This thought leadership piece looks at Instant Payments in the Middle East – how this innovative trend being implemented in the region and elsewhere is changing the payments landscape, and what banks should do to fully leverage its value.

Instant Payments are coming

- Instant Payments are a revolutionary feature of the payments landscape in more than 50 countries worldwide, and they’re coming to the Middle East.

- With their 24/7/365 “always-on” availability, Instant Payments bring speed and convenience for funds transfer, along with transparency, certainty and precision. In these ways, they meet the needs of consumers and businesses and comply with the expectations of the next generation.

- Drivers of Instant Payments systems in the Middle East include rising mobile phone ownership, growing e-commerce sales, the licensing of new payments operators, and changing consumer preferences. Further, the combination of Instant Payments and Open Banking APIs is potentially an upcoming trend in the region, creating opportunities for increased collaboration, new revenue pools and reducing competition from other participants in this ecosystem.

They are revolutionary

- An Instant Payments system affects the entire value chain of payment, so banks should assess how to incorporate and migrate their current system across their applications – including channels, products and core systems – and how to implement new value chains.

- An Instant Payments system can revolutionise C2C, B2C, B2B and C2B payments, including payments to and from governments, as well as international remittances. Importantly, such systems do not automatically imply any greater risk of liability for banks.

- A core advantage of Instant Payments is that transactions use the ISO 20022 messaging format, a new format that will be used by the majority of payments systems around the globe within the next four years. That provides richer and high-quality data using more fields, better structure and improved flexibility to adapt to new business processes.

- This promises a rich mine of data that banks can exploit to support customers – streamlining their processes while leveraging the information that each payment string contains. In this way, banks can enhance their service offerings by bringing analytics and payments closer together.

Banks need to prepare for this opportunity

- Challenges that banks in the Middle East could face when implementing Instant Payments systems include: dealing with legacy systems and at times a more batch-oriented processing approach; cash-centric economies, though this is changing; the rise of new digital entrants; and, in some instances, a branch-focused customer experience.

- Banks need to consider and plan for how they can realise the potential of Instant Payments systems and leverage their commercial potential.

- Successfully implementing Instant Payments requires that banks consider far more than the return on investment. They need a concept that integrates Instant Payments as part of a more comprehensive digitalisation strategy that comprises technical, operational and business aspects. A future payments strategy needs to comply with next-generation requirements in all of these layers.

1) The rapid rise of Instant Payments

The number of Instant Payments implementations has climbed fast in recent years. In 2014, 14 countries around the world had live systems; today, 56 do. Instant Payments have become a global phenomenon. In the coming years, this innovative form of funds transfer will be rolled out in many more markets, including in the Middle East nations of Saudi Arabia and the United Arab Emirates (UAE).

Instant Payments allow people and businesses to send and receive money instantly on an account-to-account level, 24 hours a day, 365 days a year, with end-to-end tracking and status-confirmation, and with transactions carried out even on mobile devices. The key aspect is the immediate availability of the funds on the creditor’s account – something no other electronic payment tool provides.

The number of such transactions is vast and growing impressively. In 2019, China processed more than 38 million real-time transactions daily, more than double the volumes and value transacted in 2018. India, the global real-time payments volume leader, processed more than 41 million transactions daily in 2019. South Korea led on a per capita basis with 75 transactions annually per person.

An overwhelming advantage

Instant Payments deliver speed and convenience along with a range of other features on the services layer. They bring transparency, certainty and precision of the process to move funds, and fulfil the needs that consumers and businesses have for next-generation payments. In this way, they help to build the base for innovation in the payments ecosystem by combining new technology with the safety and security of an account-to-account payments system. The system is rooted in the existing financial ecosystem and is overseen by regulatory entities (mostly central banks).

Those advantages resonate with customers and businesses. In the US, for example, about three-quarters of firms cited the following features of real-time payments as “very” or “extremely” valuable: enhanced fraud and security, 24/7 availability, easier reconciliation through enhanced data, and the fact that funds were instantly available on account.

