When I was shopping online recently, a new option appeared on the checkout screen that presented me the opportunity to finance my purchase. This new offering is becoming pervasive across all asset types, from laptops to lift trucks, and including services such as vacation travel, on B2C, B2B and even P2P shopping sites.

The goal is to make it easier for customers to access financial services as they go about their daily lives. Rather than having to arrange financing or defer purchasing, buyers can finance in the moment and businesses can receive payment quickly.

Embedded specialty financing—lending and leasing—is coming. In fact, I think it’s a trend that’s likely to change the finance landscape within the next five years. So, auto and equipment finance companies need to start thinking now about how they can capitalize on it for the best advantage.

Imagine what embedded specialty finance will look like in the real world

My Accenture colleagues recently did a deep dive in the commercial banking space and created the report Embedded Finance for SMEs based on 2,500+ online interviews with senior managers at small- and medium-sized enterprises (SMEs) in 10 countries. In it, there’s an illustrative example to help us imagine how embedded finance could work. We’re introduced to a restaurant owner who is using a new food delivery platform. One day, as he’s checking his orders, he notices a new feature that would let him have the money from food orders deposited in real time into an account. And it’s integrated right into the delivery platform. Within a year of signing up for the new service, he’s using this integrated account for most of his daily financial services needs.

In a similar manner, auto and equipment manufacturers might offer their customers a Finance Now button on their sites. It would be much like the Buy Now button we’re all familiar with on online retail sites like Amazon, but with specialty financing processes in the background.

For customers, a service like this would mean no cumbersome loan or lease application, no need for a credit check and no lengthy wait for the application to be approved. Instead, they could get financing for the vehicle or equipment they need with just a few clicks—in a simple and fast process that benefits the borrower, the manufacturer or retailer, and the finance company.

The Accenture commercial banking research indicates that more and more buyers and borrowers are warming to the idea of embedded finance. They’re also willing to pay a premium for a better experience.

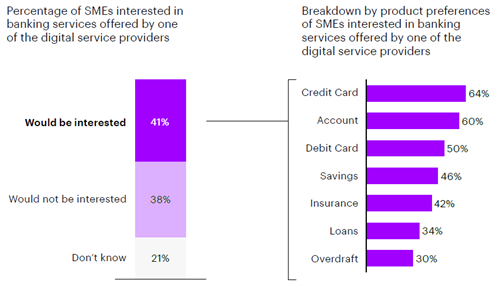

Our survey respondents were interested in a range of financial services—with more than a third (34%) of the interested group keen on loans. Across all the services, Accenture estimates that $32 billion of revenue is at stake with a potential for a further $92 billion in revenue growth. That’s not pocket change.

How auto and equipment finance organizations can capitalize on this opportunity

Approximately 85% of the respondents in our survey said they use digital services daily, so digital platforms are well positioned to embed specialty finance services and other value-added services like financial management and analytics tools. In the US, services like Stripe Capital are already offering end-to-end lending application programming interfaces (APIs) to platforms like Shopify to offer financing options to customers.

This is one of the ways lenders and lessors can leverage embedded specialty finance opportunities—partnering with digital platforms (including auto and equipment manufacturers) to provide pass-through services. The benefit of this model is that it lets the finance organization retain its brand presence. Also, the investment required to be on the platform is relatively small.

A second model is to integrate specialty finance services with a digital platform, providing platform-branded services. For customers this means a more seamless experience, but for lenders and lessors it means giving up control of the user experience and the pricing of the service. However, partnering with a platform does offer the potential for co-creating new solutions that address customer pain points. It’s also a way to gain access to the platform’s sizeable customer base, although this seldom leads to ‘ownership’ of the customer. Within these new solutions, finance companies could add additional value-added options that can be monetized as well.

Whichever of these two models fits best with your long-term business strategy, I recommend auto and equipment finance companies get started immediately. It’s extremely likely that pass-through services will become table stakes by 2025. And, if you want the first-mover advantage of integrating with platform-branded services, making a move today to partner with the right platform is imperative.

If you’d like to talk about which embedded specialty finance opportunities best align with your business strategy, please feel free to reach out to me directly.

In the meantime, I highly recommend you download the report: Embedded finance for SMEs. It offers a list of decision points in the emerging embedded finance landscape to help you consider your own embedded finance strategy, go-to-market model and execution plan.

Read report