Banking

Cloud

Volume 1

Altimeter

What does it mean

to be a bank in the

cloud?

“They need the ability to stand up and take down things like virtual call centers in a matter of days and create websites that can handle immense scale.”

Mike Abbott

Accenture Global Banking Lead

During the pandemic, banks

learned the true power of cloud.

Adoption is next.

FOREWORD

What does it mean to be a bank in the cloud?

This past year, we’ve seen disruption on an unprecedented scale. The pandemic was devastating to lives and the economy. But it also forced financial institutions to move to digital more aggressively than they thought possible, as everything from work to shopping to investing has moved online.

That push to digital has made it very clear to most banks that, in order to keep up, they’ll have to move to the cloud in some shape or form. Cloud migration was already happening pre-pandemic, but like so many things, COVID has supercharged that transition.

While some banks have gone far on their journey, others are just getting started. And almost all are asking themselves some fundamental questions. How much of my data should be in the cloud? How can I keep everything secure? How can I capture the full value of cloud?

With that in mind, we’re proud to announce Volume 1 of the Banking Cloud Altimeter — an inside guide to banking in the cloud. With this publication we’ll share our latest insights and best practices from across the globe.

Our goal is to show you not only how far the banking industry has come, but also how far it has yet to go. We want to highlight the successes, but also point out the hurdles. And we’ll talk a lot about how banks can succeed in a rapidly changing cloud landscape.

As we start this journey, we think it’s worth asking first: “What does it mean to be a bank in the cloud?” The truth is that cloud computing is nothing new — it’s been around since companies were sharing mainframe computer time in the ‘70s. So with all the hype right now around moving to the cloud, what do we really mean?

That push to digital has made it very clear to most banks that, in order to keep up, they’ll have to move to the cloud in some shape or form. Cloud migration was already happening pre-pandemic, but like so many things, COVID has supercharged that transition.

While some banks have gone far on their journey, others are just getting started. And almost all are asking themselves some fundamental questions. How much of my data should be in the cloud? How can I keep everything secure? How can I capture the full value of cloud?

With that in mind, we’re proud to announce Volume 1 of the Banking Cloud Altimeter — an inside guide to banking in the cloud. With this publication we’ll share our latest insights and best practices from across the globe.

Our goal is to show you not only how far the banking industry has come, but also how far it has yet to go. We want to highlight the successes, but also point out the hurdles. And we’ll talk a lot about how banks can succeed in a rapidly changing cloud landscape.

As we start this journey, we think it’s worth asking first: “What does it mean to be a bank in the cloud?” The truth is that cloud computing is nothing new — it’s been around since companies were sharing mainframe computer time in the ‘70s. So with all the hype right now around moving to the cloud, what do we really mean?

There is no definitive version of cloud...

and as the technology advances it becomes evermore complex and nuanced. But that is the purpose of the Banking Cloud Altimeter: to help you make sense of all this complexity so that you can work out what strategy is best for your organization and plan a successful migration.

You might be wondering how your organization stacks up against others… in this volume, we'll provide a snapshot of precisely where banks are on their cloud journey. Our Banking Cloud Rotation Index shows what percentage of workloads across each functional area have migrated so far, as well as variations by geographic area – where the leaders are compared to beginners. We’ll also hear from Accenture’s global banking lead, Mike Abbott, in a Q&A where he expands on the Banking Cloud Rotation Index and the overall state of cloud in banking.

In future volumes, we’ll hear from other members of the Accenture Banking team and industry front-runners who are leading the journey to cloud. We’ll also share market insights and track the progress of global banks and other financial institutions.

Have your own question?

The Banking Cloud Altimeter is intended to be a tool to help you navigate your journey in the cloud. We welcome your input — please get in touch to share your experiences, pose questions to our cloud experts, and let us know how we can improve this publication.

Send us an email: banking-cloud@accenture.com.

In the meantime, enjoy Volume 1; there’s plenty more to come.

