Other parts of this series:

While central banks are under scrutiny these days thanks to rising interest rates and economic uncertainty, they’ve always played a fundamental role in the modern financial services system. For a closer look at the challenges and opportunities they face amid today’s breakneck pace of digital change, I’m turning my blog over to my colleagues Rohit Mathew and Oliver Reppel. Both are Managing Directors for our practice in the Middle East.

– Mike

Now or Never: High Time Central Banks Embraced Total Enterprise Reinvention

Pity the central banker.

While this plea isn’t much heard, particularly lately, it’s worth considering how much harder their job has become since 2007.

As we’ve written before, the pace of change in the financial services industry is a major challenge as organisations use disruptive technologies (AI, blockchain and mobile banking, for example) and have greatly enhanced data capabilities. But advances in technology aren’t alone in propelling a shift in the role of central banks:

- New entrants like fintechs and bigtechs are fragmenting the traditional value chain.

- Shifting expectations of digital-age customers are altering the demand for services, products and experiences.

- Money can now be moved in real time, 24/7, from the palm of a customer’s hand—the recent run on SVB was a mobile run.

- A volatile global economy, changing external challenges (the pandemic, the war in Ukraine) and increasingly sophisticated security threats add to the mix.

That said, some central banks failed to meet a primary requirement: forecasting inflation and implementing measures to counter it (not least because, for decades, few had needed to tackle inflation). While geopolitics is partly to blame, central banks have been roundly criticised.

In this and other areas, central banks have been hamstrung by their slow progress to digital, which has exposed gaps in their capabilities. To succeed, they need to embark upon what we call Total Enterprise Reinvention. The first steps would be to review their approach to supervision and policymaking, and start their digital transition. Most have not, yet even those that have begun will need to accelerate. Ultimately, those that fail to keep pace will be unable to fulfil their roles and responsibilities.

A tough balancing act

One reason central banks have struggled is they found themselves in an unprecedented situation. But more significantly, most of them work as they’ve done for decades, and it’s clear that a legacy quarter-by-quarter approach is no longer fit for purpose in a world where transactions and reporting happen instantaneously and around the clock. To keep pace and assert their relevance, central banks need to embark on Total Enterprise Reinvention.

The cornerstone of Total Enterprise Reinvention is a strong digital core, and we will argue in these posts that it is critical that central banks leverage the latest technology—particularly data analytics and AI. However, even the right technological tools won’t make it easy to get the balance right between their roles.

Consider this: central banks need to stimulate growth by, for instance, reducing recession pressures (although here the law of unintended consequences saw the bond-buying programme saddle five of the world’s leading central banks with losses estimated to be north of US$1 trillion). At the same time, they must lower risks like those associated with inflation.

Then there are interest rates: while raising them may tamp demand-led price rises, doing so must be balanced against the need to promote growth. Moreover, central banks operate in economies that have become far more complex and globally intertwined, while technological shifts mean many of the models and assumptions they use are no longer relevant.

Central bank digital currencies (CBDCs) represent one such technological shift. They affect money supply (and likely interest rates and exchange rates) so must be handled carefully. CBDCs will also affect the banking sector, and consequently should be implemented only where appropriate and once a robust regulatory framework is in place.

That’s not all. Central banks must consider cross-cutting environmental, social and governance (ESG) factors, and clarify their priorities in areas like inflation, employment, regulation and climate change—in other words, accommodate the broad interests of the politicians who fund them and of the societies they serve. Finally, they ought to be more active in the banking sector, ensuring it is not over- or under-banked, and that it drives financial inclusion.

Doing better through better predictions

Clearly, the list of challenges is long. Central banks cannot solve them all—some fall outside their influence; others are beyond their remit. And while some challenges will ease, new ones will arise.

The solution is to focus on how best to perform their roles: central banks would be more effective at staying on top of economic developments, and supporting and enabling national resilience, stability and growth, if they had more relevant data to hand and were better able to interpret that data and make informed decisions pre-emptively.

And while regulations are an important tool, “the debate should not always be about more or less regulation,” as JPMorgan Chase’s Chairman and CEO Jamie Dimon wrote in his recent shareholders’ letter. Instead, he argued, it should be “about what mix of regulations will keep America’s banking system the best in the world”.

