The disruptions of the past two and a half years have dispelled the notion that cloud migration is a distant proposition. Instead, the cloud is the 21st century foundation for 21st century banking. Banks that are accelerating their cloud migrations are seizing the opportunity to transform not only their technology architectures, but also how they operate and their relationships with their customers.

In migrating to cloud on an accelerated timetable, every financial services organization has the opportunity to unbundle monolithic architectures and organizations to put itself in a position where it can rapidly sense and respond to an open ecosystem of choice for customers. With a loosely coupled, modern cloud architecture, a bank can focus on capacity for change, innovation, and customer needs.

However, banking is only in the early phases of moving applications to the cloud, with most banks still relying on legacy technology for core business functions, such as customer records, payments, investments, risk and compliance. The result? Higher-than-necessary operating costs, gaps in digital employee and customer experiences, and constraints on innovation and flexibility.

Customers expect financial products personalized to their context and show an increasing willingness to source financial solutions from fintech and neobank challengers. As such, a bank with a coherent and ambitious cloud migration strategy is investing in its future competitiveness in a fast-changing world.

The cloud enables a more personalized, more human connection with customers. It represents a prime growth opportunity for banks that make the transition wisely and put cloud at the core of the business. The cloud is the foundation for a bank which is embedded in every touchpoint, personalized in every interaction and able to address emerging customer needs.

Every leading bank is evaluating how to leverage the cloud to lead in its chosen markets, defend and expand market share and even disrupt parts of the value chain that new competitors are targeting. Those that are moving fast to reposition their business at scale on the cloud are already gaining the computational flexibility and strategic agility they need to leapfrog their peers.

Now is the time for every bank to choose whether it will lead or lag over the decade to come.

In this guide

What does it mean to bank in the cloud?

Why are banks moving to the cloud?

What are the benefits of the cloud for banks?

How are banks thinking about public, private, hybrid and multi-cloud?

Public cloud versus private cloud for banks

What are the key success factors for banks moving to the cloud?

Which skills are banks investing in to drive cloud success?

How are banks developing the skillsets they need to thrive in the cloud?

How are banks using cloud for competitive advantage?

What are the biggest risks for banks when migrating to the cloud?

What are the biggest barriers for banks migrating to the cloud?

How are banks approaching the risks and security challenges of the cloud?

How are leading banks driving better ROI from the cloud?

How are banks accelerating cloud migration?

Can banks modernize applications and migrate to the cloud at the same time?

Are banks really looking to modernize the core?

The key takeaways for banks migrating to the cloud

Preparing for banking in the metaverse and more with cloud

What does it mean to bank in the cloud?

The cloud enables a bank to access computing services such as servers, storage, databases, networking and software over the internet as opposed to running these services themselves in an on-premises data center. The cloud isn’t simply about technology—it’s about a new model of IT ownership that enables banks to innovate faster, become more agile and benefit from unprecedented economies of scale.

A true cloud model should:

- Provide a foundation for secure, continuous delivery of content, applications, and services.

- Make it easy for a bank to orchestrate new services without needing to manually deploy software or add new hardware to its infrastructure.

- Offer flexible, transparent consumption-based pricing—for example, a pay-as-you-go model.

- Deliver elastic services, enabling a bank to scale computing resources up or down according to demand.

- Decouple data from applications and make it available for any business process or service that may need to consume it.

Why are banks moving to the cloud?

Even before the pandemic, banks embraced the notion that every business is a technology business. They have long understood that the cloud is the foundation of successful digital transformation. Following the devastation wrought by the COVID-19 crisis, banks have emerged with an even deeper appreciation of the value of systems resilience, agility, adaptability, and scalability.

Beyond the worst of the pandemic, banking leaders are striving to build a digital core that will allow them to simultaneously transform multiple parts of their enterprises and their talent. The pandemic has galvanized many of them to compress their cloud migration agendas into significantly shorter timeframes to improve their ability to innovate at speed.

94% of banking executives project that 50% or more of their organization's business will be in the cloud within three years

—Accenture Technology Vision, 2021

As banks face heightened competition from fleet-footed, Cloud First challengers, they are accelerating their own move deeper into the cloud to reduce cost of ownership, improve resilience, become more responsive and meet emerging customer expectations. In an environment of mass virtualization and industry convergence, banks know that cloud is no longer a future aspiration, but an urgent imperative.