Q&A With Mike Abbott,

Accenture Global Banking Lead

INDUSTRY Q&A

Defining characteristics to help banks

navigate their way into the cloud

We spend a lot of time talking to clients and leaders in the financial services industry. These days, every bank is asking themselves a very simple question: “What does it mean to be a bank in the cloud?” When we started to look at this we realized that, right now, there really is no single answer to that question. So we created the Banking Cloud Altimeter to help banks learn, discover and navigate their way into the cloud. To look at the topic from a broad, strategic perspective as well as zooming in on more specific aspects with greater detail. And because this is such a fast-moving theme, where today’s needs and possibilities quickly make yesterday’s advice outdated, we decided to make this a regular publication. So now we can provide the latest information as it emerges, and as banks advance.

So right now, I’ve been flying a Cessna 172. We have two altimeters on the plane, a primary and a backup. In a plane, if you can, it’s better to fly around the clouds — it’s a lot smoother. With banking, you want to be in the cloud.

I think what struck me most was that nearly every bank has taken off on its journey to the cloud, but very few have gotten more than a few feet off the ground.

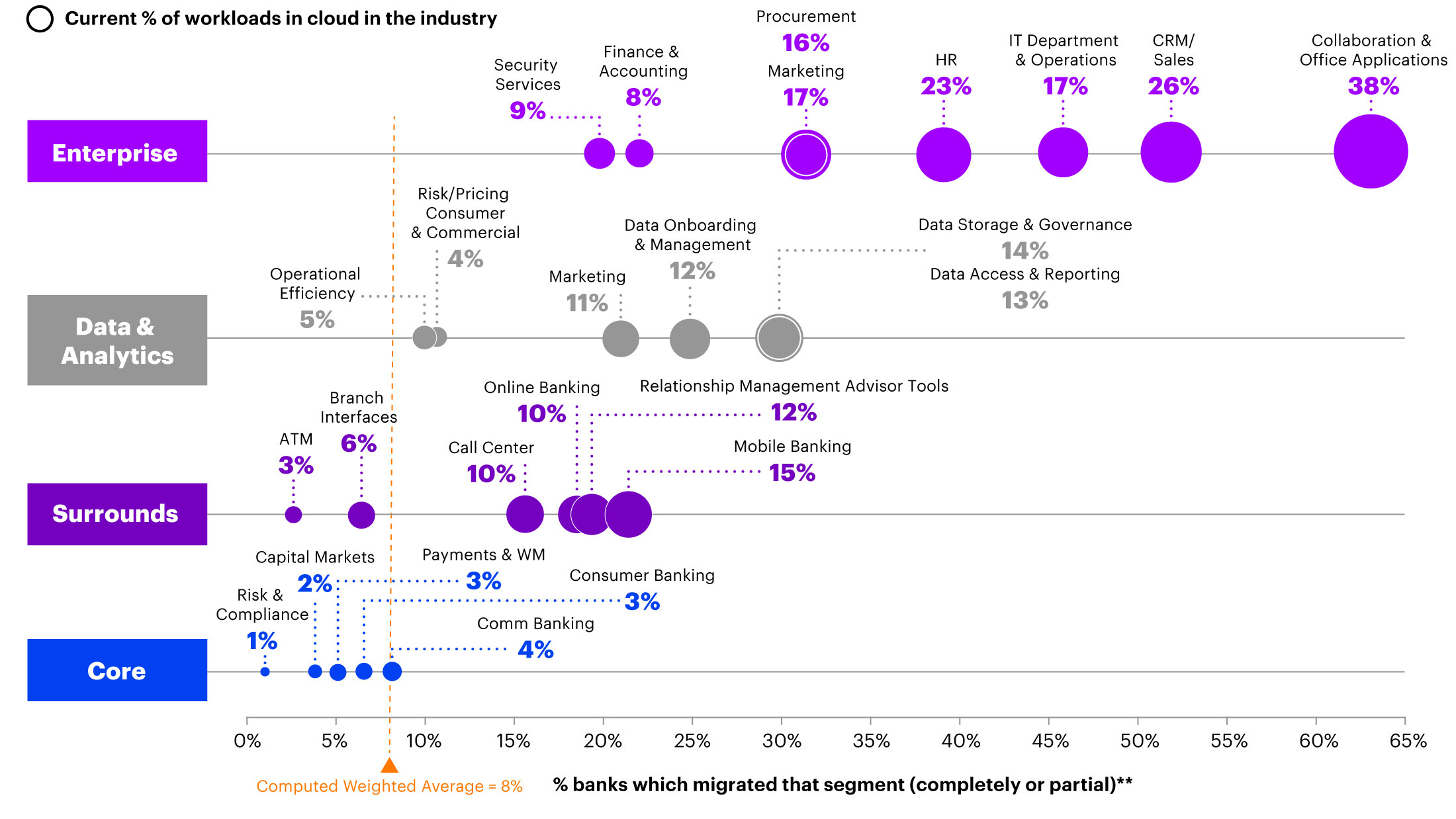

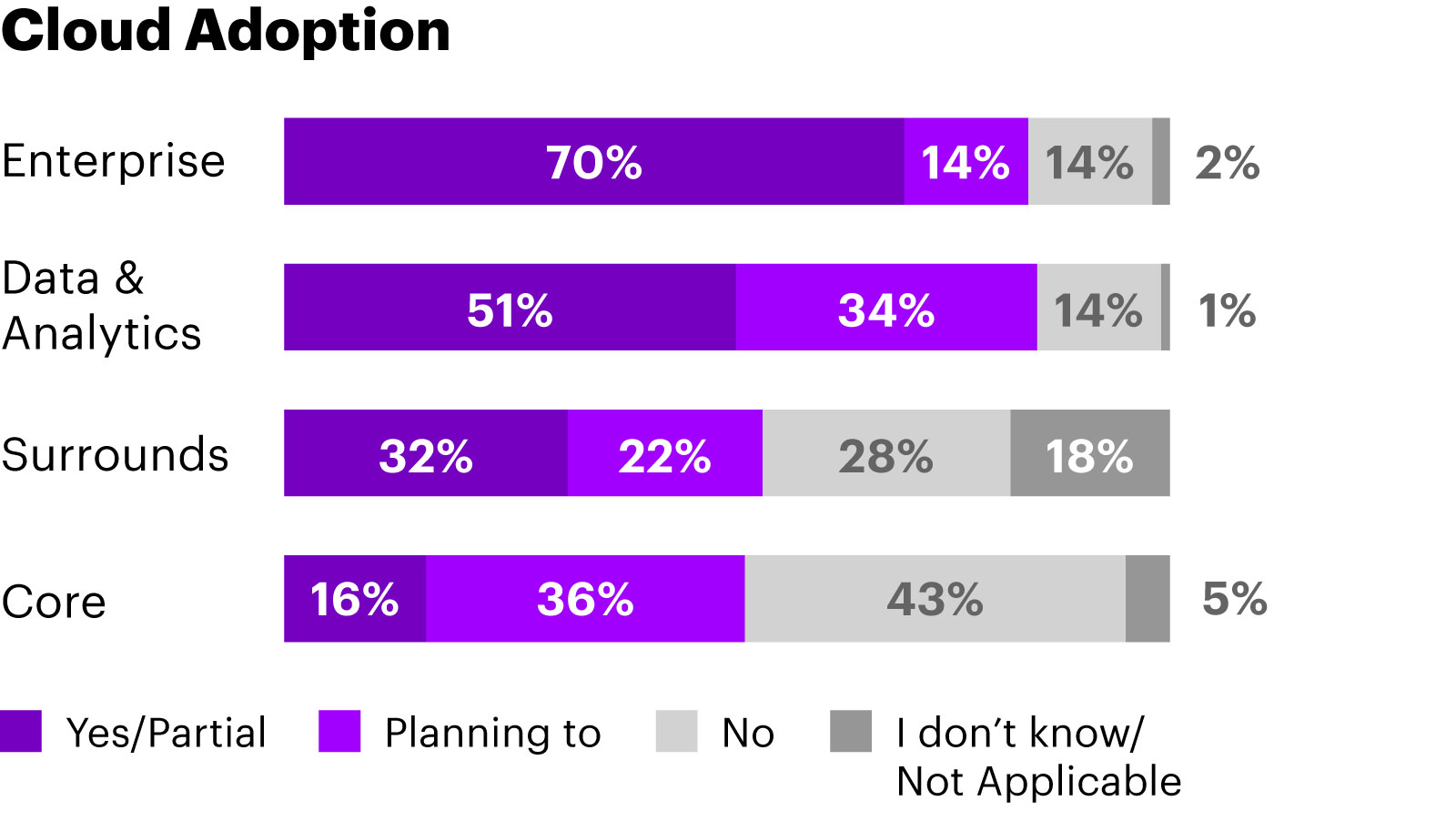

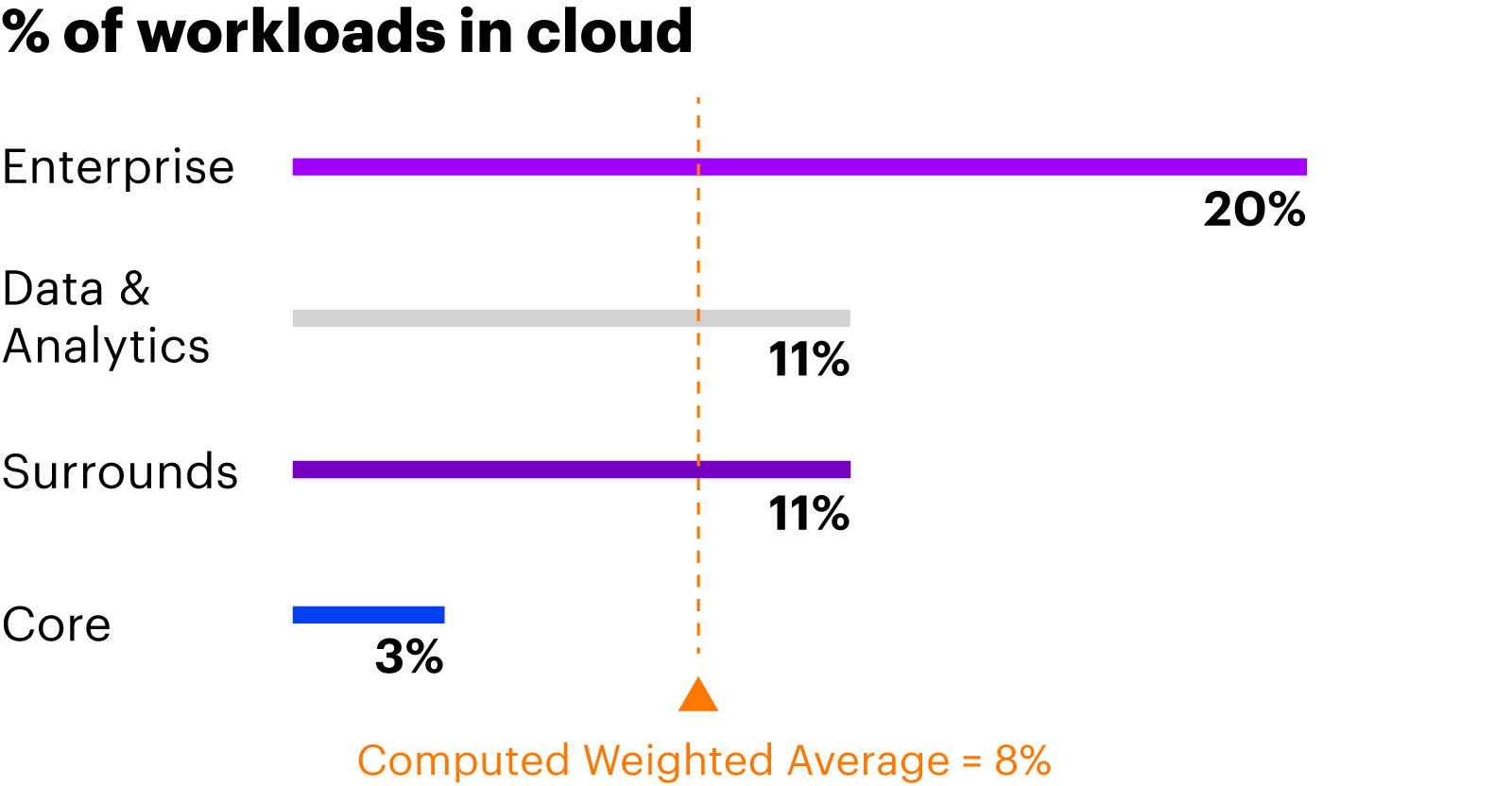