Our view is that Instant Payments will play a key role as the Middle East transforms to a region of digital, cashless economies – with take-up driven in large part by customers who want to leverage the full potential of digitalisation and “Everywhere Banking”.

The benefits of innovating existing system environments fall into three broad areas:

- Platforms and ecosystems: Instant Payments systems build on and bring innovation; they support collaboration among, and promote integration with, players in the payments ecosystem; they allow improved access and provide global interoperability;

- Service capabilities: Instant Payments systems ensure 24/7/365 availability and bring transparency and interoperability with other payments systems like real-time gross settlement (RTGS). Importantly, the traditional RTGS systems in Saudi Arabia and the UAE are legacy systems, and both nations are looking ahead to a real-time payments system that is built on modern technologies;

- Payments features: Instant Payments systems offer unprecedented transaction speeds with a maximum execution time of a few seconds; they are ISO 20022-compatible, which means they carry reams of valuable data; and they instantly notify customers and provide immediate access to funds.

In short, Instant Payments constitute a profound change to a landscape that has long been characterised by high cost and delayed operations. Instant Payments systems are moving the world closer to a time of immediate and near-invisible payments – a journey that the COVID-19 pandemic has made more pressing with fears around the risks of handling cash. Instant Payments systems support new use-cases and enable the replacement of cash without the hassle for consumers of a lengthy, complex initiation and completion process for making payments.

Instant Payments in the Middle East

In the Middle East, the launch of an Instant Payments system in Saudi Arabia, scheduled for the first quarter of 2021, comes as the pandemic has propelled a double-digit percentage rise in e-commerce sales in Saudi Arabia and the UAE, and as banks’ revenues have come under pressure in certain areas. The UAE’s Instant Payments system is in an early phase of implementation, with its launch expected in the coming years.

At the same time, the payments market in the Middle East and North Africa is growing, with the digital payments market expected to post 6.5 percent CAGR from 2020 to 2025. Key drivers include:

- A high rate of mobile phone penetration and ubiquity of internet availability, particularly in Saudi Arabia and the UAE, and the increasing popularity of e-commerce;

- Licensing new payment and digital wallet fintechs like HalalaH and BayanPay in Saudi Arabia, as well as telecom providers offering wallet services, such as STC Pay in Saudi Arabia; in addition, increasing numbers of retail outlets in the UAE and Saudi Arabia accept Apple Pay, Google Pay and Samsung Pay, and we expect this growth will continue;

- Changing consumer preferences, driven in part by shifting demographics, including the demand for cheaper, safer and faster payment options 24/7 and increased trust in digital payments. In the UAE, for example, 71 percent of consumers use digital payments rather than cash when shopping in-store, while 89 percent of Saudis said last year that digital payments were more secure than cash;

- The impact of emerging technologies (e.g., blockchain/digital ledger technology (DLT), cryptocurrencies and biometric data) that create greater competition in the market to accelerate innovation, providing improved speed, security and simplicity of the payments process.

Additionally, merchants in other global markets usually prefer Instant Payments as these are cheaper than existing card payment mechanisms, more secure and faster – as we’ve seen in India, China and Australia, where trends like Open Banking and the use of QR codes at checkouts have similarly changed the POS and e-commerce experience. Other drivers include the impact of the ISO 20022 migration, greater focus and engagement of banks on the payments space, and regulatory changes (including the advent of Open Banking and ISO 20022 migration) that further increase expectations of open, fast and frictionless services.

Beyond that, there are government aims like Saudi Arabia’s objective of ensuring that 70 percent of transactions will be non-cash by 2030, and the creation of sandboxes (like that set up by the Saudi Arabian Monetary Authority (SAMA)) to support fintechs in collaborating and testing payments solutions.

Finally, the launch of the GCC-RTGS in 2021, the 2020 launch of the regional Buna payments platform, and global initiatives like SWIFT GPI and the migration roadmap of all major RTGS schemes and SWIFT towards the ISO 20022 format mean banks need to assess their payments business – from both a business and technology perspective. Change is coming, and banks should prepare.

