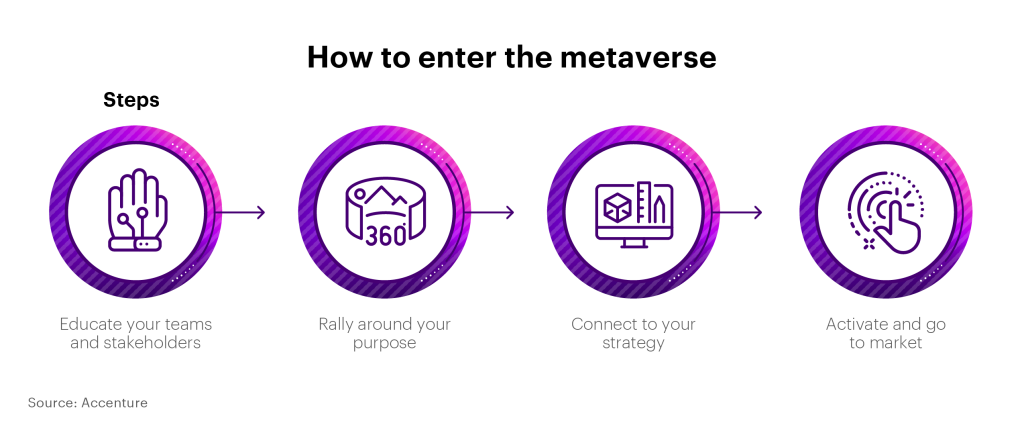

Our first metaverse post attracted a lot of attention and prompted the Ultimate Guide to Banking in the Metaverse. These posts discussed the first step in moving to the metaverse: educating your teams and stakeholders. Now, with more banks looking to understand how they can drive growth and value by entering this new frontier, we are having conversations about where and how to play. While the instinct may be to move fast (it's exciting!), let’s ensure speed to market is balanced with purpose.

Striking this balance is critical given the spectrum of the metaverse potential. Our 2022 Tech Vision defined the metaverse as, “An evolution of the internet that enables us to move beyond ‘browsing’ to ‘participating and/or inhabiting’ in a persistent shared experience that spans the spectrum of our real world to a fully virtual world and in between.”

