Cloud adoption across all industries accelerated during the COVID-19 pandemic as organisations were forced to rapidly adjust their businesses and workplace models. As they move from a capital expenditures (CAPEX) model of IT spending to a more scalable and elastic operating expenses (OPEX) model, new functions and capabilities—as well as changes in culture—are required to help them successfully manage and control their cloud spending. Cloud FinOps provides a solution.

Although we are seeing clients executing on their cloud-migration strategies, many are not achieving the benefits that they had originally anticipated. Only one in three companies reported achieving their expected cloud benefits. Industry cloud reports echo this sentiment and identify cost savings as one of the primary drivers for organisations moving to cloud—although few actually achieve them.

This value gap will constrain the appetite of the C-suite for further IT investment in the journey to cloud if the leadership cannot clearly see the business case and the value realised. Cloud FinOps helps bridge the value gap by driving a structured approach to ensuring costs in cloud services are controlled and the expected value realised. FinOps also has the potential to demonstrate the value of an organisation’s cloud investment, regardless of where it is on its journey to cloud. And, if we accept the premise that all organisations will increasingly become cloud organisations, effective cloud cost management will be critical in every industry.

Banking Cloud Altimeter | Volume 6: Banks need a flight plan to navigate the cloud.

LEARN MOREWhat causes the cloud value gap?

It can be difficult for organisations to pinpoint exactly why they are not getting their expected cost benefits from cloud. We have seen from our work with numerous firms that there are a number of key areas that have a significant impact on their ability to maximise their value, including:

- Not optimising when you are forced to lift and shift: Granted, there are occasions when a lift and shift approach is needed. Maybe you need to rapidly exit a data centre. Or perhaps you are migrating a core app and you want to quickly shift the surrounding apps into the same hosting venue. Irrespective of your reasoning, not taking the steps to optimise your infrastructure can cause significant overspend on your cloud services.

- Lack of cloud native service consumption: We understand there are challenges and apprehensions around cloud native, largely due to portability and lock-in. But we also see that those organisations that fail to capitalize on the impressive cost optimisation potential of certain services and features are missing out.

- Lack of cloud optimisation capabilities: Cloud management, optimisation and economics are difficult to master. They require a unique blend of traditional accounting skills and a deep knowledge of cloud services and hyperscale commercial structures. Finding cloud skills in the market is challenging enough, let alone creating teams of cloud and accounting people. Nevertheless, we think it is worth the effort—the results are there for the taking for those organisations that have scaled these capabilities effectively.

- Limited visibility and accountability: Well architected cloud and DevOps-enabled deployments can provide unprecedented speed and flexibility. Whilst the business benefits are compelling, this creates challenges for cost management. Organisations that do not have spend accountability built into their operating models and lack real-time spend monitoring capabilities are likely to suffer bill shock—that is, unexpectedly high cloud bills at month-end.

- Reviewing individual supplier costs in isolation: Multi-hybrid cloud is a reality for most organisations. However, this causes challenges as they struggle to normalise and aggregate their cost and usage data into a single source of truth to improve optimisation and cost efficiencies across their cloud estate.

How can FinOps close the value gap?

Cloud FinOps is not just an operating model change—it requires a change in culture, such as building collaborative working relationships between DevOps, Finance, and Business teams. By encouraging iterative, data-driven management of cloud spending, and simultaneously increasing the cost efficiency and profitability realised from an organisation’s cloud environment, FinOps helps organisations close the cloud value gap.

Effective FinOps optimises cloud value by building a continuous cycle of business, financial and architectural processes. In my experience, effective FinOps typically reduces spending across a client’s cloud estate by 20-30% as well as delivering multiple other benefits by:

- Providing control and governance: Governance processes are designed and implemented to monitor and control cloud spend, including tracking and reporting on optimisation recommendations and the benefits realised.

- Identifying opportunities for architectural reimagination: Leveraging opportunities to optimise the cloud architecture, such as managed services, removes the need for regular management by your DevOps teams.

- Providing real-time insight: Improving the timeliness of cloud cost reporting—from monthly to hourly—provides a daily ‘spotlight’ on your cloud costs for people at all levels of the organisation.

- Proactively fixing potential cost issues: Real-time visibility of spend allows you to manage against budget and catch spending anomalies early to prevent month-end bill shock.

- Empowering teams to take ownership of—and accountability for—their costs: Federated accountability for cloud usage and cost empowers your cloud teams to manage their own usage against their budget.

FinOps is an evolving mix of science and art that will fully integrate cloud costs into businesses to help them achieve true value from cloud.

