Banks and other incumbent payment players face an intriguing paradox right now. They must innovate to stay relevant, but their discretionary budgets for innovation are limited. They must find a way to do more with less.

Rapid growth in the payments market, which is attracting a wide range of new value propositions and competitors, adds to the urgency. Many of these new offerings, from embedded payments and finance to virtual acquiring and beyond, are rapidly gaining market share.

Klarna, Stripe and PayPal are all relatively recent startups that grew to control significant portions of various parts of the payments value chain. BNPL specialist Klarna, for instance, recently reported total net operating income of 5 billion krona (roughly $466 million). Stripe’s market cap has fallen from its 2021 valuation, but still sits at around $50 billion.

Apple Pay, meanwhile, is expected to handle 10% of global card transactions by 2025, while Accenture analysis projects that fintechs will control 57% of cross-border payments by that time. Further analysis by our research team suggests that $89 billion in bank payment revenues would be at risk in the next three years if card-issuing banks failed to innovate.

Banks and other incumbents are eager to compete with these newer payment services providers. But they often must do so with one hand tied behind their back. Accenture’s experience working with large financial institutions suggests that roughly two-thirds of payments change spend is dedicated to regulatory and other mandatory costs. Discretionary spending for innovative payments initiatives is usually less than a third of the overall payments change budget.

Yet the moment to move is now. The present macroeconomic climate, while not without its challenges, presents banks with an opportunity to invest counter-cyclically in payments to ride the wave when the cycle reverses. With almost-free capital drying up across the market (including for payment fintechs), this is the time for banks to catch up.

Discretionary spending oninnovative payments initiatives is usually less than a third of the overall payments change budget.

Incumbents therefore face an unusual opportunity today to get back in the consumer payments innovation race. The crucial question is how.

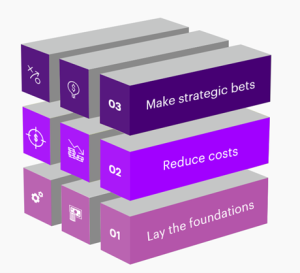

From the highest level, we see this as a three-stage investment that will keep the show on the road while also setting up future growth.

1. Lay the foundations. Continue to ensure that the bank’s core infrastructure both enables compliance with changing regulations and supports essential modernization and transformation efforts. Cloud migration and core modernization are the name of the game here.

2. Reduce costs and optimise operations. Identify discrete opportunities for savings with the right mix of technology—including automation and AI to reduce manual effort—and effectively partner to leverage capability and scale.” This will reduce charge and run costs and create capacity to invest with more discretion.

3. Make strategic bets. The third step—the one that demands renewed focus now—is crafting and executing a well-defined strategy to protect and grow payment revenue streams. This will require targeted investments in next-gen digital payments tools like embedded payments and finance, digital wallets, improved FX propositions, enhanced transaction banking, and pilot CBDCs where applicable. Well placed bets will enable a bank to enhance its payment capabilities, future-proof its systems, and boost customer retention. It will demand smart partnership decisions and the measurement of success in terms of strategic outcomes.

The first step establishes an incumbent’s right to compete in today’s payments landscape and the second keeps it in the contest. The final step describes how it can win—and there are many potential paths to victory. Some of these will go beyond traditional ways of doing business in payments. The new frontier of competition is the customer experience.

Notable examples of incumbents making strategic bets to compete from the last few years include:

- Singapore bank DBS, which since 2018 has offered a wide range of partnered consumer experiences through its Marketplace platform. DBS customers can buy or sell cars, find an interior designer, and even take accounting courses through the platform.

- American incumbent JPMC’s plan to launch a full-service travel agency.

- NatWest’s banking-as-a-service play announced last year.

- Virgin Money’s digital wallet, launched last year, with integration into Virgin’s broader rewards ecosystem.

- Santander’s PagoNxt project, which launched as an independent fintech-style global payments platform.

Watch the video: Accenture’s Sulabh Agarwal on Unlocking Opportunities with Rising Interest Rates and Key Investment Considerations for Banks from EBA Day 2023

Banks and other incumbents that can realize the greatest returns on their limited discretionary innovation investments in payments will be tomorrow’s market leaders. There’s nothing less at stake with these choices than reinventing the payment experience and fuelling the growth of the business for years to come.

Download the full report, “Payments gets personal: How to remain relevant as customers seek control,” To discuss how your payments organization can get back in the payments innovation race, contact Sulabh or Amit.

Thank you to Will Hay for his generous contributions to this article.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. Copyright© 2023 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.