Interest rates and inflation are on everyone’s minds. Cost-conscious customers want to see value for their money and don’t want to pay for what they don’t use. Companies, in turn, are looking to better align their pricing with costs. Even as budgets tighten, they want to attract new customers, reduce churn and boost revenue.

The upshot? Small and large businesses across industries are rethinking how they price their products. That’s where usage-based pricing comes in. If you haven’t yet considered this pricing model, now might be the time.

What is usage-based pricing and why does it matter?

Usage-based pricing means a company charges a customer for how much of a product or service they use rather than a flat fee. If you’ve paid a utility bill or used a rideshare app, then you know what usage-based pricing is.

Pricing typically varies by when you pay and how usage is priced. For when you pay, there are two models. In a pre-payment/credit burn-down model, customers pay for a product or service before they receive or use it. Funds are deducted based on usage. In a pay-as-you-go/metered model, the customer pays after use.

How usage is priced

| Volume-based Pricing | Graduated Pricing | Tiered Pricing | Overage Pricing |

| Based on unit consumption. | Per-unit price differs by use level. | Based on a pre-set consumption tier for the period. | Based on a flat subscription fee for a base number of units, with a per-unit price applied to each unit that exceeds the base amount. |

| Mobile Phone Plan Example: pay $0.05 per minute on a mobile phone plan. | Mobile Phone Plan Example: pay $0.05 per minute for the first 500 minutes and $0.10 per minute thereafter. | Mobile Phone Plan Example: pay the 500-1,000 minute unit price for 750 minutes used. | Mobile Phone Plan Example: pay $19.99 for the first 500 minutes plus an additional $0.05 per minute for every minute over 500. |

Customers tend to like usage-based pricing because value is directly tied to price. The upfront cost is typically low, and they can scale their use as needed to control their spending without having to renegotiate the plan.

This customer appeal is a plus for businesses that want to expand their consumer base or launch new products. The model also helps companies boost customer lifetime value. By tracking usage, they can drive adoption and find new opportunities for cross-sell and up-sell. Another benefit? There’s no cap on revenue. As usage goes up, so can earnings. Usage-based public software-as-a-service (SaaS) companies saw 31% more year-over-year revenue growth than their non-usage-based peers.

Meeting business demand for value-added services

As businesses move to usage-based pricing, they need payment and billing solutions to support this new pricing model. Bigtechs and fintechs have been quick to step in.

Accenture’s research, Reinventing commercial payments for profitable growth, shows that a failure to offer value-added commercial payment services like usage-based pricing is a top frustration for businesses. Four out of 10 commercial payments clients surveyed said they would likely switch to another payment provider that offered value-added services.

These services also rely heavily on modern digital technology cores such as cloud, AI and data for deployment and enablement. However, a big concern highlighted by our commercial payments research is that more than 50% of banks still have relatively low levels of digital core technology maturity.

Future-thinking banks and commercial payment providers need to consider how they can transform their offerings to support their clients’ needs.

Those that don’t have the capabilities can collaborate with a fintech to seize this opportunity and turn commercial payments into an engine for revenue growth.

Who’s offering usage-based pricing now?

Usage-based pricing is common in utilities, telecom and cloud computing. Now, other industries, from entertainment to transportation, are starting to embrace it, too.

Generative AI will likely boost the popularity of this pricing model even more. Why? Large language model (LLM) computation costs are high. Businesses that build their products on LLMs will need to align their pricing to sustain this cost and pass it along to their customers.

Take Intercom, for example. This AI customer service platform provider charges a customer a small fee each time its AI agent, Fin, resolves a customer’s question. The customer pays only if Fin delivers results. If Fin can’t answer the query, the customer doesn’t pay. By pricing this way, Intercom not only ties price to value, it also lowers risk for customers, making it easier for them to give Fin a try. Hear what Intercom’s CTO Darragh Curran has to say about their company’s move to usage-based billing for Fin.

