Back in 2009, Apple coined the catchy phrase, “there’s an app for that.” Since then, apps (single-use apps, that is) have multiplied exponentially and become part of everyday life for most people. But a new breed of app is on the rise, and it’s threatening to consolidate power and market share. The “super-app” is becoming a major disruptor in the online marketplace and the digital financial services ecosystem. Should incumbents be worried, or is this an opportunity in disguise?

What’s a super-app?

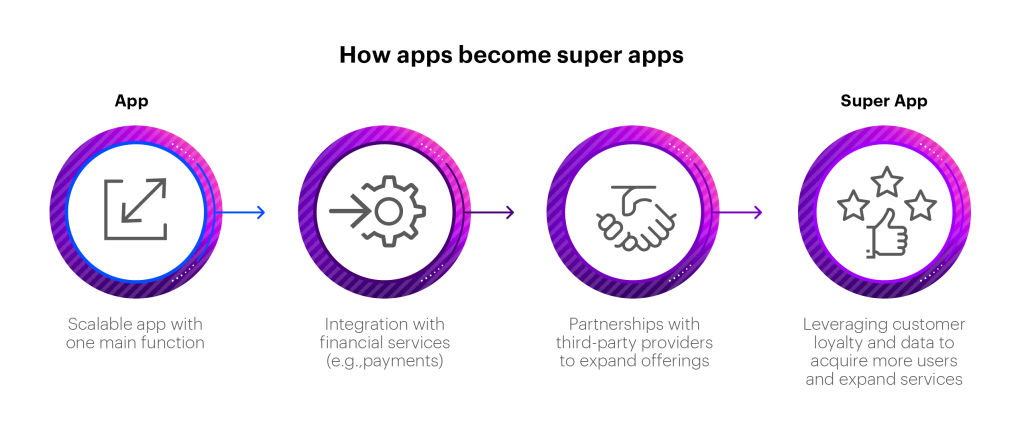

A super-app is an umbrella app that offers a full ecosystem of services shaped around users’ everyday lifestyle needs, using one integrated interface or platform. It usually involves a marketplace of third-party offerings fully integrated into the ecosystem and makes use of vast amounts of data to engage with users and offer a wide variety of experiences and services.

Some of the most common features in super-apps include:

Payments and financial services

- Cashless payments

- Mobile payments

- Investment platforms

- Insurance

- Credit and loans

- QR code payments and rewards

Retail services

- Event ticket bookings (e.g., movies, theatre, sporting events)

- Restaurant and grocery ordering

- Hotel bookings

- E-pharmacies

- Transportation ticketing (e.g., bus, train, flight)

- Other e-commerce

Other functions

- News and media content

- Calling and messaging

- Job search

- Entertainment (e.g., music, videos)

- Real estate and rentals

- Cloud storage

Why are super-apps on the rise?

As using apps has become an established behavior for many consumers, they have become comfortable doing more and more online and on their smart phones—from shopping and banking to attending business meetings, watching movies, booking transportation and more. This has paved the way for super-apps to consolidate a market that has become too large and unwieldy for users to keep up with.

Super-apps offer the benefit of a one-stop platform for multiple tasks that users want to perform online. Opening a single super-app is much more convenient for users than managing dozens of individual apps. This is the main reason super-apps are gaining ground over single-use apps.

By bringing together a range of experiences, services and functions on a single platform that customers already feel confident using, super-apps provide seamless experiences that keep users engaged. Also, by offering loyalty rewards, users are encouraged to conduct more of their business on the super-app to maximize those benefits.

Super-apps are already dominant in several markets

1.24 billion users China’s leading social app has become a successful super-app, offering messaging, social networking, shopping, payments and other services for free.

230 million users A widely used digital wallet in China started by the marketplace giant Alibaba, Alipay’s QR code payments are used by millions of businesses from luxury malls to street shops.

187 million users Southeast Asia’s leading super-app, Grab, offers services in three main areas: deliveries (food, meals, packages, documents), transportation (ride hailing) and financial services (payments, e-commerce and insurance).

![]()

170 million users Although it started as a call centre for ride-hailing services, Indonesia’s GoJek super-app now offers over 20 services in transport & logistics, food & shopping, payments, daily needs, business and news & entertainment.

150 million users India’s leading super-app offers mobile recharges; utility bill payments; travel, movie, and events bookings; in-store payments; parking payments; tolls and payment at educational institutions through their QR code system.