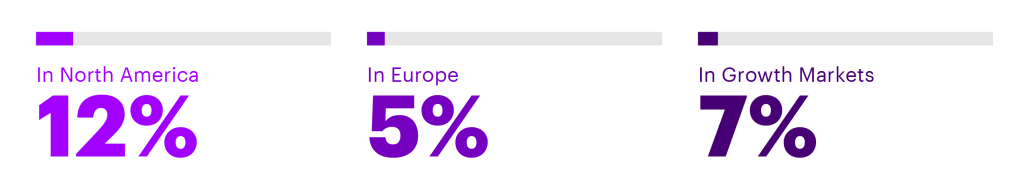

On average, the percent of total workloads in banking that have been migrated to the cloud:

What are the benefits of the cloud for banks?

By opting out of the data center business, banks can realize significant cost savings by using new architectures or applications in the cloud. Moving to cloud enables them to improve the security, resilience, and efficiency of their IT services. Furthermore, the cloud allows them to do new things and get them done faster. It is a platform for innovation, experimentation and business agility.

Nine in ten banks report that the cost to maintain mainframes has increased over the past few years.

— Accenture’s Banking Cloud Altimeter

Here are some of the major benefits of the cloud for banks:

- Democratization of technology: The cloud offers banks of all sizes access to the latest technology with a variable pricing model. It is essential to fully leverage emerging technologies like artificial intelligence (AI), machine learning, and natural language processing.

- Faster speed to market: Use of off-the-shelf cloud services on a dynamic infrastructure can cut delivery times for digital programs launched in response to changing market conditions, new revenue opportunities and evolving customer needs. Our experience shows that moving applications to the cloud reduces time to market by 30–50%.

- Transformed cost-curve: Banks can leverage the cloud to reduce infrastructure costs in the long-term, reinvesting year-on-year savings in growing the business. They can transition to a greatly increased proportion of variable versus fixed technology costs. This is becoming particularly attractive as costs of maintaining legacy technology rises. Accenture’s experience of helping many large banks move their applications to the cloud is that it typically cuts their operational costs by 10–20%.

- Access to API ecosystems and powerful data management and analytical capabilities: The cloud API ecosystem and advanced analytics unlock opportunities such as real-time accounts reconciliation and liquidity management. Without the cloud, banks cannot unlock the benefits of Open Banking.

- Best in class security: Security and systems resilience are being tested like never seen before. Hyperscale cloud providers offer efficient approaches to keeping mission-critical systems secure and up-and-running, no matter what cyber-criminals and other disruptions throw at them.

- Keep pace with new-age competition: Fintechs and challenger banks are exploiting the speed, agility, and vast service offerings of the cloud to enter markets with differentiated offerings in a cost-effective manner. Cloud adoption enables incumbents to nimbly respond to these digital attackers.

How are banks thinking about public, private, hybrid and multi-cloud?

Public cloud services are hosted in the public domain in a multi-tenant environment and are usually accessed via the internet. Examples include Microsoft Azure and Amazon Web Services (AWS.) The public cloud gives banks access to massive data centers that are located across the world, which allow a bank to elastically scale usage of services in response to business demand. Some banks are concerned about data privacy and data sovereignty issues using public cloud services might raise.

However, leading hyperscale companies like Azure and AWS deal with a massive amount of data and are therefore committed to protecting themselves and their clients against public attacks. Banks usually protect themselves by setting up a secure, private channel to the cloud service provider, for example, via Azure Express Route or AWS Direct Connect.

A private cloud belongs to a single organization and services will be delivered via a secure, private network. The infrastructure may be located in a bank’s own data center or hosted and operated by a third-party service provider, but in either case, the bank will not be sharing cloud computing resources with any other organization. In this model, a bank may gain more control over its infrastructure, but will not benefit from the scalability, economies of scale and flexibility of the public cloud.

A hybrid cloud is a combination of public and private cloud solutions. Multi-cloud refers to using cloud services—be they public or private—from multiple service providers. Hybrid and multi-cloud enable banks to take advantage of cost arbitrage across competing cloud service providers and avoid the risks of vendor lock-in.

Banks are tailoring their cloud strategy, and which models they leverage to their existing technology environments and the business value they hope to achieve as well as to data privacy regulations in their core markets. The leaders are looking at how they can take advantage of the out-of-the-box services of the public cloud, while aligning deployments with their risk posture.