2. Instant Payments systems: Use cases across the board

Instant Payments systems provide the platform that supports various use-case requirements for C2C, B2C, B2B and C2B payments – including payments to and from the government. Starting with C2C, people can use Instant Payments as an enabler to replace cash, purchasing low-value items and with those transactions carried out via mobile phone. Additionally, with a “proxy service” people can use aliases like mobile phone numbers to send and receive funds without providing lengthy account details.

On the C2B front, consumers can shop online for goods and services, and pay bills to businesses or government in real-time. Businesses and governments can use Instant Payments for B2C purposes, including paying wages and ensuring staff can cash out some or all of their salary instantly to meet emergency requirements. And governments can use Instant Payments to distribute subsidies, welfare or emergency relief.

B2B use cases include just-in-time payments to suppliers. In Saudi Arabia, for instance, Esal’s e-invoicing service could be combined with a real-time payments option.

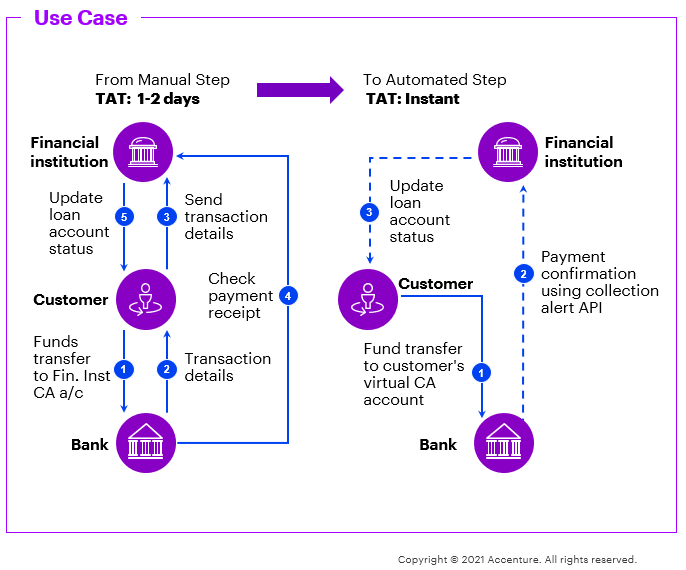

The benefits of an Instant Payments system don’t end there. While they are routinely used for peer-to-peer (P2P) payments, which have grown fast elsewhere, Instant Payments systems have a host of other uses. One is Request-to-Pay (RTP), where the original initiation of the payment is conducted by the creditor. Thus, RTP could, for instance, provide a cash management solution for corporate customers looking to assess liquidity more easily. Such an offering could be portal-based as part of the corporate’s internet banking offering or an API that integrates directly with the firm’s ERP (see diagram). The benefit for clients is a real-time digital payment value chain, which allows them to leverage digital’s full potential.

While the traditional acceptance process for a customer loan might take up to two days due to lengthy manual processes and delayed moving of funds, Instant Payments support the immediate transfer of funds and thus reduce the time until the final loan account status update to few seconds. (Source: Accenture)

