Banking has been blasted by the winds of change in 2023. If you think we’re not in Kansas anymore, you’re not alone.

The industry right now has a surprising amount in common with some of the most iconic characters from The Wonderful Wizard of Oz, the famous L. Frank Baum story published in 1900 and adapted for the big screen in 1939.

I don’t mean Dorothy, the wizard, or any witches, wicked or otherwise. No, many banks right now remind me of the Scarecrow, the Tin Man and the Lion.

This motley trio sprang to mind when I was thinking about our latest banking consumer study. The report, “Reignite human connections to discover hidden value,” is built on a survey of 49,000 banking consumers around the world. It confirms what many of us have felt for some time now—that digital banking today is functionally correct but emotionally devoid.

Some key findings of the research include:

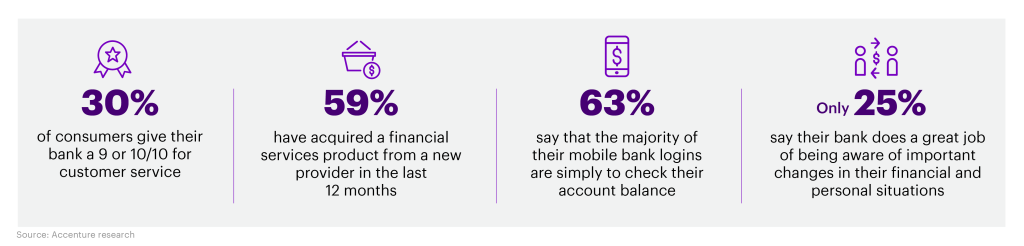

- Customer satisfaction is generally widespread, but shallow. Banking has an overall net promoter score of +24, but only 30% of customers give their bank a 9 or 10/10 for customer service.

- The customer experience is highly fragmented. Consumers have, on average, 6.3 financial products, but only half of those come from their main bank. Almost 6 out of 10 have acquired a financial services product from a new provider in the last year.

- Digital channels are impersonal. About two thirds of consumers say that the majority of their mobile bank logins are simply to check their account balances. Only a quarter say their bank does a great job of being aware of important changes in their financial and personal situations.

Our research suggests that most banks today have something in common with at least one of Dorothy’s companions. (Recall that the Tin Man was looking for a heart, the Scarecrow a brain and the Lion sought courage.)

Right now, the experiences most banks offer most customers most of the time either fail to touch the customer’s heart or don’t have quite enough brains. Fortunately, there’s a lot banks can do about this—if they can marshal the courage.

But what, exactly? There’s no yellow brick road to follow or man behind the curtain to ask.

Instead, I suggest banks consider the following five actions to address today’s most pressing and widespread customer pain points.

1. Build a digital brain

Around the time Judy Garland was charming audiences as Dorothy, one of the biggest assets for any bank was a veteran branch manager. They would get to know customers on a personal level and use that knowledge to provide exceptional service. One of the hallmarks of that service was continuity—customers didn’t have to start from square one with every interaction with their bank. Their branch manager remembered them.

This human connection was lost as banking became digital. Though banks today know more about their customers than ever, they have a hard time putting all that information together to provide continuity of experience.

A “digital brain” can solve this problem. This is a new way for banks to obtain, structure and use customer data. Banks can even combine their own data with that of partners and other sources to build a more complete picture of each customer’s attributes and interactions. This creates a digital memory of the customer in the same way a bank manager would. (No promises about what it does for scarecrows, though.)

2. Focus on purpose-driven, integrated propositions

One of the biggest reasons that the banking customer experience is so fragmented today is the siloed approach most banks take to product development. (This is mostly a response to the incredibly long period of near-zero interest rates we recently left, but that’s a topic for another blog.) Analysis by Accenture Research of leading banks in nine markets found that fewer than 15% reward their customers for the total relationship customers bring to the bank—the number of products and services they use or the transactions they conduct with a bank.

Reversing this approach is a great way to build more durable connections with customers and avoid deposit runs caused by interest rate hunters. Banks can build holistic offerings that connect credit, debit cards, deposits, mortgages and other products through both physical and digital touchpoints.

Some banks, like Bank of America and RBC, have taken promising early steps here, but I think there’s much farther to go. Think Amazon Prime.

3. Reimagine the branch network

Another striking finding from our research is the durable and widespread appreciation of brick-and-mortar branches. There really is no place like home. Two out of three customers surveyed, across all age groups, said they like seeing branches in their neighborhood. And 63% turn to branches to solve specific, complicated problems. Despite this, branch networks shrank over the last decade as banks embraced the digital revolution.

There’s no place like home. 67% of customers surveyed, across all age groups, said they like seeing branches in their neighborhood.

Further closures are not guaranteed good business. Analysis we did for our Top 10 Banking Trends for 2023 report showed that banks spent more than $650 billion globally maintaining branch networks in 2019. That seems like a lot, but it translates to about 84 basis points on the average deposit. At a time when interest rates are over 400 basis points in most economies, paying an extra 84 to retain deposits isn’t an expense that can be cut. It’s a crucial investment in the bank.

Banks should consider experimenting with new formats and deploying new technologies in their in-person experiences. Some are already making strides. For example, nbkc, a community bank that happens to based in Kansas City, has partnered with a local retailer to create a unique blend of bank branch and retail shop that also offers art made by local citizens.

4. Make digital loveable

It might not surprise you to learn that customers generally find digital banking experiences impersonal. Building a genuine human connection through a smartphone is a tremendous challenge—and a vital one to address. If a bank makes digital its default service channel, it must create a human connection there or its entire business will become a commodity.

Making digital loveable will require banks to find both their hearts and brains. A key point to keep in mind here is specificity of audience. Banks will need to offer the correct experiences to customers from different generations and walks of life.

One promising early example comes from the Spanish bank BBVA, which is creating personalized and simplified digital experiences for customers over 65. Anyone who has ever helped an older relative set up an email account can appreciate the value here.

5. Capture the hidden value in digital

Digital channels have been major investment areas for banks for years—and every investor, eventually, looks for a return. For many banks, digital profits have not yet arrived.

One underexplored area here is bringing branch-like experiences to digital. This could allow customers to make self-directed and assisted digital purchases, either with the help of staff or chatbots. For example, Intesa Sanpaolo, Italy’s largest bank, launched its ‘AI Sales’ program in 2020 with the goal of tripling online sales by 2023.

Towards the end of The Wonderful Wizard of Oz—spoiler alert for a 123-year-old book, incidentally—the Wizard is revealed as no magician but an ordinary human. He can’t give the Tin Man a heart, the Lion courage, or the Scarecrow a brain. But then, he doesn’t need to, as he helps them realize that what they wanted was inside them all along.

Our global consumer study suggests that most banks today have a lot in common with Dorothy’s three companions. Time will tell if they have what it takes to give today’s banking consumers what they want.

If you’d like to learn more about how your bank can bring more emotion and intelligence to its customer experiences to ignite growth, I would love to hear from you. I can be reached here.

You can also find our full Banking Consumer Study here.