Banking Top 10 Trends for 2023: Our annual report predicts the trends that will shape banking’s future.

LEARN MOREPublic cloud versus private cloud for banks

Most larger banks with significant investments in legacy systems are likely to run hybrid private and public clouds for some time yet. For them, private clouds are considered a landing zone for the most sensitive data and applications or as a starting point for a more thorough transformation via the public cloud.

Many smaller and mid-size banks—unencumbered by big monolithic systems—are considering an accelerated migration to the public cloud. This gives them the ability to buy technology on a pay-as-you-go basis rather than needing to build infrastructure. It also enables them to get higher levels of cost-efficiency, flexibility and ease of regulatory compliance.

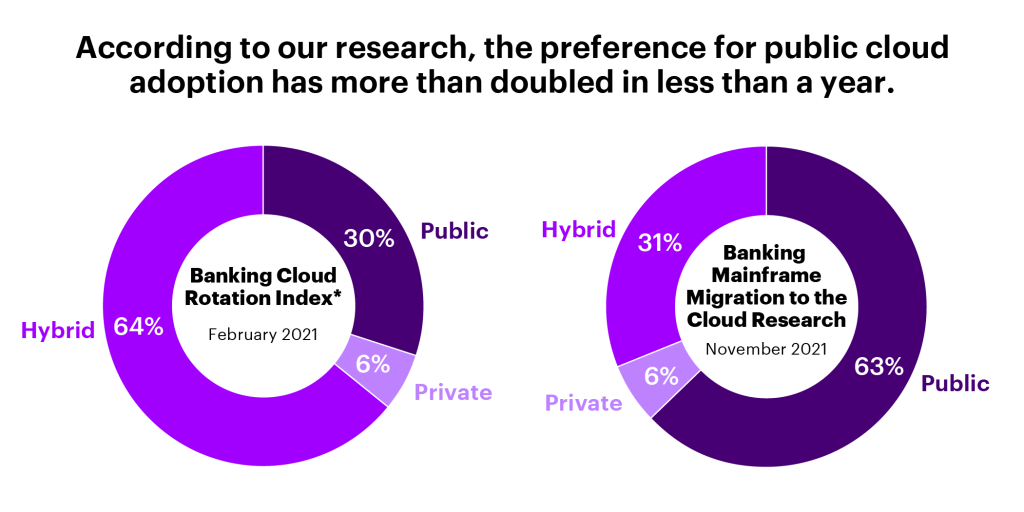

Our research indicates that banks have a strong preference for the public cloud for core system migration. Around 61% of banks plan to move their mainframe workloads to public cloud environments, about 30% plan to use a hybrid cloud model; and just 9% plan to use private cloud. Indeed, many banks that are in hybrid cloud are looking to move 100% public to simplify their environment.

Most banks have adopted a multi-cloud strategy, encompassing multiple infrastructure-as-a-service, platform-as-a-service, and software-as-a-service offerings. Some have made a conscious choice to use different public cloud providers to avoid vendor lock-in and meet data sovereignty requirements in different countries. In others, multi-cloud environments have emerged organically as various parts of the business have deployed different clouds in response to new needs.

60% of our top 20 banking clients have a multi-cloud strategy.

- Accenture Banking Cloud Rotation Index, February 2021

Using multiple public cloud providers can deliver compelling benefits, including enhanced workload performance, reduced service disruption and vendor diversification. However, if not planned properly, a multi-cloud approach can cause costs and complexity to soar. In the longer term, leading banks aim to harmonize cloud resources from multiple providers under a cloud management orchestration layer.

What are the key success factors for banks moving to the cloud?

Cloud migration cannot be a purely IT-driven exercise. People, skills and ways of working will all need to evolve to maximize the cloud’s transformational potential. The banks that are most successful in realizing the cloud’s benefits of increased organizational speed and agility, and lower costs get all lines of business involved, align organizational talent behind the cloud and help ensure that business and IT are on the same page.

There is no one-size-fits-all approach. Leading banks balance business drivers, technology needs, and market dynamics to achieve the right blend of scale, shape, and speed for their needs. Consequently, their cloud initiatives start with defining the business value that technology transformation can enable in terms of new capabilities, cost efficiencies, or risk mitigation.