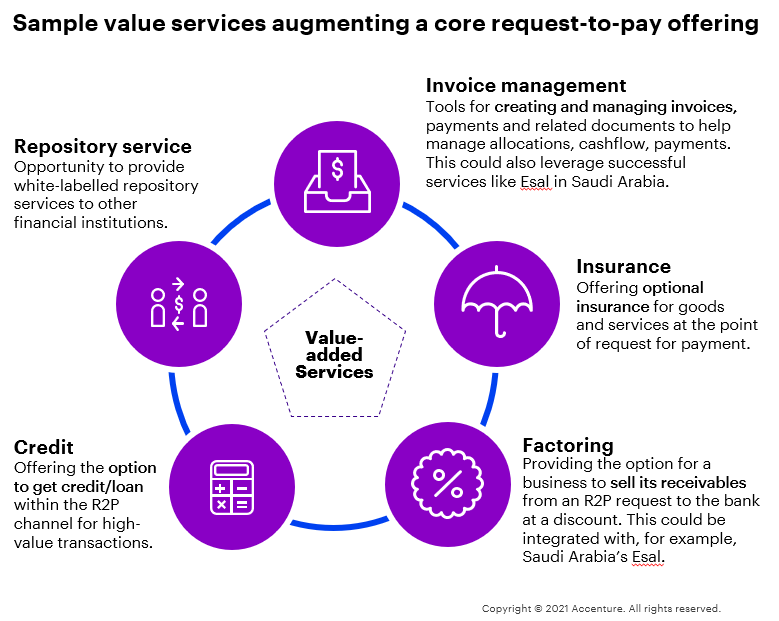

Instant Payments also make bulk payments more efficient, disburse instantly approved loans to bank clients, and ensure immediate credit card repayments for consumers. In addition, Instant Payments mean settlement and liquidity risks are no longer a deterrent for central banks and other banks, and, as we shall see, they allow those that offer Instant Payments to analyse customer data and spending habits to build overlay services.

Furthermore, instant international remittances that could be built as a natural extension of Instant Payments would circumvent the slow settlement and high costs of the traditional correspondent banking route. The popularity of international remittances and the prevalence of non-bank competitors in this product segment in Saudi Arabia and the UAE make that an important consideration for the banking industry to define solutions based on Instant Payments. Finally, as the diagram below shows, an Instant Payments system would further support a range of new up-sell and cross-sell opportunities.

In summary, there are numerous compelling reasons why banks should begin to consider now how they will transition to Instant Payments. On an existential basis, doing so means they will remain relevant; after all, they can expect that many non-bank players have already started entering this market in the Middle East. Unless banks begin their strategic Instant Payments programme, they might find they are too late to take the best advantage of the opportunities.

Adopting Instant Payments will allow banks to fulfil the expectations of next-generation consumers and businesses. By providing must-have services linked to an Instant Payments system, a bank will increase its chances of retaining existing customers and attracting new ones, which in turn will ensure clients remain within its orbit for its traditional offerings like loans and long-term account services.

Following this route will also help banks in the UAE and Saudi Arabia to participate in the drive towards Open Banking, which will soon be a reality in the region – with payments being a core component. And banks will benefit in other ways. The infrastructure underpinning Instant Payments systems makes it easier to manage liquidity and settlement risks via multiple settlement cycles, for example. It brings gains from reduced handling of cash and cheques. And it increases the velocity of money. It also allows full ISO 20022 interoperability with other payments streams in the process of adopting the new format (for example, SWIFT cross-border payments).

RTGS v Instant Payments systems

There are similarities and important differences between Instant Payments systems and real-time gross settlement (RTGS) systems. While both process single transactions and make funds available in real-time or within a few seconds, a core advantage of Instant Payments systems is that they operate 24/7/365. An RTGS, on the other hand, operates only during central bank operating hours or days.

In addition, while the debit and credit sides of the transaction are synchronous for both, only the Instant Payments system provides both payer and payee with immediate confirmation after payment completion, and thus an immediate status of finality.

RTGS systems are based on another messaging model, usually supporting a SWIFT MT messaging format via Y-Copy or V-Shape, whereas an Instant Payments system mostly uses the data-rich ISO 20022 format in a messaging loop back to the payment originator for status confirmation.

Both can be contrasted with retail batch payments. These are processed by file rather than as individual transactions, with funds available only in 1-3 days, and with the debit and credit sides of the transaction asynchronous.

3. Implementing Instant Payments

Banks should start their strategic planning early in order to support Instant Payments and leverage their commercial potential.

Implementing Instant Payments affects a bank’s entire processing cycle and most core banking applications. That means devising clear plans that address issues across their architecture including channels, products and core banking systems.

Such plans should be based on structured impact analysis and integrate considerations on whether to implement specific Instant Payments applications, replace key payments engines or upgrade existing ones. Banks should also keep in mind that cloud-based technologies will likely provide viable solutions in the future.

Furthermore, realizing 24/7 real-time processing requires reorganizing business and IT operations. Comprehensive testing is crucial when implementing a new payment format like ISO 20022, and to comply with maximum execution times and time-outs.