We have seen that different parts of the bank are farther along in their journey than others. For example, many banks are well underway in moving their enterprise applications to the cloud. Of the 100 banks we looked at, more than half had moved a substantial portion of those services to the cloud, with an average of 20% workload migrated. At the other end of the spectrum there’s core banking systems — the heart and soul of a bank. The vast majority of those systems still remain on prem. Banks have moved less than 3% of core workloads; they are looking for help with navigation, for the pathway to move to the cloud. This isn’t completely surprising. We expected to see enterprise way ahead of core. But it shows that there’s still a lot of work to be done.

We’re also seeing banks move their data and analytics to the cloud and what we call their surrounds, which are their applications that touch consumers. These can be everything from their mobile apps to their call centers, even their ATMs. Yes, ATMs are moving to the cloud.

In this inaugural issue, we start by asking a simple question “What does it mean to be a bank in the cloud?” As simple as that sounds, it turns out to be incredibly complex. When we look back to the ‘60s and ‘70s, the mainframe was the original cloud — it was a shared computer that provided services to one, and often times many, corporations at the same time. Then in Volume 2, my colleagues Brent Smolinski and Larry Albin will be diving into the question “What is the cloud continuum?” This is an important topic because the days are gone when banks could choose between two or three discrete types of cloud. We’re also going to be talking about where banks currently are in the journey to the cloud, and we’ll look a little bit into the future to see where they’re going.

