The world of banking is big—too big for one person to cover alone, especially with today’s digitally-fueled pace of change. In that spirit, I’m turning my blog over to my colleague Steven Smith for this post on the once-in-a-generation opportunity emerging in retail banking right now. Steve is a managing director at Accenture and our Banking Industry Lead for our US South market unit.

– Mike

I still remember the night back in the winter of 1986 when my mom dragged me out into the cold Michigan night to look at Halley’s Comet. “Come on,” she urged, “it’s only here for a short time!” Halley’s Comet is a short-period comet visible from Earth approximately every 75 years, and she wanted to be sure I didn’t miss the chance to see it.

Retail banks today are in a similar position. They face a once-in-a-generation opportunity to serve their customers in new ways. The implications of missing out could span not years but decades. In the part two in this series, I’ll discuss what I believe are the five essential steps to successful transformation.

Part 1: The stars align

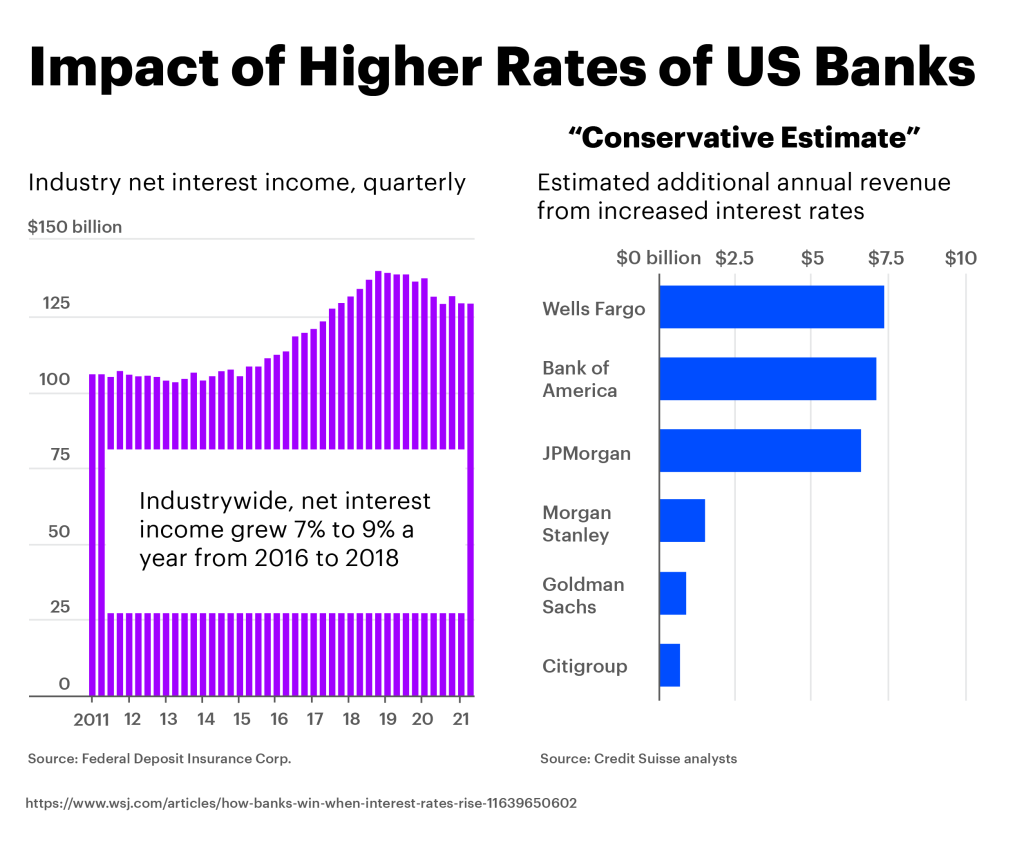

Consumer banking, like astronomy, is cyclical. Right now, major trends are aligning in a super-cycle. COVID-19, the war in Ukraine, inflation, rising interest rates, the Great Resignation and social unrest are just a few. Banks right now face a brief opportunity to capture increased profits from a rising-interest-rate environment and invest them in their transformation efforts.

Just how much money are they likely to have? Well, a conservative estimate based on a Credit Suisse analysis is that top-tier US banks will each gain additional revenue of more than $5 billion a year—possibly up to $7.5 billion.

Some banks will be tempted to sit tight on this additional revenue or pass it on to shareholders. There are plenty of persuasive reasons for this, like economic uncertainty, reduced customer confidence, prolonged inflationary pressures, rising beta on deposits and potential higher credit losses. Research by Celent indicates that 65% of North American banks believe it is harder to win and retain business now then it was 12 months ago.

There’s also rising competition from fintechs, neobanks, and non-banks, each seeking to raise the bar for customer experience.

Some banks may feel that the digital customer experiences they offer today are sufficient. Certainly, most banks have achieved at least basic competence here. Research from MagnifyMoney found that users of the mobile apps of the 110 largest incumbent banks, credit unions and online banks in the region gave their tools an average rating of 4.1 out of a possible 5.

However, today’s digital banking experiences amount to a galaxy of indistinguishable stars. To use a favorite phrase of Mike’s today’s digital banking is mostly functionally correct and emotionally devoid. True differentiation going forward will depend less on the pixels and more on driving meaningful experiences through hyper-personalization, transparency, product innovation, human availability when it matters and, ultimately, measures that promote customers’ financial wellness.

This is especially true as retail customers shift from over-saving (a consequence of pandemic stimulus checks and the moratorium on student loan payments) to over-spending due to pent-up demand, inflationary stress on the value of the dollar, the increase in unsecured lending balances, and so on.

