Bankers must be weary of all the talk about disruption; in the past 15 years they’ve had to survive both the economic and reputational fall-out of the Great Recession, digitize their business and start moving it to the cloud, manage the greatest-ever distribution of relief funds to see their customers through the COVID-19 pandemic, and help impose an unprecedented regimen of global sanctions against Russia and its allies. All while defending their customers and revenue against the sniping of a new breed of competitors.

Disruption? It’s become business as usual.

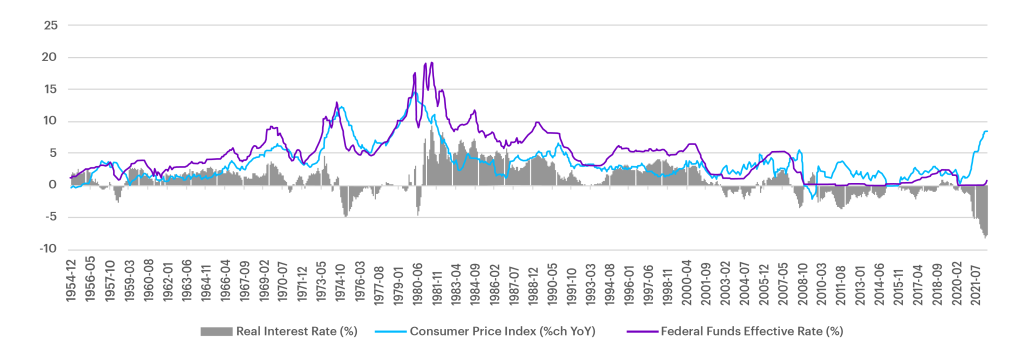

Just the latest development to test banks’ business models is the rise in inflation and the accompanying hike in interest rates. It’s been 30 years since inflation in the US exceeded 4% for more than two months (see Figure 1), yet the average inflation rate for the first four months of 2022 is a shade over 8%.

Figure 1. US inflation and Fed Funds rates from 1954 to 2022

Sharp rises in interest rates are rare but not unheard of. What differentiates the last and the current hikes from the three previous ones is that they kicked off pretty much at 0%. Our analysis suggests that the market reacts differently when this is the case. The reaction also does not remain consistent as the rate continues to increase, nor is it the same for both a rapid and a gradual increase.

Spotlight on the balance sheet

Whenever interest rates trend upwards, analysts start to pay closer attention to banks’ balance sheets. Currently, it’s estimated that 28% of US bank deposits are non-interest-bearing. This is the highest recorded during our period of analysis (1984 to 2022), but of course it varies from bank to bank.

Also under scrutiny is the share of banks’ deposits that can be categorized as ‘hot money’—funds that are susceptible to being moved at short notice in pursuit of the best returns. Our analysis is that 24% of all the funds in US bank accounts consists of hot money. This ranges from 4% for the top four banks to 48% for selected digital banks and 36% for all the other banks which we analyzed. Banks with the lowest shares of non-interest-bearing deposits generally have the biggest shares of hot money.

The quest for a better beta

So far, so good—these are all factors that banks are very familiar with. They feed into the crucial calculations of the propensity of these funds to move and the optimal deposit beta—the portion of the Fed’s rate hike that must be passed on to deposit holders to dissuade them from moving their funds. The knack, of course, being to maximize the gap between interest paid by borrowers and that paid to depositors.

Our analysis of this propensity to move leads us to believe that non-interest-bearing deposits could shrink by 1.15% to 1.43% for each 100 bps increase in in the Fed Funds rate. Put differently, a 500 bps hike could result in a $1.1 to $1.4 trillion decline in non-interest-bearing deposits in the US.

Sleeping Beauty starts to stir

That’s based on historical trends. But this time things are likely to get a lot more interesting. The sudden sharp rise in the inflation rate, the first of its kind in almost half a century, has shocked many consumers out of their lethargy. For a long time these customers—known in the industry as Sleeping Beauties— couldn’t be bothered to chase higher rates for their savings. Now they’re strapped for cash and the effort yields some kind of a return. What’s more, the advent of comparison sites like Bankrate.com and MaxMyInterest.com makes finding the highest interest rate as easy as falling out of bed. Some even offer to open the new bank accounts on your behalf and automatically move your funds around as different banks take the lead in the rates merry-go-round.