Smart prioritization is another success factor. Successful banks stratify and prioritize their application and infrastructure portfolios in a way that realizes the most value from the migration as quickly as possible. They also focus closely on strategic data architecture and governance to help ensure the business owns data in the cloud and can leverage it appropriately.

It is critical to find the right partners—especially security and risk partners--to help ensure migrations are impeccably designed, prioritized, and executed. Leaders involve their security and risk from the outset, helping to define platform-level and application-level controls, approving cloud architecture choices, and identifying the best candidates for core security automation.

Operating an IT estate is fundamentally different in the cloud. The traditional model of managing capacity by purchasing and running physical hardware doesn’t work. Instead, banks must continuously manage consumption, capacity, performance, and, most crucially—cost. It requires a vastly different skillset as well as new operational functions. Banks should invest in these skills to help ensure success.

Which skills are banks investing in to drive cloud success?

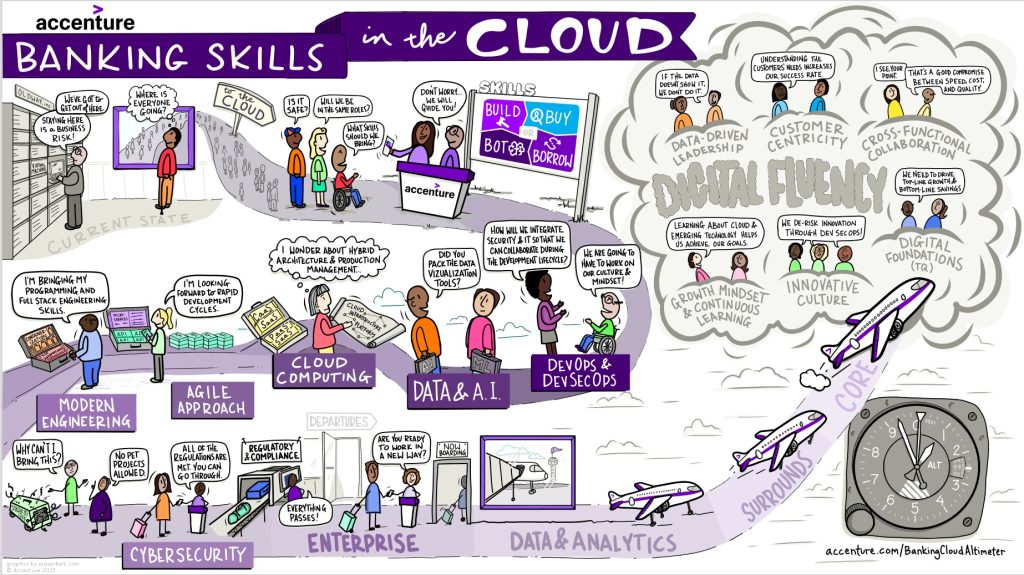

Cloud skills can be divided into two broad categories—the technical skills necessary for an engineering-led transformation and proficiencies in using cloud technology to shape better business outcomes. The first category includes the technical skills people need to design, build, operate and maintain cloud computing systems—skills in cloud architecture, engineering, security, data management and modelling, and development.

We call the second category the technology quotient or “TQ” skills. They span a cloud-powered bank’s entire organization and include digital fluency, cloud value optimization, cross-functional collaboration, data-driven leadership, customer-centricity and innovation culture. Leading banks are investing in both categories, understanding that cloud isn’t just a new IT model, but a new operating model.

How are banks developing the skillsets they need to thrive in the cloud?

Leading banks are taking a four-step approach to developing a cloud-ready talent ecosystem:

- Defining the technical “power skills” and behavior needs as well as future roles required for the shift to the cloud plus a workforce plan to fill those roles.

- Auditing current talent profiles as well as the bank’s overall digital skills proficiency to identify skill and capacity gaps as well as skill adjacencies.

- Accelerating new-skilling and up-skilling programs to build on existing talent.

- Applying the new skills and fostering continuous learning.

What are “cloud skills” for banks, anyway? | Accenture Banking Blog

LEARN MOREHow are banks using cloud for competitive advantage?

Bank-specific cloud solutions are catalysts for innovation and new growth, enabling experimentation at speed. With the agility, speed and efficiencies of the cloud, banks can shift focus from simply keeping the lights on in their data centers toward wielding technology as a competitive advantage. And by taking advantage of cloud economics, banks can free people and funds to focus on innovation.

