At the recent Money 20/20 conference, I spoke with The Fintech Times about which potential disruptors banks and payments players are most concerned about. Accenture surveyed over 200 payments executives to find out what they thought were the biggest potential disruptors and growth opportunities in payments. That research will be available early this year, but I can share some initial findings here. As the industry starts to assess what the “new normal” looks like for 2022, there are five areas that banks and other payments players should focus on.

Adapting to changing customer behaviors and expectations

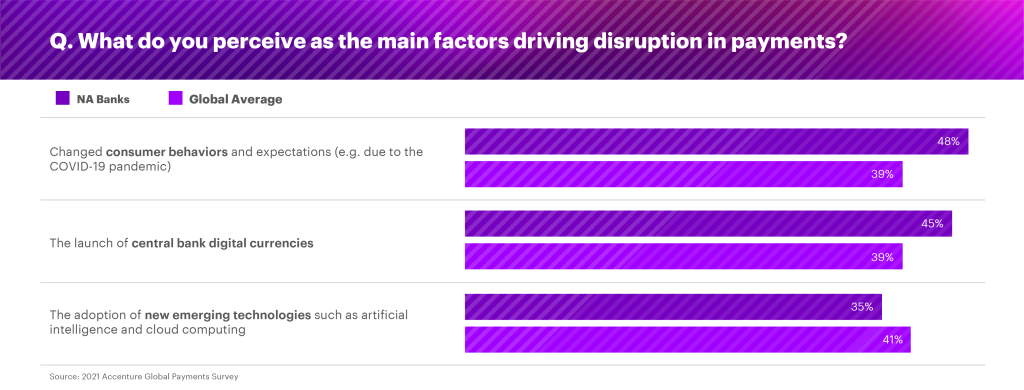

The huge change in customer behaviors and expectations during the pandemic has made this the number one driver of disruption in payments for banks around the world. In our survey, 48% of North American banks and 39% of all banks considered it one of their top two disruption factors.

The baseline for what customers expect from their banks has moved: they now demand seamless digital shopping and payment experiences, the ability to pay from any device, and advanced levels of data protection and fraud prevention.

This expectation applies to all types of customers, including consumer, SME and wholesale. The changes banks have made to personal banking and payments platforms need to be brought into business banking as well, because the new behaviors and expectations are migrating across these lines.

Meeting these new expectations will require banks to use data and cloud technology to analyze and predict customer behavior and smooth their payments journey.

Central bank digital currencies (CBDCs)

Accenture’s survey reveals that CBDCs are considered by banks to be the top driver of crypto-related disruption in payments, making them an even bigger concern than the adoption of cryptocurrency itself.

In North America, more than twice as many banks said CBDCs were a major disruptive force they need to deal with, than those that were concerned about cryptocurrencies. Globally, the number was 50% higher for CBDCs than for cryptocurrencies.

As these new digital currencies emerge, banks need to have plans in place to accept payments using CBDCs. Also, they will have to address how they deal with CBDCs from other countries, as a new type of foreign exchange. This is likely to require faster adjustments than banks are used to, because governments are moving quickly to introduce CBDCs.

Security and identity

The bad actors are always investing heavily in new ways to defraud customers, businesses and banks. Customers are looking for assurances that their investments, purchases, data and identities are safe. Business clients want assurances that their payments partners will protect their data, and therefore their reputation.

Banks should be looking at value-added services that help them stay ahead of the fraudsters—identity protection, security and fraud prevention will help banks maintain the trust of the customers and businesses that use their payments systems. Banks have a lot to gain by demonstrating that they remain one of the most secure options for payments.

Identification technology is developing quickly in areas like facial recognition, voice recognition and other biometric tools. Purchasers are also becoming less tolerant of needing to remember complicated passwords or punching in long strings of numbers for every transaction, while businesses are looking for seamless back-end integration and reliable protection from fraudsters and hackers. The challenges of balancing security with a satisfactory user experience should be a priority for banks and legacy providers.

Learn how Accenture supports Women in Payments, a growing network that unites women in payments from around the globe.

LEARN MOREMoving payments to the cloud

Cloud technology is adding value to traditional payment capabilities in the form of flexibility, efficiency, scalability and speed. Areas that have been affected include card issuing, international payments, and accounts payable and receivable.

Incumbent banks and payments providers need to learn more about how cloud technology can enhance their existing services through better use of data, stronger security and greater agility, in addition to the use of artificial intelligence to improve service and fraud detection.

Banks differ widely in terms of their progress in adopting cloud technology. Those lagging behind will need to accelerate their cloud strategies to stay competitive.

The expanding payments ecosystem

Ecosystem plays and partnerships are essential to competing in a volatile payments environment. Vertical integration and silos are not effective in today’s payments landscape.

Banks should consider platforms that allow them to be flexible and respond quickly to the latest technological innovations. They have indicated that introducing new payments methods is a major driver of growth, but keeping up with the pace of innovation can be difficult.

Banks can benefit from partnering with fintechs and other payments players to speed innovation, while those partners also benefit from banks’ value in the payments ecosystem: banks are trusted by customers and they are set up for a complex regulatory environment that may be difficult for fintechs and other players to comply with. Banks can address risk and compliance in order to make things feel safe and predictable in a changing and unpredictable world. The partnership is mutually beneficial: fintechs and distribution partners provide the speed and technical know-how, while banks provide the trusted brand, stability and compliance infrastructure.

Respond with agility

I believe that agility is the number one attribute that banks and legacy payments providers need to invest in. The ability to quickly adapt to change and introduce new products is essential in the current payments environment, where both the pace and the amount of change have increased lately.

Building in agility and rapid response to changing realities is critical for all payments providers, including banks that want to retain both individual customers and business clients while enhancing profitability. Digital-native providers are reaching customers quickly and introducing innovative business payments solutions, with or without banks as partners. Banks that allow their integration with the emerging ecosystem to weaken will likely struggle to maintain their market share.

Watch my talk with The Fintech Times at Money 20/20.

To learn more about our growth in payments research, register to download the full report, “Growing payments to new heights: The value propositions that pay”.