With all this at play banks are likely to find that, in the first rising rate environment in the post-digital age, it’s harder than ever to hold onto their deposits. Of course, not all banks are equally threatened. Commercial banks have long had to endure outflows of cash with their clients using a variety of tools to help them exploit even marginally higher rates; the incentive now is significantly greater. Monoline-lenders will experience a bigger increase in the cost of their liabilities than more diversified banks. Many digital neobanks have survived on interchange fees because their customers have been content to park their money in zero-interest accounts; life will be harder when they have to start paying for these deposits. And as I mentioned above, banks and lenders whose liabilities include a big share of hot money will need to quickly come up with a strategy to retain these deposits—and these customers.

Strategies to survive the shake-out

I foresee a big shake-out. Zero rates have distorted the market, driving many banks to focus on individual products rather than the customer as a whole. As rates continue to rise, the folly of this approach will be exposed. While the motivation for deposits to move is likely to increase, and the friction impeding it likely to diminish, there are measures banks can take to protect their interests.

- Address the customer as a whole. Many banks responded to their inability to make money on deposits by focusing on the sale of individual products. This siloed approach made perfect sense in a zero-rate environment, but it fractured their marketing strategy and—now that rates are rising— has left them exposed. By shifting your focus back to the total customer and developing products that link deposits and lending (mortgages, auto, credit cards) into offerings like that of Amazon Prime, banks can recapture market share and avoid competing on price alone.

- Identify deposits that are most likely to move. Advanced analytics and the abundance of data make it possible for you to not only identify the deposits that are most likely to go off in search of better returns, but also to develop models that tell you how much you’re likely to lose for every beta basis point separating you from the interest rate front-runners. AI-driven marketing automation tools that leverage digital market data allow you to launch targeted, personalized promotions and offers to dissuade your fickle customers from fleeing—while leaving the Sleeping Beauties undisturbed. To date, most bank marketers have developed digital marketing tools for acquisitions—it’s time to turn those engines towards your existing customers.

- Innovate on both the asset and the liability sides of the balance sheet. In a rising-rate environment it’s easy to focus just on deposits, but banks should find ways of rewarding customers for borrowing as well as depositing money. In some ways it’s back to the future—look at what was successful in the 1990s and modernize it. Balance transfer could become real-time features of a buy now, pay later offering. Tiered can spread the risk and reduce rates for consumers. Laddered CDs anyone? How fast can your customers add a product (like a CD, a specialized saving account, etc.) in your mobile app? Rethink everything with a digital-first mindset.

- Help customers to maximize their interest rates. Instead of submitting to the plunder of rate maximization apps, consider making a virtue of necessity and launching your own app. Show empathy and commitment to customers’ best interests by offering to help move their funds, even to your competitors—you’ll be forgiven for explaining the limited potential gains and the benefits of keeping their funds in place. Self-cannibalization may seem unpalatable, but it’s better than being boiled in someone else’s pot. For inspiration, banks could look to Huntington National Bank, which supports its customers with digital tools like The Hub, Huntington Heads-Up and Money Scout. Huntington’s first digital-only product, Standby Cash, is a line of credit giving customers access up to $1,000, with qualification based not on credit scores, but how customers manage their checking accounts.

- Explore the role of branches in securing your deposits. Many customers still believe their money is safely stored in their local branch. Without perpetuating this myth, you can take advantage of the underlying motivation: people appreciate a physical connection with their bank. Use your branches, and the people in them, to remind customers that your organization is not a soulless interest-paying entity but a team of professionals who care about their money and their financial wellbeing. I’d be prepared to bet that, for a lot of them, that would be a good reason to leave their money where it is.

- Get ready for M&A. As rates continue rising, lenders and neobank models funded by hot money will be tested and stressed. Monoline lenders that had ROEs in the high teens in a zero-rate environment could find themselves suddenly short of “cheap” cash. This could be a once-in-a-decade opportunity for liability-rich banks to improve their long-term ROEs, balance their lending portfolios and reduce dependency on commercial (often real-estate-heavy) lending. And, as neo valuations come down to earth, there will be numerous opportunities for acquisitions and bringing on next-generation talent. Capital One is a great example of a bank that improved its stability, and its performance, through a succession of carefully selected acquisitions in the last cycle.

It’s still all about the customer

History teaches us that when interest rates rise, banks make more money. But that’s history; for many banks, this time will be different.

That doesn’t have to be the case, however. The first step, I believe, is to recognize what is beyond your control and what you’re able to influence—with new technology at your disposal. And then, I would argue, it’s vital that you pursue the interests of the bank alongside those of your customers, rather than seeing this as an opportunity to simply optimize your deposit beta at the cost of the customer. There is no doubt banks can optimize in the short run—but in the long run you’ll be better off if you gently wake up the Sleeping Beauties and use this opportunity to build trust and loyalty.

This is a story, and a debate, that will run for some time to come. I’d welcome discussing it with you; you can reach me anytime here.