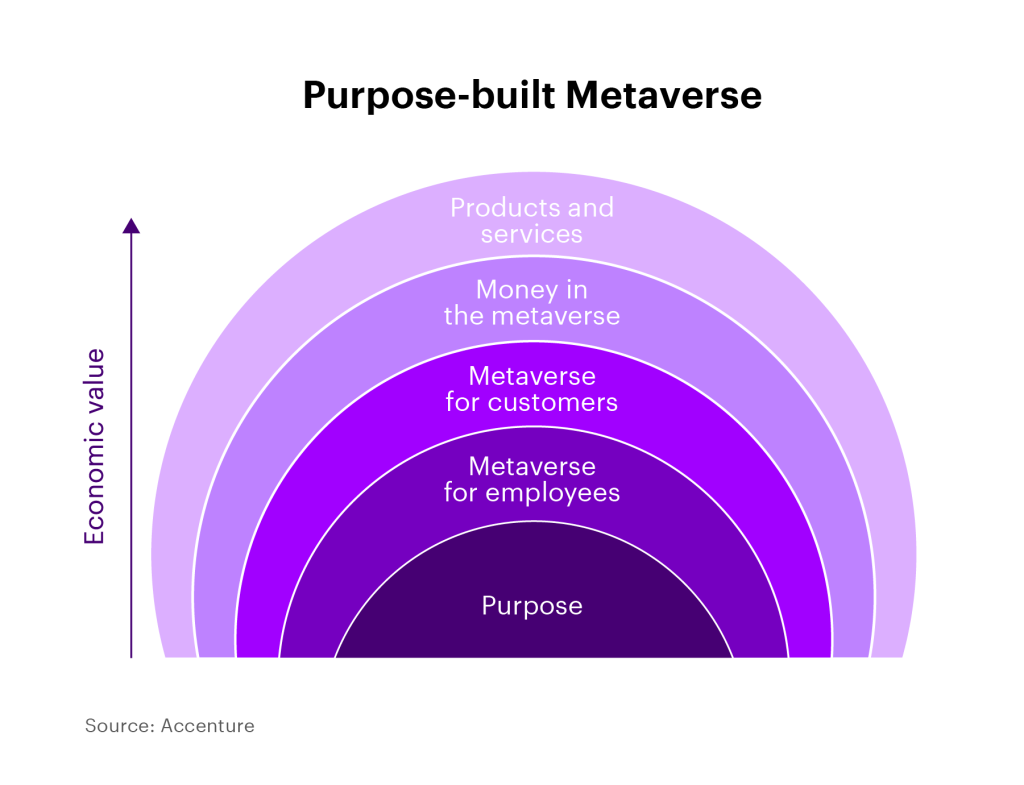

We understand this definition can feel enormous and broad. While some of banking’s early movers, such as Amex, Fidelity, HSBC and JPMorgan Chase, have provided lessons in meaningful experiences, we see an opportunity for banks to explore new products and services and reimagine banking experiences by defining their own purpose-built metaverse.

It’s now time to talk about the next steps banks can take to enter the metaverse with purpose.

1. Rally around your purpose

The metaverse offers an opportunity to imagine and invent better experiences for the real world. With this potential, banks should not be simply replicating what they do today in 3D but looking at where they can offer improved experiences and services with this range of technology. This will give users meaningful reasons to come to the space and continue to return.

In these early days of banking in the metaverse, we are watching key themes emerge that touch on purpose, including payments and loyalty, entertainment, community, financial health and wellness, and education.

To jump-start your thinking about your purpose in the metaverse, ask these questions:

- What do my customers and employees need right now? And how can the metaverse help improve the experiences I provide in new and more impactful ways?

- What are the outcomes I’m looking to achieve this year? And how might the metaverse help my bank reach these goals?

- Just like any strategic initiative, you must ask: What impact are you looking to have? And how do you plan to measure it?

It all starts with your purpose.

By focusing on the employee experience, including recruitment, onboarding, immersive learning and engagement, you can enable the bank in the metaverse from within. Beyond employee experiences, applications for internal, corporate metaverses are vast.

We’re already experiencing this influence. One Accenture Park is Accenture’s metaverse for employees—our CEO, Julie Sweet, recently shared its training success and plans to onboard 150,000 people this year. And as our previous post describes, organizations like Bank of America are using virtual reality to train vast numbers of employees in multiple locations.

Beyond the employee experience, the metaverse has the potential to transform how we work. The Harvard Business Review recently asked, “Feeling under pressure with too many meetings scheduled today? Then why not send your AI-enabled digital twin instead to take the load off your shoulders?” As mind-bending as that may sound to us now, it is a possibility.

As you consider ways to leverage the metaverse and enhance employee experiences, resist the urge to duplicate known experiences, like virtual training classrooms with eight-hour training days. As Sweet highlighted, giving purposeful attention to engagement will support shared experiences ranging from collaboration and meetings to performance management and team-building events.

In the metaverse, banks will pivot from delivering products and services to collaborating and partnering with customers. This represents both opportunities and challenges as you consider how to stay relevant and build trust with your customers in this new place.

From pride parades and dance parties to e-sports and omni-reality spaces, we continue to see more customer-facing experiences across the industry that represent potential for customer engagement. We encourage banks to move beyond their current role and explore community engagement through events, speaker series or meaningful co-sponsorships. Banks should be continuously iterating on the customer experience to encourage re-engagement, a key success factor in your metaverse space. Customers need meaningful reasons to continue to return.

Trust-builders will be vital, so continue to move with purpose and connect to the ‘why’. Why are you leveraging this channel? Are you being purposeful with your metaverse experience and offering value beyond a new space? What are you solving by being here? This will all play into your strategy and your choice of platform (more on that below), as each platform has a different set of end users.

