Other parts of this series:

Compared with challenger banks, some traditional banks have been slow to adopt Open Banking. This is perplexing, given the potential $416-billion market opportunity Open Banking represents and the growth we expect to see over the next three years. Some banks have had understandable reasons to be hesitant about adopting Open Banking—but they won’t for much longer.

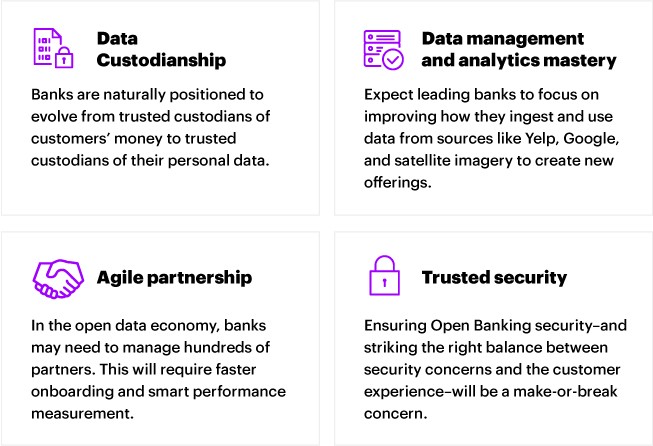

Banking leaders understand that they need to prepare now for the sea change that Open Banking will bring. They will want to build these four specific capabilities: Data custodianship, Data management and analytics mastery, Agile partnership, and Trusted security.

Your customers will determine which capabilities take priority

In markets where customers are, despite robust regulation, reluctant to embrace Open Banking-powered data exchange, bank leaders are addressing customer hesitancy with detailed information about the parties that tap into their data, the reason they need access to it, and the length of time the data is needed. For these markets, data custodianship is the priority.

As the current keepers of their customers’ money, banks are very well positioned to become the custodians of their personal data too. Our Global Banking Consumer Study shows that 37% of consumers trust their bank “a lot” to look after their data, while less than 10% trust big techs or neobanks to do so.

Core competencies for data custodianship and consent management

- Ensuring data is trustworthy and has been properly collected and extracted (provisioned)

- Safely storing the customer’s data and associated consent within processes and infrastructure

- Establishing proficiency in data handling, data stores, data identification and categorization algorithms

In some regions, consumers are more open to adopt products and services powered by Open Banking. Banks in those regions should invest heavily in their data management and analytics capability to enable the launch of innovative products and services for eager customers.

As Open Banking apps, initiatives and APIs gather momentum, a new Accenture report details how banks can lead in the open data economy.

LEARN MOREKey capabilities for data management and analytics mastery

- Developing a common framework for collecting, sorting, integrating and maintaining data

- Integrating data stores, data identification and categorization algorithms, machine learning capabilities and data audit mechanisms

- Creating data catalogs across cross industry data sets that bridge silos and make actionable insights possible

Regardless of a region’s level of market readiness, capabilities in agile partnership and trusted security are crucial.

Banks may need to build relationships with hundreds of partners— real estate agents, legal services firms, travel companies, auto dealers and more—in the Open Banking and open data economy. Some of these partners will be strategically important to banks, while the rest will be tactical partners who simply execute tasks.

Forward-thinking banks will become knowledgeable about their strategic partners’ businesses, the data sources they wish to access or offer and the integration issues they face.

Core competencies for agile partnerships

- Developing and implementing an accelerated onboarding process (from months to weeks), so partners deliver value rapidly

- Measuring the success of partnerships through KPIs such as revenue per partner and customer engagement per partner

Security is key for developing agile partnerships

Security is essential for creating a trusted Open Banking ecosystem. Beyond regulatory compliance, banks can emphasize their security prowess to gain consumer trust and encourage adoption of Open Banking.

A 2020 Akamai report revealed that 75% of credential abuse attacks against the financial services industry targeted APIs, highlighting why consumers might be skittish about Open Banking security.

Core competencies for security

- Implementing appropriate authentication and authorisation protocols, securing and encrypting API traffic, behavioral biometrics as well as general preparedness against new threat vectors

- Mitigating bots to protect open APIs from data loss, fraud and distorted analytics

What banks need to succeed in Open Banking

Bank leaders should begin building their capabilities in data custodianship, data management and analytics, agile partnerships and security now to ensure they don’t lose market share or their slice of the $416 billion Open Banking revenue pie. Given the scope of the task at hand, it will be too late to get started after the wave of Open Banking has swept through the industry.

Leading banks will move beyond the idea of owning or guarding sensitive customer data, money and information. Banks that can aggregate data, extract insights and offer customers meaningful experiences will ride the Open Banking wave to be success in the emerging open data economy.

For a fuller discussion on preparing for Open Banking, contact me here or on LinkedIn.

To learn more about the changing landscape in payments, visit the Accenture website to download the full report, “Catching the Open Banking wave.”

Read report