It’s pretty bold. In the next 24 months, we expect doubling of the workloads moving to cloud. There’s this paradox: Almost all banks that we surveyed are working in the cloud, yet a computed weighted average of only 8% of their actual workloads have moved to the cloud. So everyone’s in, but they’re only partially in. An enormous amount of work lies ahead to truly capture this opportunity.

It has accelerated the move dramatically, because banks have realized that they need elastic capacity. They need the ability to stand up things like virtual call centers in a matter of days and then take them down just as quickly. They need to create websites that can handle immense scale. Barclays set up a 3,000-person call center. A large US bank put up a website and a virtual call center to deal with mortgage forbearances in a matter of days. We partnered with the banks to help them do this work, which is only possible because of cloud-based services and capabilities.

None of that would have been possible on prem. Only the unlimited capacity of the cloud could have met the needs of COVID.

Banks have learned an enormous lesson: The cloud is not just nice to have. It’s going to be an essential part of their strategy going forward. To put it bluntly: We could not have gotten through COVID without the cloud.

Long term, it’s about the ability to put humanity back into banking. What banks have built as they’ve moved to digital is functionally correct yet emotionally devoid. Just imagine a day when you can text with your banker, any time of the day or night. You’ll have no idea it’s not a person because they can take care of everything you want, and they can anticipate your needs. That’s all possible with cloud-based AI, with digital memory and an empathetic brain. The ability to tap into these tools is the great thing about the cloud. Cloud also democratizes access to technology. Every bank, from the smallest to the biggest, can access the same technology.

There will never be one cloud strategy. It’ll be what you want to make of it. The ethos, culture and the values of the bank will drive the organization’s ultimate strategy in the cloud.

The biggest fear banks have right now is moving their data to the cloud, yet most already have, with a large move of enterprise applications. Security has always been a concern in every major shift in technology, but we always get through it. When mobile payments were launched, the #1 fear was putting a credit card on our phone. Now, there’s billions of cards on phones. All those barriers will come down over time.

I think the advantage we have is that we’ve worked with so many banks, helping them develop their strategy, overcome their concerns and obstacles, and migrate successfully. So we’ve come to grips with what works and what doesn’t in all different circumstances. That’s reassuring for our clients. And then of course we have a good track record for execution, which also helps ease the uncertainty of what, for many banks, is still a journey into the unknown.