![]()

48 million users Operating across 13 countries in the Middle East and North Africa, Careem offers a wide range of services including transportation, food, shopping, deliveries, payments and sending credit.

How is Open Banking powering super-apps?

The rise of Open Banking around the world is enabling super-apps to use financial data from multiple sources to target customers’ needs and deliver financial products. This will give the platforms an even greater opportunity to provide a range of financial services and target the right services to each user.

Open Banking will power super-apps by:

- Maximizing personalization: Open Banking creates an ecosystem that proactively helps platforms leverage customers’ data and create truly personalized experiences for them.

- Accessing everything on one platform: Once the super-app is able to use Open Banking data, consumers can make payments, check their account balances, monitor recent transactions and perform other traditional banking operations from the app’s digital wallet, reducing the need to access a bank’s own app.

- Using advanced technology: Analytics, artificial intelligence, and machine learning can leverage Open banking data to build customer-relevant products and foster a culture of data sharing and data-driven decision-making across the super-app’s business ecosystem.

- Connecting the right partners: As Open Banking expands further into open finance and open data, super-apps will be able to access and connect with a larger number of partners to provide faster speed to market for new products and an even wider customer base.

How will super-apps affect banks?

Super-apps integrate financial services into their platforms to provide seamless experiences for their customers. For banks, this means that an increasing number of users may bypass banking apps and simply use the more integrated super-app. Super-apps with digital wallets also make it easier for the users to stay in the super-app ecosystem and reduce their dependence on cash and credit cards.

Some banks have already become a part of the super-app ecosystem by providing unbranded “banking as a service” to the apps, making all of this seamless integration possible. The regulatory framework around financial services is so onerous that many super-apps simply don’t want to navigate it themselves, especially across multiple markets and regulatory regimes. This means that super-apps offering e-commerce, loans, insurance products, investing platforms and more are creating strategic partnerships with both banks and fintechs in their key markets to provide these services.

As the popularity of super-apps grows, they could become a much bigger source of competition for banks than either neobanks or fintechs. By keeping users engaged on their platform, they could make it almost impossible for banks to convince customers to leave the super-app in order to use the bank’s standalone digital banking apps.

Banking Top 10 Trends for 2022. Our annual Top 10 Banking Trends report predicts the trends that will shape banking’s future.

LEARN MOREWhat should banks do now?

Banks generally have three options for responding to the rise of super-apps:

- Accept changes to the market and try to stay competitive by promoting their own offerings.

- Extend their reach by embedding services (possibly unbranded) within super-apps or other digital financial services.

- Compete head-to-head with the super-apps by launching their own wide-ranging super-app encompassing both financial and non-financial offerings.

Let’s look at each of these options in more detail:

Accept: Choosing option 1 will limit banks’ growth, although well-established banks may be able to hold on to their market share because they are trusted brands that have a large customer base and proprietary data. However, banks may find that even the customers that stay with them are also using super-apps for some of their financial needs, potentially chipping away at profits.

Extend: Option 2 is the approach that many banks will likely consider. Some will offer white-label services in the background and quietly generate revenue from them. Others may continue to leverage their brand within the super-app’s ecosystem, using the platform to create a smoother and more convenient user experience. However, given the fact that the number of super-apps is limited, banks will need to act quickly or risk having no one left to partner with.

Compete: Option 3 will attract the boldest banks—those willing to reimagine their business model and adjust their vision to embrace the challenges of building an ecosystem of their own. In order to compete with the rising and established super-apps, these banks will need to:

- Establish a vision: Banks need to pinpoint what their role will be in this new era before undertaking the transformation to become a financial services or lifestyle ecosystem. Banks that don’t carve out a defined niche could find themselves made redundant.

- Embrace open data: Super-apps thrive on the free flow of information between entities. To compete, banks will need to explore open data architecture and application programming interfaces (APIs) too.

- Become a data player: Banks will need to build data management capabilities like analytics algorithms and machine learning to unlock the value of their own data and third-party data, and launch new user experiences and journeys.

Download our full report on Banking Top 10 Trends to find out how super-apps and other top trends are shifting the focus for banks. Contact us to discuss your strategy for surviving—and thriving—beyond the rise of super-apps.

With thanks to Vibhu Gangal and Deepika Rathi for their contributions to this article.