The challenges of implementing Instant Payments systems for banks in the Middle East fall into five areas, though not all will be relevant to every bank.

- Instant Payments target state: some banks have a complex architecture with multiple payment engines, which limits how well and how fast they can build new capabilities.

- Legacy architecture: Many banks still run legacy application systems. These hamper Instant Payments systems’ operations because they offer limited availability, have a slow response time and aren’t easily scalable.

- Digital maturity: Banks in the Middle East are yet to catch up with digitalisation updates that peers in markets like the EU and China have realised some time earlier, while the region’s economies are cash-centric, and there are currently few digital payments options.

- Non-bank competition: International and domestic competitors are gaining market share and revenues as they are more agile and quicker to introduce innovative services.

- Lack of customer-centric, next-generation services offerings: Banks in the region provide an outdated customer experience, with high transaction costs and a significant reliance on physical branches.

Instant Payments systems as a route to innovation

Banks can work to overcome these challenges by setting out a comprehensive, future-proof digital strategy that focuses on parallel work streams to deliver the benefits of Instant Payments. This should complement classical business case calculations with a mindset on a “benefit case” that considers the long-term potential of new products and services based both on Instant Payments and on further applications for the services layer.

Banks should also consider carefully when and how to implement Instant Payments, how to define their commercialisation and supportive pricing strategy, and how these workstreams fit the overall digitalisation of services offerings.

In part, this requires a sophisticated branding and marketing plan around innovative products and services based on Instant Payments that will promote the use of this service in the market. Banks can do this by instituting loyalty programmes, by building attractive services around Instant Payments, and by establishing a zero-fee policy for certain customer segments (for example, for personal customers) to support initial adoption. In this way, they can craft a go-to-market layer for new services, products and use-cases, as their peers have done elsewhere. Other customer segments (e.g., corporates) might then be ready to pay for the instant quality and immediate confirmation of Instant Payments.

We’ve seen in other markets that some banks prefer the status quo. In the UK, for example, banks generate significant revenues through the existing card interchange, which has slowed the progress of Instant Payments in e-commerce and POS use cases, even though implementing Instant Payments would mark a new offering and revenue stream for banks’ merchant clients. Our view is that banks are better-placed looking to the future and considering how to make Instant Payments’ offerings commercially viable.

In other words, rather than being slow to adopt Instant Payments, banks would do well to exploit it as a platform for innovation through which they can realise numerous next-generation digital banking services. These could include: paying by proxy; offering a greater variety of customisable payments; offering electronic real-time payments to customers related directly to their accounts instead of intermediate layers (e.g., as with cards); and solutions that help customers in areas like personal finance management and invoicing.

In this way, they can use an Instant Payments system to build a range of opportunities, all the while being careful to ensure their offering is future-proofed and aligned with global trends and the widely used Open Banking AISP and PISP standards, which cover account information and payment initiation respectively.

From data to education

A crucial aspect of Instant Payments is that they use the messaging format of ISO 20022, which will soon be the language of all financial transactions globally. ISO 20022 is a format with more fields, increased field length and structure, and greater flexibility than most legacy formats, including SWIFT MT, providing information transfer with higher quality.

Ultimately that will bring greater value for retail consumers, commercial customers and bank operations. Banks elsewhere have leveraged these data capabilities to provide overlaying value-added services like automated receivables-matching, virtual account services, e-invoices for payment initiation, and account reconciliation for B2B clients.

Taking advantage of this data, though, requires that banks initiate their migration programmes as soon as possible and further manage their corporates’ enhancement projects to be able to support ISO 20022. Thus, banks must communicate closely with their corporate clients to ensure both sides implement this format simultaneously and thus fully leverage the potential of ISO 20022. Doing so will allow a seamless end-to-end message transfer within the ecosystem.

There are other factors to consider too. An Instant Payments system requires: that customers can initiate payments using their mobile phones; that the bank’s system is available 24/7/365; and that it adheres to the short response time for incoming and outgoing payments. In addition, banks would benefit from setting flexible limit thresholds for Instant Payments, and ensuring their systems can process such payments while complying with fraud management, sanctions and anti-money laundering requirements.

