Other parts of this series:

If there’s one thing the payments industry has learned to expect over the last decade, it’s the unexpected. Even before the pandemic rewrote the rules on customer expectations, industry incumbents were being compelled to innovate by forces such as the advent of new technology like artificial intelligence, disruptive new competitors of all sizes, and shifting regulations.

Yet, incredible as it may seem, the biggest changes in payments are still ahead of us.

Our latest global payments survey, built on input from hundreds of banks, payments processors and fintechs from around the world, revealed that a startling nine in 10 of them think that disruption in payments will increase over the next three years. The top three factors they expect to drive disruption are:

- The adoption of emerging technologies like artificial intelligence and cloud computing

- The launch of central bank digital currencies

- The impact of the COVID-19 pandemic on consumer behaviors and expectations

Our new report, Growing payments to new heights, takes a closer look at how the industry is changing—and how a small group of payments players are outgrowing the market.

For the most part, these growth leaders are digital-native disruptors like Wise, Stripe, Klarna, Square and Afterpay. They are leveraging innovations that could replace traditional payments rails.

Fueling payments growth with new value propositions: Accenture research highlights how payments leaders outgrow the competition in the face of disruption and evolving customer needs.

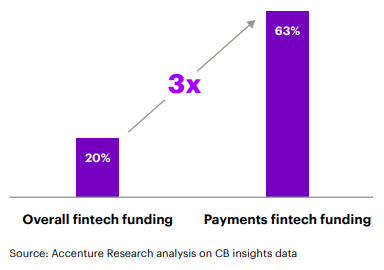

LEARN MOREAnd there’s no doubt that the market sees strong potential for growth in these businesses, as funding for payments-focused fintechs grew three times as fast as general fintech funding between 2018 and 2020.

The growth rate of fintech funding between 2018 and 2020

So what are these disruptors doing differently?

Lessons for payments growth from the disruptor’s playbook

Our report identifies four powerful strategies that digital-native disruptors have used to reshape payments markets like international transfers and small merchant acquiring.

1. Focus on scale over margins

Some disruptors use digital platforms to serve large markets at low cost with high efficiency. This lets them grow in markets with margins that payments incumbents have seen as too narrow to merit strategic investment.

Wise, for example, has cut the cost of sending £1,000 to euros by 26% in six years. Its most recent fiscal year showed 33% YoY growth in revenue.

2. Target neglected customer pain points

Many challengers have found space to grow by addressing customer pain points which incumbent payments players have neglected. For example, the Dutch fintech Adyen offers a smartphone point-of-sale terminal that makes business simpler for merchants. This eliminates the need for separate cash registers, barcode scanners, and customer-facing displays. It improves the customer experience and reduces both costs and hassles for merchants.

3. Wrap value around the payment

In today’s digital landscape, payments are often about much more than just payments. Some disruptors are growing by wrapping the right combination of value-added services around payments, or by embedding payments into wider digital ecosystems.

For instance, Stripe augments its e-commerce platforms through partnerships with banks. With Stripe Treasury, Stripe users can embed financial services into their payments platforms, while Stripe Capital provides an end-to-end lending API that allows platforms to offer financing to merchants.

4. Compete at multiple stages of the value chain

Disruptors are expanding the horizons of competition in payments by targeting more than one part of the payments value chain. One common approach to this is building products that are sold as white-label offerings through another company. This can even go both ways, with a payments provider owning some end-customer relationships and, for others, serving anonymously in the background.

Afterpay, for instance, offers merchants credit payments solutions integrated into online checkouts. But it also partners with the Australian bank Westpac, which offers banking as a service, to provide banking products to its own customers through Afterpay’s own brand and channels.

Digital-native payments players have used these strategies to cause significant disruption in payments. But they are not the only payments providers thriving right now.

Our research also identified a select group of incumbent payments leaders who, over the last three years, have achieved notably higher CAGR than their peers.

In the next post in this series, we’ll look at what sets these Payments Growth Leaders apart.

To learn more about growth opportunities in payments, contact me here. You can also read the full report, Growing payments to new heights:

Read report