Adapting a business to usage-based pricing

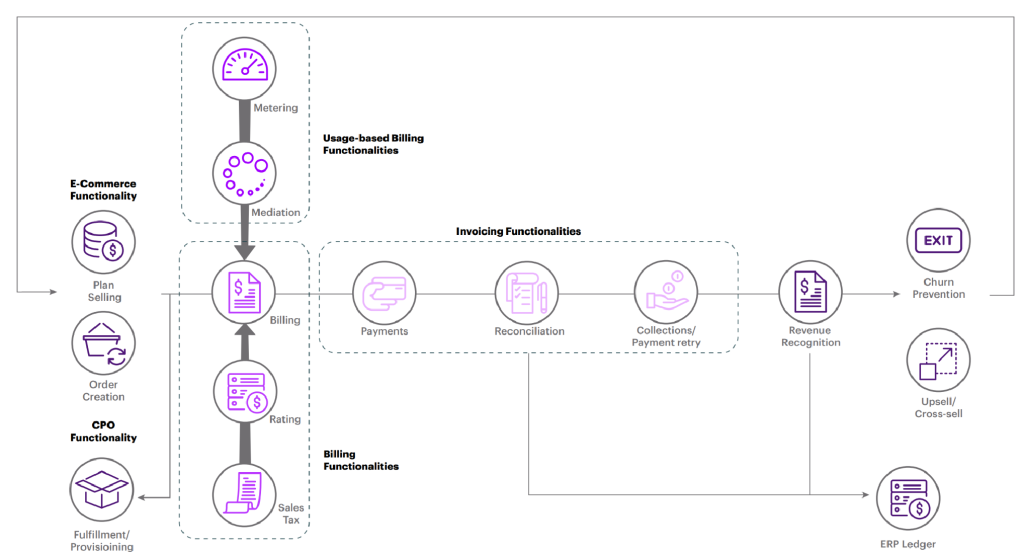

Usage-based pricing touches almost every function across the business, from sales to revenue recognition, transforming the quote-to-cash (Q2C) process. Billing is no exception.

Customers and customer-facing teams need to track usage and spending in real time. So, companies must be able to meter usage, instantly aggregate the data, tie it to a price plan and pull it into a bill.

The quote-to-cash process under usage-based pricing

It takes time, planning and thoughtful execution to implement usage-based pricing and billing. Here are a few important considerations:

-

- Choose the right metric to charge for: Pick a usage metric that reflects your product’s value and is easy to understand. Use metering and mediation to track and convert the data into readable billing information.

-

- Provide usage visibility: Plan for the need to equip your team and customers with tools or dashboards to track real-time usage and spending.

-

- Focus on accuracy and reliability: With usage-based billing, there’s a huge amount of data throughput per minute. Just seconds of system downtime can lead to a significant loss of records or billing errors.

Choosing the right provider

With the right engineering team and resources, you can build and manage the necessary systems in-house. However, maintaining and updating them to keep pace with regulatory requirements, new products, pricing changes and expansion into new markets may be more than you want to take on.

One way to tackle this effort is to work with a services provider—a popular option, particularly for bill payments. Accenture research shows that nearly 60% of clients are highly likely to subscribe and purchase these services.

In response to this demand, Zuora, Metronome, Stripe and other players in the space are starting to create their own ecosystems of services to support value-added payment solutions. For example, Stripe is continuing to invest in its Revenue and Finance Automation (RFA) stack so that it can serve as a one-stop shop for key services such as billing, usage, revenue recognition, tax and payments.

“We now enable usage-based billing with our new Meters API. You can ingest usage data in real time, connect it to your pricing, ensure accurate billing based on usage, and cohesively integrate it with the rest of the RFA Suite for end-to-end management of usage-based revenue.”

Stripe Sessions 2024, Opening Keynote

Is usage-based pricing right for your business?

Ask yourself a few questions first:

-

- Do you have the staff and resources you need? Usage-based pricing is more complex than other pricing models. It’s important to consider whether you and your partners have the right capabilities to make this change.

-

- Are your competitors offering it? If they are, usage-based pricing might work for your company. If they aren’t, you still may want to experiment and add usage-based pricing to your current pricing model.

-

- Is your product or service a good match? Successful usage-based pricing depends on having the right metric. If your product is complicated, it may not be easy to identify one.

Usage-based pricing is gaining popularity. Whether you’re a business planning to offer this kind of pricing to your customers or a bank that helps companies tackle their payment needs, now is a great time to think about how you can unlock value for your clients.

We’d love to hear your thoughts about usage-based pricing and billing. Please contact either Sulabh Agarwal or Austin Brizgys.

Be sure to download the Accenture report, Reinventing Commercial Payments for Profitable Growth and read Stripe’s report on the state of subscription and billing management.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.