Cloud is a critical enabler of advanced digital technologies that open the door to new business models and revenue streams. With the cloud, banks can more easily tap into the next generation of digital technologies that are already reshaping the competitive landscape as well as unleashing the full value of their data and digital ecosystems.

This is about the combinatorial potential of advanced technologies like artificial intelligence and machine learning and the vast numbers of future edge devices connected to the Internet of Things. And it’s about working more closely with suppliers and partners in a digital ecosystem, sharing data securely to create new Open Finance offerings, or enabling new business models.

Banking Cloud Altimeter | Volume 6: Banks need a flight plan to navigate the cloud.

LEARN MOREWhat are the biggest risks for banks when migrating to the cloud?

Banks operate in a sector with a low tolerance for reputational and regulatory risk. Among those that are still reluctant to move core systems to the cloud, the biggest concerns are the risk of disruption to the business, the complexity of the changes to their operations and systems, and the need to comply with stringent security, data, and privacy rules.

The risks of migrating production workloads to the cloud can be managed by working with experts who have done it before. Public cloud providers understand the risks and have built mitigations for most into their systems. Leading banks can overcome these risks by establishing governance and operations, risk, security, and compliance guardrails that help ensure consistency, security and stability.

What’s holding back a successful move to the cloud? | Accenture Banking Blog

LEARN MOREWhat are the biggest barriers for banks migrating to the cloud?

The banking industry is the traditional heartland of big iron. For years, incumbent banks have depended on mainframes to deliver the speed, uptime and capacity necessary to handle the exceptional volumes associated with core banking processes as well as the resilience and security demanded by an essential service such as banking.

Many cite regulatory ambiguity, and the economics of their fully depreciated data centers as reasons to not to rush their migration to the cloud. Furthermore, banks recognize that migrating core operations to the cloud is not easy. It will involve some cost and hardship in the short to medium term. They want to chart a course to their destination that will get them there with minimal risk and disruption.

Furthermore, many banks are wrestling with the sheer complexity of managing the business and operational change that goes along with the cloud, finding the right level of security to match their operating environment, and aligning IT and business. A lack of cloud skills is another formidable barrier to cloud transformation.

Top three barriers to cloud migration cited by executives: Complexity of business and operational change; security and compliance risk; and misalignment between IT and the business.

—Accenture Cloud Continuum research

One of the biggest obstacles to wider public cloud deployment is architectural complexity, particularly among larger banks. Many incumbents face a daunting challenge in untangling the complex legacy systems they have built over the years and executing a large-scale move to public cloud. Many technology executives also believe it’s more cost effective to deliver services on private cloud.

Another barrier to faster cloud adoption lies in reskilling existing IT teams and hiring new talent to drive cloud strategy. More than half of CEOs across industries report that the lack of technical skills across the organization is a top concern for their cloud transformations, while 85% of IT leaders report gaps in cloud skills large enough to slow down their cloud projects.

How are banks approaching the risks and security challenges of the cloud?

As banks embrace multi-cloud environments and cloud providers create and release new services at an increasing pace, security is as important as it has ever been. However, banks also recognize that the tools, processes and even skill requirements needed for securing cloud environments differ substantially from securing on-premise environments.

Leading banks will consider cloud security as a multidimensional challenge, seeking to embed security into each cloud deployment from the outset:

- Determine a framework: Leading banks will focus on enveloping cloud certification processes, security architecture requirements, and other control processes into a single end-to-end lifecycle. They will also leverage best practice, frameworks and guidelines from NIST, CIS, CSA and ISO to guide security controls.

- Detecting security risks: Most security risks in the cloud arise through simple misconfigurations of cloud resources that create security vulnerabilities. Automated tools can help detect these vulnerabilities.

- Prevent vulnerabilities: Misconfigurations of cloud resources can be prevented before they happen with an ever-evolving selection of cloud-native security guardrails. Some cloud providers offer the preventative capabilities as part of their policy engines.

- Leave space for innovation: Remediations, manually or automatically invoked, offer an alternative to indiscriminate preventative mechanisms for avoiding potentially insecure configurations of cloud resources. Most providers offer these tools to close security vulnerabilities without hampering the innovation and elasticity that are the promise of the cloud.

