to more efficiently serve customers by partnering with fintechs and other innovators that have developed new, low-cost platforms. Some have adopted the latest AI and machine learning technology to streamline their operations and innovate at lower cost.

Payments products choices are expanding

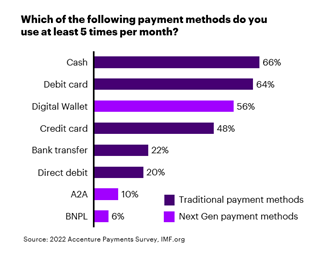

In addition, current economic conditions are changing customer demands at an exponential pace. Due to the high inflation, high interest rate environment, consumers are paying more attention to what they buy and how they buy it. This is causing a shift in the product mix and buying behaviours like the industry has not seen before. While credit cards were once the default payment option for consumers, the landscape has expanded. Consumers are considering account-to-account (A2A) payments, super-apps and digital wallets, and buy now pay later (BNPL).

Money is also changing form. Digital currencies like stablecoins and central bank digital currencies (CBDC) are showing more promise to become mainstream. (You can learn more about CBDC in my earlier blog post, Why CBDC stands to benefit not harm banks.) Technologies like blockchain are also likely to play a key role in securing digital identities, especially as payments move into the metaverse and other new digital environments.

Consumer are expecting greater choices in terms of payment methods than ever before, and they are looking for the ones that can help them manage their finances better.

Customer intimacy is new frontier

As consumers and clients face a difficult time with cash flows and credit availability, they will seek a steady hand through the next phase of their journey. This is where new relationships will be established, more meaningful than any loyalty programme can provide. Payment providers that use their customers’ transactional data wisely can support them with cash flow challenges, credit optionality, and repayment options, making their lives easier. The more financial institutions can be helpful during uncertain times, the better their relationships will be in the longer term.

Banks can use customer insights to connect each client to the most suitable payments products for them and make timely suggestions to help customers manage their spending and debt successfully. That level of customer intimacy will be especially important in this challenging economic environment, where people might need more guidance than usual to see them through the ups and downs they’re experiencing.

Friction-free payments

Although customers are becoming more conscientious about their spending, they still don’t want paying for their purchases to interrupt the flow of their activities—whether they’re online or out on the town. Using methods like digital wallets and embedded payments in super-apps, payment is becoming more invisibly integrated into the customer journey so that purchasers don’t need to stop and enter information or make decisions about how to pay. These expectations extend beyond borders—international transactions are also expected to be seamless, fast and low-cost.

The results of our soon-to-be-published 2022 payments survey show that customers are adopting “next gen” payments methods like digital wallets. For example, when asked what payment methods they used at least five times per month, more people included digital wallets (56%) than credit cards (48%). These low-friction digital payments tools—usually involving just a click or a tap—offer customers a variety of fast, simple ways to get what they need. Anything requiring more effort is considered “old fashioned” these days.

Always on, always safe

The more reliant customers become on digital payment methods, the more crucial it is to build resilience into these payments systems. Customers are no longer used to waiting for a transaction to go through. At the same time, even a short period of downtime can create chaos for retailers, service providers and customers. This is happening in an environment when the transaction levels across most electronic payment types across most geographies are increasing.

Customers and businesses today are both also increasingly concerned about fraud, data breaches and identity theft. As the payments ecosystem becomes more complex and interconnected, the focus on cybersecurity will need to sharpen to ensure that there is no weak link in the chain of providers. When data leaks happen, customers don’t care which ecosystem partner dropped the ball—whoever is visible to them is going to take the blame.

An unrelenting and exciting pace of change

Thanks to my colleague Dhruv Salhotra for his contributions to this post.

To discuss the modernisation of your payments estate to meet today’s needs and prepare for tomorrow’s, contact me here. To read more about the ideas and solutions we brought to Sibos this year, please visit this page.