Other parts of this series:

For the past several years, customer expectations have been rapidly evolving alongside digital disruption. Customers across all industries demand more digital interaction, spend more time on their connected devices, while also expecting the continued personalisation, authenticity and quality experience. According to “Fjord Trends 2018,” this will continue with a slight twist: “digital and physical design will become one and the same, and will have huge implications for brands and organisations – in terms of how they develop products, services and experiences.”

It should come as no surprise then, to learn that financial services (FS) firms view customer experience as a crucial driver of change. In our FS Change Survey of 2017, seventy-seven per cent of those surveyed quoted customer experience as an internal driver, while 76 per cent quoted it as an external driver. As new technologies cause disruption and nimbler digital-native startups enter the market, traditional players know that the risk of losing the battle to retain customers becomes greater.

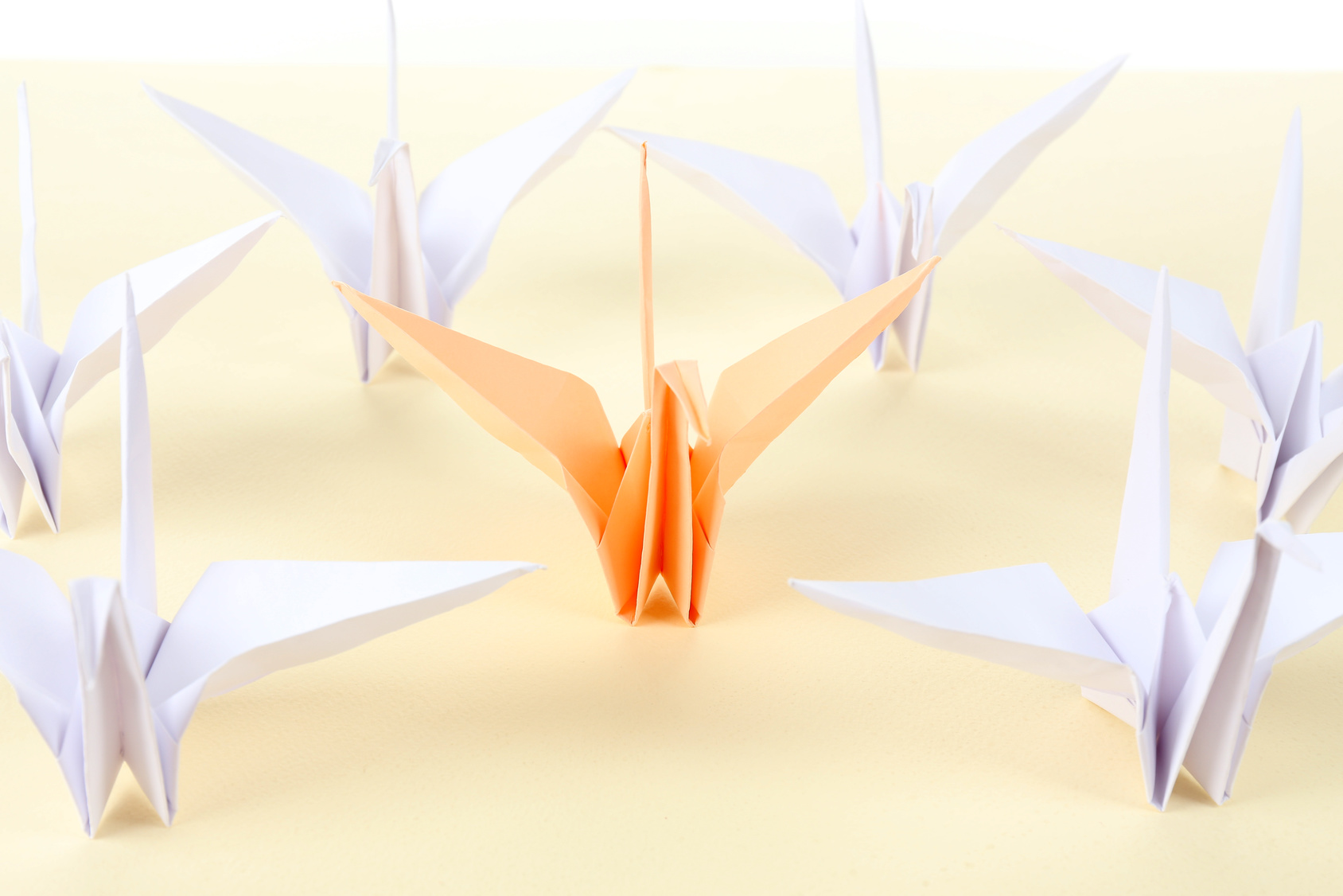

While a majority of FS firms understand the growing importance of meeting and exceeding customer expectations, our survey revealed that a small group of banks and insurers were doing things differently and achieving better results. What separated these ‘change leaders’ from their peers was investment in customer service and new digital technologies. When asked what percentage of their resources was devoted to customer service and experience, change leaders reported more than half (57 per cent), while the rest of the industry remained at 37 per cent.

As a result of this difference in investment of resources, change leaders also reaped better rewards. When asked about the success rate of change programmes in improving customer experience, change leaders reported 66 per cent, while their peers stayed at 52 per cent.

So, the overall themes emerging out of our Change Survey in regards to customer experience is clear: everyone in FS agrees it’s a critical internal and external driver for change, but those that put more resources into it report better results.

“You have mandatory change because of regulation, you have change because of what competitors are doing, and then you have another kind of change: to catch the latest trends and what the customer is asking of you, but also what the customer has not asked for, but which you can imagine. This is the change that can deliver the greatest economic benefit,” said Cristoforo Avagliano, BNL BNP Paribas, one of our survey respondents. As I pointed out earlier in this series, the perception that mandatory investments ‘crowd out’ discretionary and strategic investment was not proven in the results of our Change Survey. When asked whether mandatory investments ‘get in the way’ of discretionary and strategic investment, only 15 per cent of the respondents said ‘greatly,’ a majority (69 per cent) said ‘to some extent,’ and 16 per cent said ‘not at all.’

It’s paramount that change strategies must, at the very least, keep pace with the ever-increasing customer demands and expectations, and at best, should outpace them. These issues are just as relevant for corporate and institutional clients, as they are for individual private or retail customers. So how do FS firms of all types and sizes alter their metabolism to achieve that?

In my previous two posts, I’ve talked about how the human factor (employees) can make or break growth and the importance of leadership and culture within FS firms. Customers make up the other third of this ‘people first’ approach. Leveraging the true power of digital is about reinventing the organization to find new ways of serving customers and creating value. FS leaders need to recognise the crucial link between the empowerment and engagement of colleagues (from the front-office to the back-office) and the experience delivered to end-customers and clients. Traditionally, our industry has had very engrained ways of working – especially brokers, RMs and branch staff. But there are many success stories of FS firms building new behaviours and skills.

Change at FS firms needs to begin with the customer in mind; ideally the customers and/or end-users would be involved in the design process. Great changes are simple, human and delightful experiences for people to go through; they also have more impact and carry less risk of non-adoption or failure.

FS firms will also need the help of customer experience specialists who can map out client experiences, bring design thinking, prototyping and user-testing techniques into the change efforts.

Putting customers at the heart of change programmes at FS firms means considering them first and reverse-engineering the transformation. Those that achieve this great mind-set shift will be the ones not only retaining the loyalty of their existing customers, but also reaching a new segment in the digital age.

To find out more about the Financial Services Change Survey or to join our FS Change Director Forum, please contact me here, or on Twitter @AndyYoungACN.

You can read more survey results here.