Finally, there are country-specific aspects. For banks in Saudi Arabia, for example, Instant Payments will provide a fallback option for the Saudi Arabian Riyal Interbank Express (SARIE) system, the payment and settlement system that links all banks in the country.

Corporates, SMEs and other businesses need to adapt

A successful Instant Payments system also requires work by businesses that will use it, many of which will need to establish online and digital channels, including mobile, as a front-end for initiating payments, and rework their liquidity management modules to take account of the speed of funds transfer that Instant Payments bring.

They should also:

- Enhance their ERP and payments systems to provide the data required to initiate Instant Payments in line with ISO standards;

- Upgrade internal reporting applications to process acknowledgements sent by their bank;

- Automate reconciliation processes to the greatest extent possible.

It’s worth noting, too, that businesses in the Middle East will likely benefit from learning more about Instant Payments, as a recent study found was the case for peers in the US. While most US firms were aware of Instant Payments solutions, sizeable numbers had reservations in areas including technological constraints and fraud, with this varying depending on the firm’s size (see table).

Potential hurdles to Real-Time Payments adoption

Real-Time Payments inhibitors cited by firms, by annual revenues

| Reasons | Less than $10M | $10M-$100M | $100M-$1B | More than $1B |

|---|---|---|---|---|

| Technological or resource constraints | 33.30% | 48.90% | 38.20% | 42.90% |

| Lack of RTP knowledge | 46.70% | 26.70% | 47.10% | 28.60% |

| Concerns over fraud | 40.00% | 28.90% | 44.10% | 38.10% |

| Do not see benefits of RTP | 26.70% | 20.00% | 20.60% | 14.30% |

| RTP harms cash flow | 15.60% | 11.10% | 23.50% | 14.30% |

| Other | 2.20% | 4.40% | 0.00% | 4.80% |

Source: Making Real-Time Payments a Reality: Rising Demand for Real-Time Payments, Mastercard and PYMNTS (2020).

4. How to prepare for Instant Payments?

When thinking about Instant Payments systems, banks need to factor in more than just the return on investment; they should ask, too, questions about the arena in which they operate. For example:

- In what way would the payments strategy need to integrate external roadmaps and comply with external milestones?

- What steps will the central payment system operator (e.g., the central bank) take that we can use to our advantage?

- What is the strategy of the local banking association and that of the wider group of stakeholders?

- How should our payments strategy evolve, including our product strategy across retail and corporate payments?

What is the most suitable branding and marketing strategy for the local market?

The considerations don’t stop there. There are requirements to manage fraud, anti-money laundering and compliance issues once an Instant Payments system goes live, as well as the impact of running a system 24/7/365 on IT systems and the overall operational costs. Banks must also consider vendors, determine how to recover the costs used to implement and maintain the system, and conduct business analysis and process-mapping.

Preparing for Instant Payments, then, requires a comprehensive plan that will deliver the bank’s desired targeted outcome at the right pace and with certainty. And that raises its own questions of a higher-level nature, including how an Instant Payments system will affect areas like change management, the bank’s strategy and operating model, its testing and data strategy, and its technical architecture and development.

If that seems like a lot to consider, it’s worth reiterating that Instant Payments and the players that underpin such services are moving to upend the Middle East’s payments landscape. Banks seeking to stay relevant need to take action now – become first-movers and position themselves to greatest advantage for a digital future. That starts by asking the right questions and initiating a comprehensive Instant Payments impact analysis.

Advantageously, central banks and regulators in many countries have conducted similar projects to provide the rails upon which Instant Payments are processed. Insights, lessons learned and a variety of data-points on the go-live of these systems can help banks in the Middle East prepare for their transition. To succeed, they should build on those insights and start to move towards an era of future-proofed payments. That starts by crafting a sound Instant Payments-based product strategy and then rehearsing live operations to ensure their Instant Payments offering will be a success.