Yes, absolutely—I could talk about this all day! But seriously, I think that over time, the cloud revolution will make the digital revolution look small.

FEATURED CONTENT

For many banks, the journey to cloud has just begun

In February 2021 we began to profile 100 global banks to create the Banking Cloud Rotation Index — a snapshot of where banks are in their journey to cloud.

The Accenture Banking Cloud Rotation Index: Profile of 100 Global Banks***

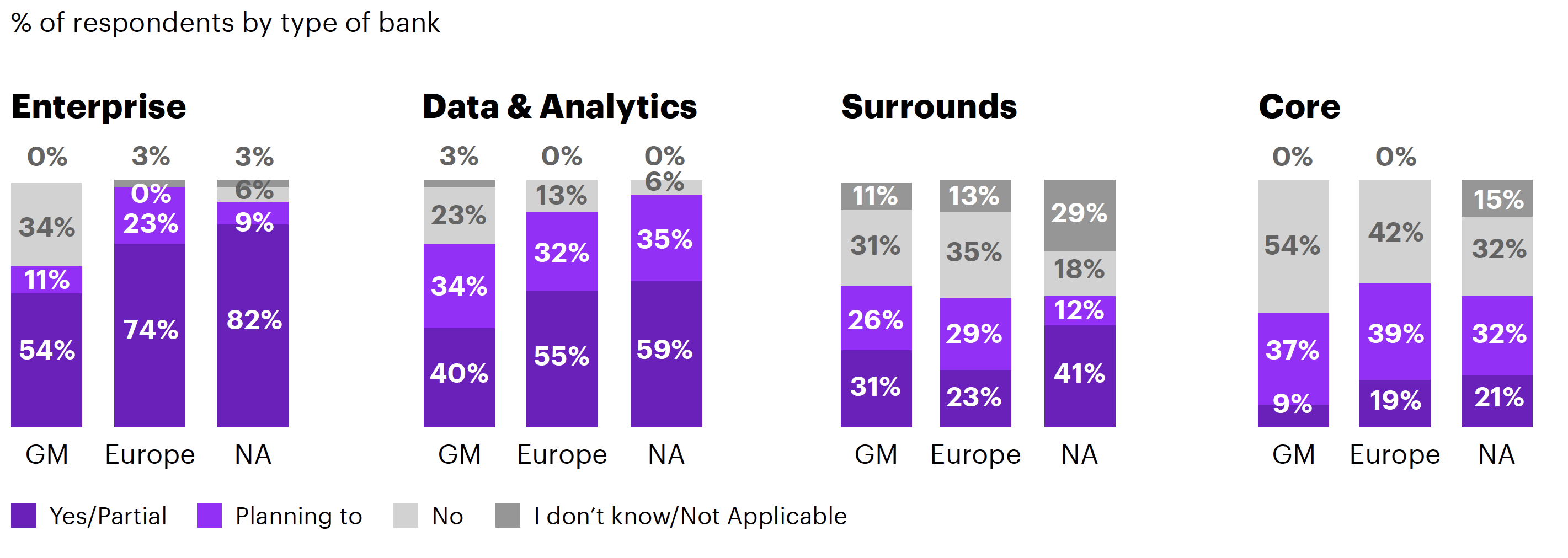

The following highlights some of the key data points we uncovered, specifically on workloads migrated across four functional areas: Enterprise, Data & Analytics, Surrounds and Core.

The biggest takeaway? While most banks have adopted some form of cloud, just 8% of their workloads across the four functional areas have migrated to the cloud to date*.