- Align cloud with existing security processes: Leading banks are looking to integrate cloud governance with their existing enterprise security tools and processes via third-party and cloud provider tools.

-

Banks face a shortage of cloud-specific security talent. High demand and limited supply forces them to be creative in attracting and retaining the skills needed for the journey to secure cloud. Some are looking to reskill and upskill traditional infrastructure SecOps professionals with native premise security skills to succeed in the cloud. Another approach is to encourage developers to add security skills to their portfolios.

How are leading banks driving better ROI from the cloud?

According to our Banking Cloud Altimeter research, two thirds of banks are failing to capture the value they expect from their use of the cloud. Our experience indicates that those that achieve higher ROI focus on people and organizational matters as much as they do on the technical aspects of cloud migration.

Recent industry cloud research conducted by Accenture found that leaders who transformed their people along with their technology achieved an average 60% higher ROI on their cloud investments than those that focused solely on the technology. They focused not just on cloud tech but also on the skills, culture and ways of working required to maximize the cloud’s potential.

Alignment between the C-suite and the company’s cloud ambition, strategy, priorities and trade-offs are critical success factors. C-suite executives need to communicate these to everyone in the organization, fostering a culture that is more open, fluid, collaborative and innovative. Encourage collaboration between IT and the business to unlock better results.

3 ways banks can get great ROI from the cloud | Accenture Banking Blog

LEARN MOREHow are banks accelerating cloud migration?

To supercharge their journey to the cloud, banks need an ambitious vision and a practical implementation plan. The leaders regard moving to cloud as a means to achieve business outcomes, rather than as an end. The essential first step they take is to thus align the enterprise behind cloud migration as an enabler for efficiency, innovation, and growth.

They build their cloud strategy on a systematic framework for delivering and measuring business value. This enables banks to make a business case for each workload and define the cloud target state (including architecture, infrastructure, and operating model.) Successful banks also classify data and applications to understand technical interdependencies and data localization requirements.

Some banks early in the cloud journey identify some low hanging fruit to be harvested by shifting to software-as-a-service applications. To identify prime opportunities, leading banks balance cost savings against factors such as application complexity, legacy needs, data-location and compliance requirements and long-tail interdependencies.

Some banks choose to migrate a high volume of their workloads into the target environment and then modernize once they are in the cloud. This allows them to recoup the savings more rapidly. Others focus on modernizing applications and shifting them to the cloud as business priorities dictate. This is a slower and gentler approach as they can retrain their talent and move to the cloud in increments.

Moving to the cloud is a major undertaking for any bank. One of the critical success factors is understanding which outcomes the institution wishes to achieve and measuring its progress towards its goals. Banks are most successful in shifting towards the cloud will define their key performance indicators early in planning for the migration.

They will determine which metrics they wish to track—for example, cost reduction, improvement in employee efficiency and productivity and enhanced security—and monitor these metrics before, during and after migration. With today’s mature cloud monitoring and management solutions, 80% or more of the work of monitoring these metrics can be automated. In addition, these metrics can be defined at the cloud design pattern level and enable tracking performance to an application level.

Can banks modernize applications and migrate to the cloud at the same time?

In our experience, banks are choosing whether they want to prioritize the realization of cost efficiencies by exiting from the data center business as quickly as possible and using these savings to modernize—or whether they want to prioritize modernization with the goal of building new business capabilities faster and transforming their ways of working.

In the former case, migrating legacy applications as rapidly as possible and with minimal changes offers the fastest route to the cloud. This approach also allows banks’ teams more time to get to grips with the development, governance, spending and security nuances of operating in the cloud before investing in complex modernization initiatives.

However, we find that other banks prioritize modernization because using cloud-native services enables them to achieve other business goals, such as implementing Open Banking strategies, harnessing the power of big data, enriching their digital customer experience through AI or driving higher velocity in delivery. To go this route, banks will usually need to bring new cloud talent into their organization.

This will be a slower journey to the cloud, but it will also help banks to drive cultural change, more rapid development and new ways of working via agile methodologies, DevSecOps and other approaches that enable them to move faster and more nimbly. Banks experience positive results from this approach when there is a clear advantage to modernizing a legacy app and removing its infrastructure footprint.

Are banks really looking to modernize the core?