Although Mr Dimon was talking about the US, his point holds true elsewhere. Despite a proliferation of regulations post-2008—which constrained economic growth by tying up capital—banks continue to fail and taxpayer-funded bailouts remain part of the landscape. It’s worth asking whether there is a better way to safeguard customers and shareholders.

That takes us back to the failure to forecast and reduce inflation. Most central banks’ predictions fell short because they lack the technological tools and people to analyse huge quantities of economic and business data, and provide answers in an environment where time is of the essence.

A fully digitised central bank would have no such difficulties. Better still, it could demand and process more and better data from banks to improve its forecasting of the industry and the economy—shifting from today’s reactive stance to a proactive one.

The digital regulator

Digital transformation, then, is crucial if central banks are to aspire to a new performance frontier. Subsequent posts will explore the steps they should consider. For now, it’s worth noting two final points:

- Some central banks do recognise the need to act. Germany’s Bundesbank, for instance, is on a journey to becoming a “digital Bundesbank”, and is focused on three areas: digital products, expanding its analytics capability, and introducing fully digitised processes. Failing to take these and other digital steps, the bank has said, would jeopardise its mandate. Most central banks would benefit from a deliberate and ongoing strategy that focuses on a strong digital core, drives growth and optimises operations by combining new technology and ways of working.

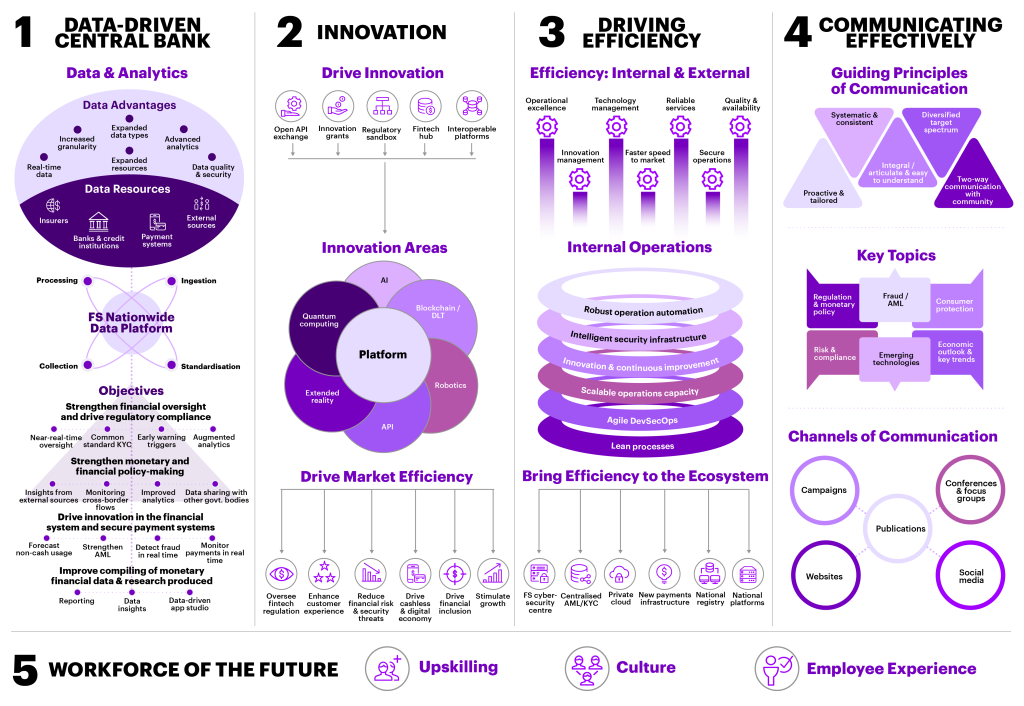

- While each central bank will map its own path to becoming a reinvented central bank—which we cover in our whitepaper on digital regulators—a successful pivot requires building on five pillars: data, innovation, efficiency, communication, and a future-ready workforce (see graphic). With this approach, central banks can achieve their regulatory objectives and move society forward.

Our next post will examine data and people, and show how better data-capture and the use of data analytics and AI, when combined with a strengthened workforce, can bring new capabilities and reshape how central banks approach monetary policy.