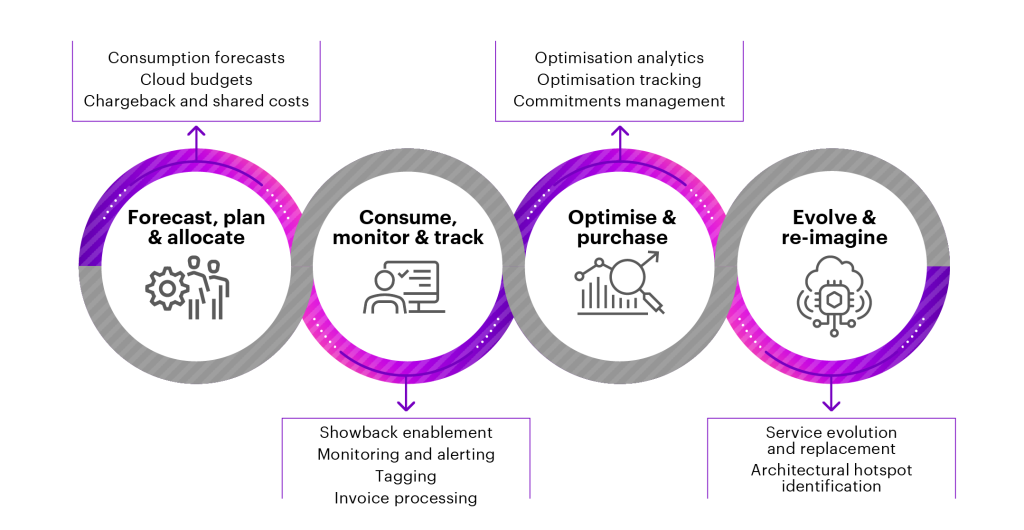

These four core functions should be used to drive success, managed by a central FinOps team:

- Forecast, plan and allocate: Understanding your consumption forecasts is vital for the long-term financial stability of your IT function. Getting an accurate, near-real-time view of this consumption is incredibly powerful, allowing your organisation’s decision makers to effectively plan and manage resources. Accurate forecasts empower IT executives to allocate cloud budgets for future expansion to parts of the business where they will have the biggest impact. Mature FinOps processes include effective and automated chargeback mechanisms, so that cloud costs are charged back to the appropriate business units.

- Consume, monitor and track: Detailed tracking of cloud spending is vital. Near-real-time visibility and feedback of costs improve ways of working and cloud-use behaviours. Known as the ‘Prius effect’, real-time tracking allows DevOps teams to see instantaneously how their actions affect the overall cloud bill. This ensures that cost considerations are built into teams’ day-to-day operations, and usage spikes can be assessed immediately rather than at the end of the month when it’s too late to modify the behaviour. Showback clarifies cloud spending data to help cloud executives determine overall business value and allocate future resources effectively.

- Optimize and purchase: Continual cloud optimisation activities are necessary to ensure your cloud estate is lean and operating efficiently. DevOps teams need to be accountable for their cloud spending and consider cost during their planning, build and deployment cycles. Organisations can fully leverage their cloud services by implementing a number of cloud optimisation tactics ranging from usage optimisation (e.g., rightsizing), pricing optimisation (e.g., purchasing commitments), and architectural optimisation (e.g., containers, serverless computing, improved hardware).

- Evolve and reimagine: Using the right services for your architecture is one of the keys to cost savings. Some options for optimisation include using managed services where possible to reduce the IT infrastructure operating cost. This lets the cloud handle standard tasks so that you can focus your IT teams on business priorities. Using serverless architecture and managed services, such as GCP Cloud Function or AWS Lambda, lets you pay only for the function execution time and further reduces your ongoing management of the workload.

The future of FinOps

Current FinOps thinking only scratches the surface of what is possible, but it is already changing the way organisations run their cloud infrastructure—from addressing issues in real time to reining in spending that doesn’t deliver demonstrable business value. We think there are three major areas of growth in FinOps:

- Ecosystem of tools: As clients continue to improve their cloud FinOps capabilities, tooling is an area that will continue to develop at speed with more and more vendors entering the market offering a variety of value propositions. There are a number of different use cases that vendors are addressing including cloud cost management aggregation tooling (e.g., Cloudability, CloudHealth, Flexera One), automation tooling (e.g., Ansible, Terraform, Kubernetes) and specialist optimisation tools (e.g., NetApp Spot). Organisations will need to start considering whether an ecosystem of tooling vendors, rather than a single tooling partner, is most likely to provides the gamut of capabilities required for their FinOps function.

- Business value and unit economics: FinOps maturity will reach a point where cloud spending will be tied directly to business value—commonly referred to as ‘unit economics’. Clarity around spending and accurate metrics will help organisations create goals based on business performance and identify where they should spend in order to capture additional value and maximise their returns from their investments in the cloud.

- Addressing the cloud continuum: As organisations expand the capabilities of their cloud, they’ll discover new opportunities and options for meeting the ever-changing needs of the business. Rather than comprising a few discrete options, the cloud today consists of a continuum of technologies that include Multi, Edge, Public, Private and Hybrid. Organisations will be using cloud not just as a single, static destination, but as a future operating model, recognising cloud as a launchpad for innovating and new ways of operating.

As the cloud continues to evolve and gain importance within financial services, effective FinOps is becoming an urgent business imperative. You can find more on getting the most out of the cloud in Accenture’s Banking Cloud Altimeter.

Contact me to find out how your business can get more value from the cloud.

I would like to thank the key contributors to this blog post: Sam Gunn, Dan Sinclair and Dean Oliver.

Get the latest blogs delivered straight to your inbox.

Subscribe