Banks are uniquely positioned to bridge customers’ fiat assets in the physical world and their digital assets in the virtual world. This can provide customers with an increasingly holistic view of their wealth, while also providing the bank with opportunities to deepen client relationships and potentially offer new services.

As digital assets become a greater proportion of customer holdings, the demand and value for banks to ensure the safekeeping of these assets will increase materially. Banks that have not already developed an approach for providing digital asset custody are at risk of failing to meet the needs and expectations of their customers as they enter and navigate this virtual world.

Customers will need the ability to transact with one another in the metaverse. The current experience is less than ideal. For example, customers should not have to remove headsets to key in credit card numbers. Digital assets are native to the blockchain, and the money of the metaverse should be as well. Banks can issue and operate the money of the metaverse, enabling seamless transaction experiences, while opening a new and sustainable revenue stream.

We see value pools and use cases across retail and commercial banking and wealth management as a result of this technology. For example, leveraging a digital twin of a home for an immersive mortgage discussion with your broker. We addressed more immersive home buying experiences in our previous metaverse post, but take a moment to imagine 3D scans for a realty listing that’s certified on blockchain. Appraisers no longer need to visit the property in-person when they use apps like Wander and Matterport with their Oculus Quest.

Apply this immersive experience to any type of personalized advice conversation, even a personalized portfolio review with a specialist, as shown in the image below.

As banks consider how to drive value in the metaverse, there is incredible potential to move beyond banking and look at new products and services now available because of the metaverse. Continue to ask, “What can I offer now?” For example, what role can you play in enabling a high-net-worth customer to procure and safely store digital art in the form of a non-fungible token (NFT)? Also, how can you host community events for your senior customers as they explore ways to engage and source retirement information?

2. Connect to your strategy

After defining and understanding your value pools, a broad set of capabilities and services will need to be carefully considered to support and activate new, meaningful experiences. This will improve the likelihood of engagement and, more importantly, re-engagement by users.

When selecting purpose-rich metaverse services and capabilities, we recommend considering the required maturity of the following:

- Responsible metaverse: security, risk & compliance, governance, equity & inclusion, employee & customer safety.

- Data, analytics, and AI: persistent data & analytics, measurement & KPIs.

- Technology & enablers: assisted reality, virtual reality, augmented reality, blockchain, digital twins, IT support, and more.

3. Activate and go to market

Selecting your platform says a lot about how you go to market as it will set the tone for end users and experiences. The metaverse landscape is continually evolving, and not all platforms are created equal. Banks have already established a presence in Decentraland, Sandbox, Minecraft and so on.

Choosing between a permissioned or permissionless platform is the most important choice. Why? It determines ownership. For example, the permissioned Horizon Worlds platform allows users to sell digital goods for a ~47.5% fee, while the permissionless Decentraland platform enables users to sell digital goods on OpenSea for a 2.5% fee. This fee difference is determined by who “really” owns the digital good—Meta in the case of Horizon Worlds and the user (via an NFT) for the parcel in Decentraland.

As a starting point, consider the segments, marketability, experience enablement, technical capabilities and platform growth potential and how these criteria will support your purpose.

As with most platform decisions, entering the metaverse will come with risk. Buying land in Decentraland could be perceived as volatile and expensive. The buyer must protect their private keys which control the underlying NFTs. Additionally, NFTs represent a bet on the future, so if Decentraland loses active users to another platform, the value of its parcels may decrease. These risks are part of the metaverse equation—don’t let them deter you from exploring.

As you walk through your metaverse strategy, we hope you continue to make moves with excitement. We understand there is a lot to unpack in this new world. Keep in mind that many experiential aspects of the metaverse have their roots in gaming. It’s a new and emerging area, so stay curious while adopting a “test and learn” approach. And with that, remember to focus on value as you look to the future and continue to experiment while forming your adaptive, purpose-built strategy. Enjoy the purposeful exploration!

And reach out for assistance—we're here to help guide your metaverse mission.

Special thanks to Alexandra Convey, Accenture Song Brand & Marketing Strategy Consultant, for contributing to this blog post.