Definitions

Dig into the research findings of the Banking Cloud Rotation Index:

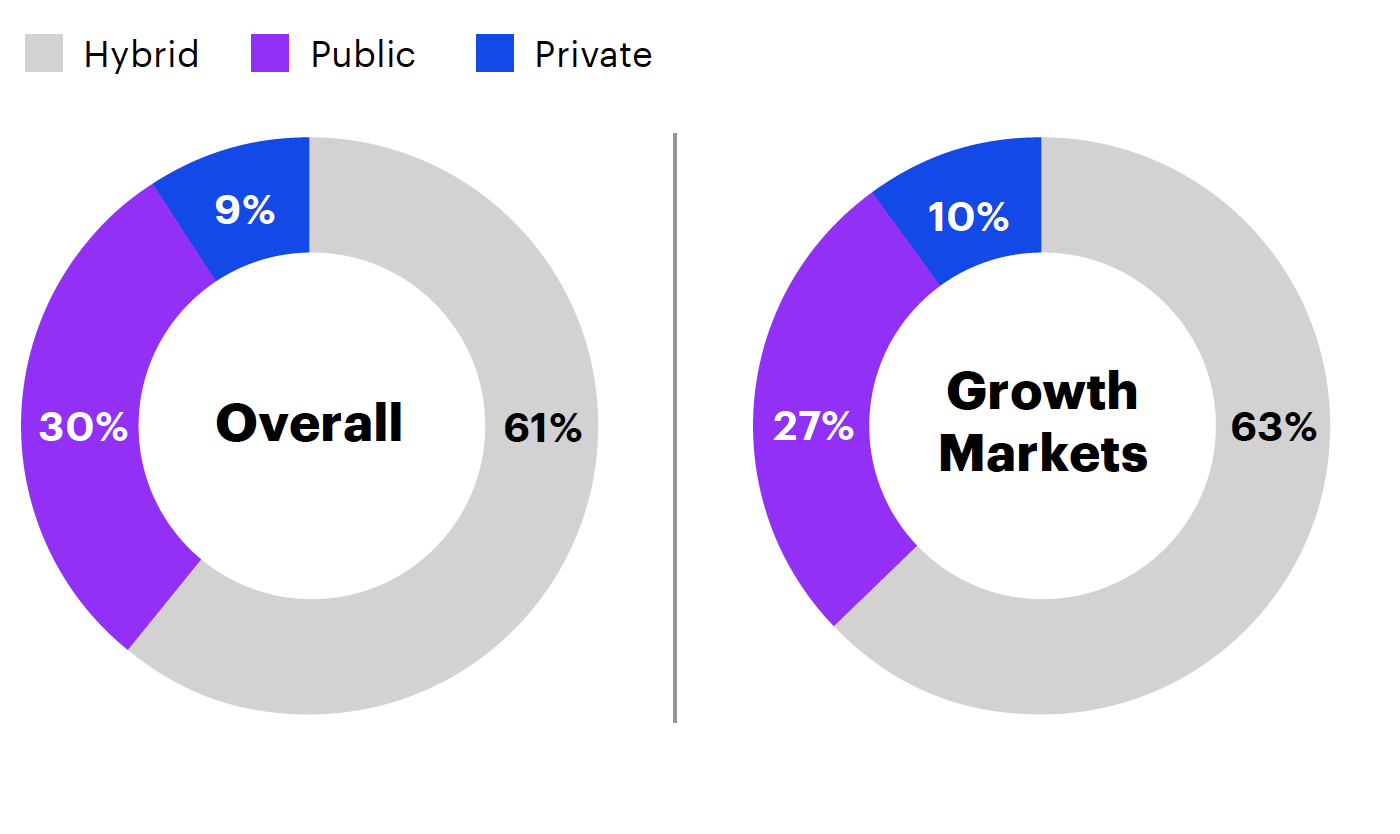

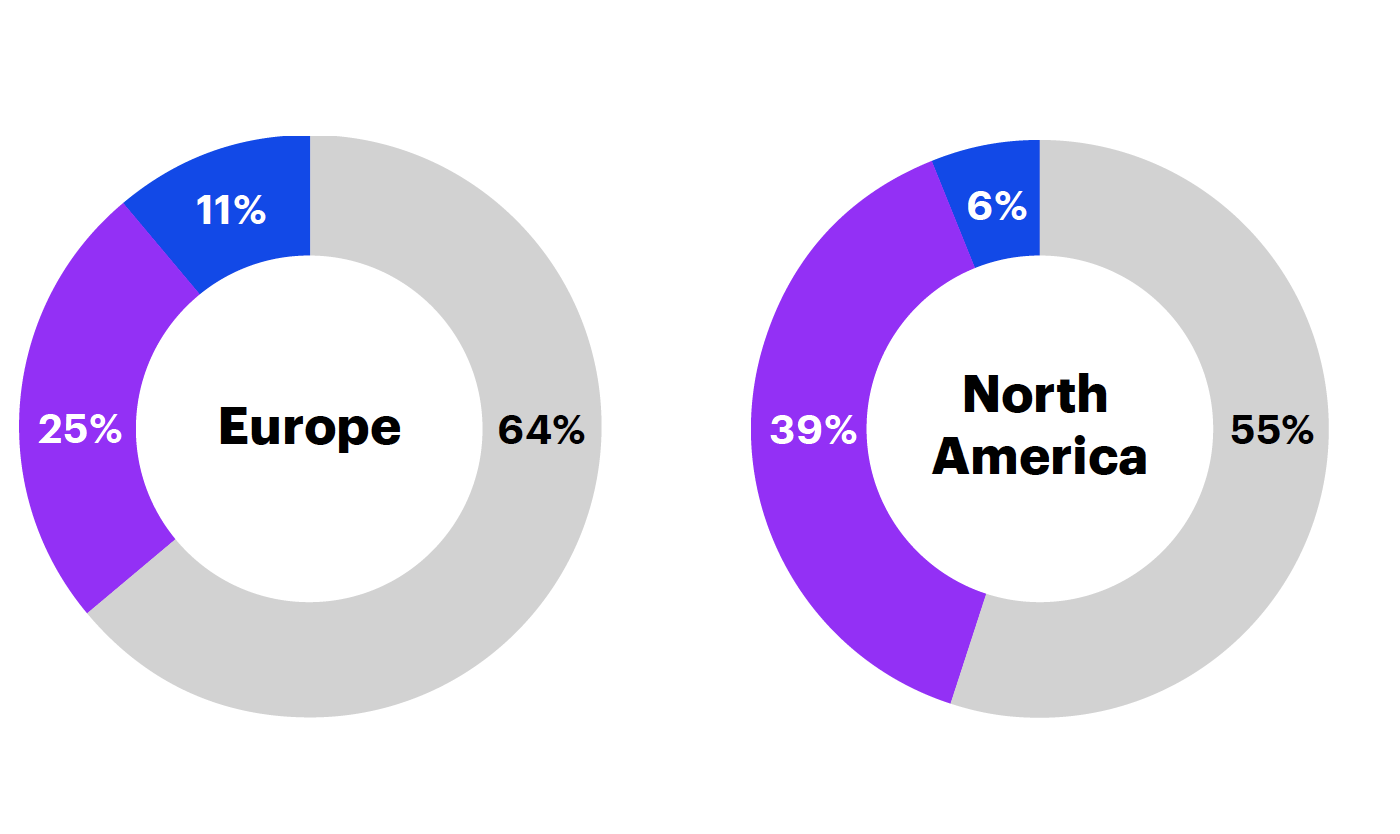

Workloads migrated vary by region, with North America in the lead

On average, the percent of total workloads that have been migrated to the cloud

Enterprise functions have journeyed the farthest while data & analytics are catching up*

Decisions on primary cloud environment currently lean toward hybrid but public cloud is the future

*Note: Weighted average, calculated using the following weights: Enterprise (10%), Surrounds (25%), Data & Analytics (15%) and Core (50%). Since there is a considerably high dispersion on the values of the sample, the weighted average might not be statistically significant at an industry level.

**The average by segment includes banks that are already migrating to cloud, the ones who are planning to migrate and the ones who didn’t migrate.

*** Growth markets = emerging, developing markets outside of NA, Europe and Japan.

Source: Accenture’s Banking Cloud Rotation Index survey, based on a sample of 100 respondents

Have your own question?

“Over time, the cloud revolution will make the digital revolution look small.”

OTHER VOLUMES

Banking Cloud Altimeter

Our digital magazine compiles the latest developments in cloud banking.

ABOUT US

Accenture Contributors

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services—all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 537,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities.

Visit us at www.accenture.com.

For more information on Accenture Banking Cloud Services visit: Accenture.com/BankingCloud

Have your own question?