In our survey of 150 banking executives across 16 countries focused on large banks that are planning to or are in the process of migrating their mainframe workloads to the cloud, we found that there are no half measures for banks that have made the decision to migrate their applications to the cloud. Tentative pilots and protracted rollouts are not on their agenda; they’re moving with speed and determination to reap the potential returns.

Eighty-two percent said they plan to move more than half of their mainframe workloads to the public cloud. Nearly a quarter aim to migrate more than three-quarters of their workloads. The vast majority of these cloud enthusiasts expect to achieve their targets in the next five years.

The most important benefit they are targeting is speed and agility—43% of the surveyed executives said this was a strong motivator. Security (41%), new capabilities for revenue growth (37%) and cost savings (31%) are other critical factors. Of those who highlighted capabilities for revenue growth as a motivator, 36% expect an internal rate of return of between 11% and 15%, while 32% are even more optimistic.

Tell us what you think.

Have you or are you planning to migrate your legacy mainframe systems to the cloud?

What share of your core systems are you planning to operate in the cloud?

When is your organization planning to reach its targeted mainframe migration to the cloud?

Planned mainframe migration to the cloud survey results. How does your organization compare?

The key takeaways for banks migrating to the cloud

The cloud is not new. Yet many banking incumbents have still only dabbled in it. A sizable portion of workloads still run in on-premises data centers due to technical complexity, compliance and data sovereignty concerns, and a fear of change. Banks that are not migrating most of their workloads to the cloud are missing opportunities to make their business more efficient, resilient, and customer focused.

Cloud maturity is rapidly becoming a hallmark of the world’s best-performing banks, a catalyst for increasing the metabolism of institutional change and a spark for cultural change and the workforce of tomorrow. While those that are taking a slow and steady approach are making progress, they risk falling further and further behind those with more ambitious migration plans and timetables.

The cloud continues to evolve in exciting new ways that promise to unlock new avenues for innovation, differentiation, customer value and profitability. One of the most significant developments is the rise of an industry cloud for banking. The banking cloud is an evolving combination of digital assets such as data capabilities, algorithms, software, and platforms tailored to banks.

It enables banks to rapidly build custom solutions on top of services, infrastructure and applications that offer regulatory compliance out of the box. Banks can assess which cloud building blocks can be customized to their needs, rather than needing to build risk mitigations and compliance measures from scratch with each new app or deployment—accelerating time to value.

With industry cloud, banks can integrate cloud, data, AI, platforms, and experiences with high levels of customization to reinvent their business models and customer experience. For Capital One, banking cloud solutions allowed it to consolidate systems and datasets—enabling personalized and secure services while meeting regulatory requirements.

Preparing for banking in the metaverse and more with cloud

Industry cloud also enables banks to accelerate responses to market changes by building strategic partnerships and alliances with cloud providers, industry incumbents, and suppliers for new or enhanced products and services. According to Accenture research organizations embracing this strategy are more likely to increase adoption of new technologies, a must for business reinvention.

Moreover, banks can leverage industry cloud to create new business lines and spinoffs from advanced technological capabilities, gaining access to new markets and revenue streams. Goldman Sachs, for example, is combining data, algorithms, software, and platforms to unlock new revenue streams as part of its ‘One Goldman Sachs as a Platform’ initiative.

Industry cloud tools and platforms are also the bedrock for banks building the metaverse—a three-dimensional virtual world where people can transact and own or lease digital assets. The cloud will enable the metaverse’s captivating experiences and easy functionality, offering banks the opportunity to put humanity back into banking.

The cloud is also an essential capability for banks looking to reduce carbon emissions and improve sustainability. Cloud migration can deliver a double helix effect of shareholder and stakeholder value—simultaneously reducing costs and carbon emissions when approached from a sustainability perspective.

The cloud is central to resilient, sustainable enterprise operations and future competitive advantage. Banks that are not substantially on the cloud won’t unlock the capabilities a modern business requires—greater flexibility, more agility and new opportunities for innovation. Banks that delay a shift to cloud at scale are incurring significant opportunity costs and are even risking their survival.

The journey to the cloud has just started, and there is no end point. This is a new way of working and a new way of operating that all banks will have to embrace.

To learn more about our services and our research on the subject, check out our interactive digital magazine, with research, ideas and insights affecting the big strategic decisions for banks navigating the cloud.

Learn More