This is why I firmly believe that hesitation to invest these profits will lead to long-term regret. The question is not whether to invest but where.

The spotlight shifts to trust and innovation

As consumers brace for an economic downturn, they will be seeking a safe harbor where they can weather the storm. Trusted institutions have a head start in filling this need. For example, by explaining the difference between a cryptocurrency supernova and the growing constellation of central bank digital currencies, incumbent banks should be able to advise and protect their customers as they grapple with tricky, unfamiliar issues. Customers will be watching their banks closely to see if they are really “there for them” when it matters.

Fintechs are also feeling the impact of a pull-back in funding coupled with rising labor costs, which could lead to a culling of their numbers. However, those left standing are likely to be stronger—and even stronger competition for traditional banks. To counter this threat, incumbents will need to go beyond upgrading their mobile apps and building better digital versions of themselves. They will have to show clearly the value they provide their retail customers.

This value, and the differentiation it delivers, will be founded either in business model transformation (open banking, platform marketplaces, embedded finance) or innovation (new capabilities, hyper-personalization, partnerships in adjacent markets). Both strategies will require modernization from the inside out, as legacy platforms impose fundamental constraints on speed to market, data availability and innovation generally. Modern platforms will need to include event-driven architecture, advanced data and analytics capabilities, and modernization of the core.

But like Halley’s Comet, this opportunity will not be here forever. We believe retail banks that act now to redeploy the surge in net interest income will benefit from their transformation for many years to come.

Part two: 5 smart steps to digital transformation in retail banking

The stars are aligned right now to create a generational opportunity for North American retail banks to use a projected revenue windfall to supercharge their transformation. In fact, this is already happening. One indicator is Celent research showing that most retail banks have increased their IT budgets by nearly 5% in 2022, compared with just over 4% in 2021, and will continue at a consistent rate of over 5% in the next 12-24 months. Another is Gartner’s 2021 Board of Directors Survey, which found that more than 7 out of 10 financial services industry leaders foresee substantial transformation by 2026.

But much like the brief window we have to see Halley’s Comet, the current opportunity for banks to generate value through transformation is likely to be fleeting. Most recognize this—nearly every NA bank has one or more change programs underway. Most of these fall under the umbrella of an annual budget and focus on a point solution such as back-office automation, a digital channel for better customer experiences, or product and pricing evolution. Whatever the focus of your change initiatives, ensuring that your constellation of offerings stands out in retail banking’s crowded night sky is no easy task.

Seize the moment to strengthen your position

This window in time is a rare opportunity to blast off from your current position in the market and to adopt a more favorable orbit. Most banks have a transformation playbook. Fewer successfully execute it. We believe that the following five steps offer a reliable high-level path to retail banking transformation.

- Build a clear, compelling vision. Ensure you can articulate your value proposition in the market, including any product innovation or evolving business models. This includes clear identification of your target customers, the capabilities you’re offering them, what differentiates you from your peers, and your North Star. The NA banking market is now saturated with digital products and services. Becoming a better digital version of yourself or growing your AUM won’t be enough to stand out. Knowing where you intend to win will go a long way to defining the path for the realization of your vision.

- Understand the business value. Modernization and transformation should not be “tech for tech’s sake”. Quantifying the material business value is table stakes for gaining board-level approval for transformation. We believe significant change should include the definition of an operating model that will allow your investment to be offset by increased revenue (for example, newfound net interest income from rising interest rates or entirely new revenue streams) or decreased spend (like operational gains from automation or other process improvements).

- Assess your readiness. What is the status of your architecture, technology, processes and talent? Do they give you the capabilities you need to realize your vision? It’s vitally important that you identify any gaps between where you are today and where you want to be. The shift from COBOL and mainframes to Python and APIs may feel like a decades-long journey, but measuring that gap will open up a variety of remediation options that span different operating models (buy, build or rent) and labor pools (contract, hire or consult). A proper gap analysis will identify the jobs that need to be done, allowing you to build a transformation roadmap aligned with the vision and business value.

- Plan for culture and talent. Any transformation goes way beyond new technology. It impacts the entire organization in terms of how it will be branded, how it will interact with customers, how employees will be engaged and how change is managed. In addition to all this, modern delivery entails new processes and skills as well as interactions with ecosystem partners, which impact the workforce. Understanding your workforce’s change readiness is vital, as it can highlight specific actions which can be hugely helpful in accelerating meaningful adoption of change.

- Execution. This is the final and most challenging step. Starting small and scaling fast will give you the ability to test and learn. Begin with a sample of customers and evolve as necessary, testing your value hypothesis and continually refining it to optimize the outcome for your target market. Trying to change too much at once, becoming paralyzed as you analyze where to begin, and not having a clear plan can all be significant impediments to a successful transformation. Access to the right resources—whether they are your own people or deployed by a partner—is critical, because experience in finding and realizing value is indispensable. The right talent should help to accelerate, de-risk and illuminate the transformation journey ahead.

This approach to transformation can be applied to many different parts of retail banking. It will generally begin to capture value in under 12 months, beyond which greater dividends will be achieved. The stars are aligned right now for retail banks that are planning to transform. Rates are rising while customers still seek value in their primary bank. The economic downturn has yet to affect most incumbent banks, and fintech valuations are shrinking. Failing to capitalize on this opportunity could cause more harm than just regret, but getting your transformation coordinates right could turn your bank into a spectacular comet that astounds and impresses everyone.

To discuss North American macro-economic trends and how retail banks can respond, please get in touch with Mike or Steve.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document may refer to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied. Copyright© 2022 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.