Other parts of this series:

In our discussions with banking executives, a common theme is how the lending market is changing and constantly giving rise to threats and opportunities, as covered in our Commercial Banking Top Trends for 2024. Confronting these changes is essential, but it also requires banks to be willing to reinvent to stay ahead.

Previously, we touched on three shifts in lending which covers being data-driven, embedded finance and integrating ESG practices. In this final post, we cover the last strategic shifts: how banks can rethink their lending product, service offerings and business models to remain competitive.

Shift #5: Reimagine product and service offerings, like the “all-in-one account”

Commercial banks must craft intuitive, end-to-end digital experiences to satisfy borrowers’ demands for a seamless lending process. Personalized propositions are vital, as a one-size-fits-all approach fails to address the varied financial needs of customers. Banks also need to simplify the onboarding of customers to multiple products to minimize duplication of processing, contacting customers and documentation.

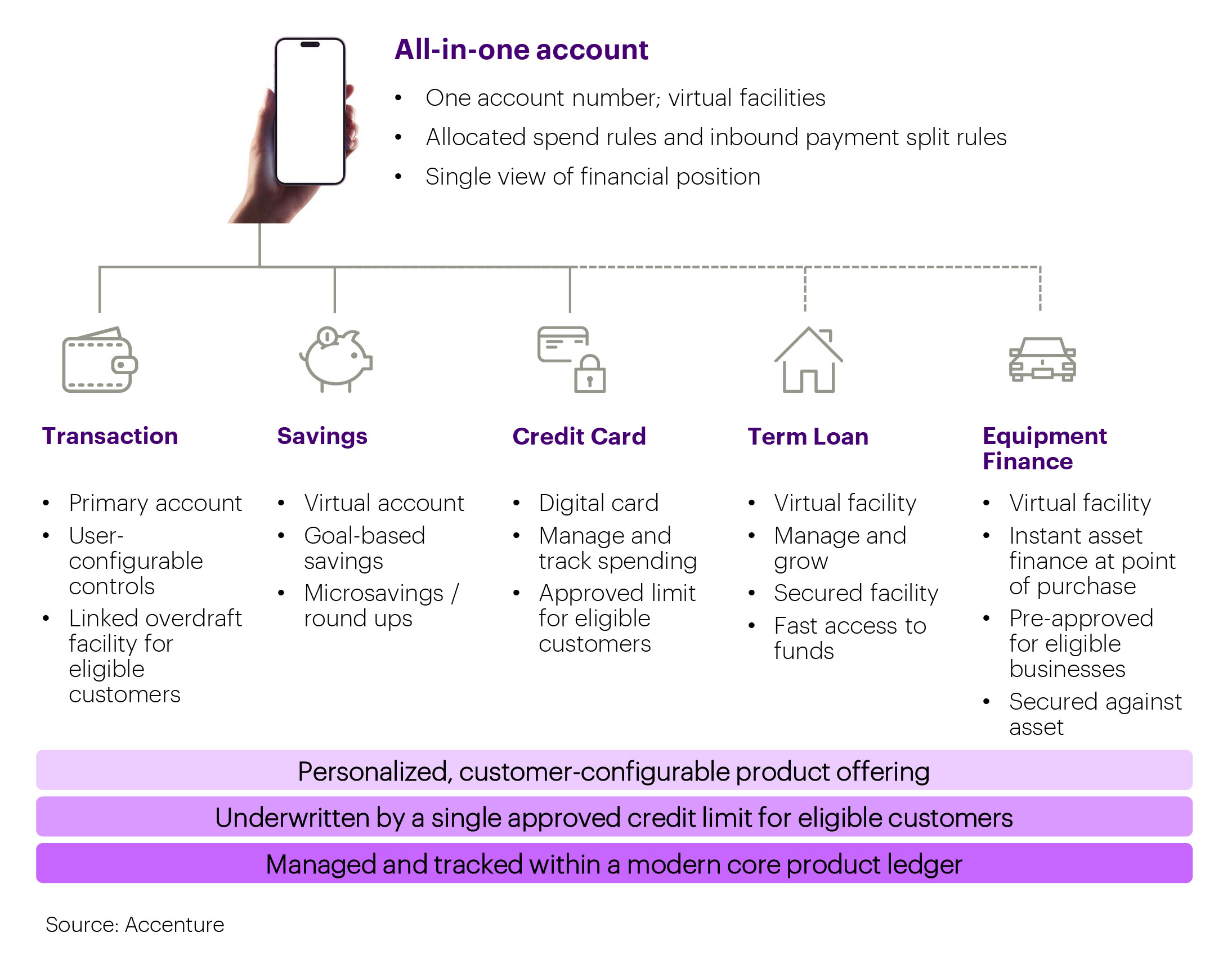

The “all-in-one account” is an example of a reimagined product offering that can cut through this complexity. In contrast to the one-size-fits-all approach that offers the same product to every customer, an “all-in-one account” provides a flexible, comprehensive solution tailored to meet various individual needs within a single account. It delivers a unique proposition and evolves with the customers changing needs. The one account number is a flexible offering for virtual facilities, sets rules for allocated spend and inbound payment split and provides a single view of a customer’s financial position.

Figure 1: Features of an all-in-one account

An Asia Pacific bank introduced an all-in-one numberless card that functions as a credit card, debit card and ATM card. It features a prequalified “Always On” loan, budgeting tools, insights and monitoring. This account makes managing finances easier for customers and provides access to working capital when needed. It also allowed the bank to open an account, issue a credit card and secure a loan in under five minutes.

Shift #6: Transform the lending business model

New banking business models have shifted from yesterday’s rigid vertically integrated and linear value chain with “macro products” to today’s more common approach of unbundling product components.

As banks worked through their digital transformation journey, many simply transferred their existing value chain and business model to a digital format. But we are seeing a shift from the traditional vertically integrated models to more flexible and composable models inspired by digital challengers. Composable technology, for example, acts like a set of building blocks that you can mix and match in different ways to create various capabilities.

In this model, banks are deconstructing their operating model into micro-products or services, then re-bundling these components with offerings from other providers to create customer-centric solutions. The ability to unbundle and re-bundle banking and lending products around customers is crucial to effectively address their diverse needs. The key differentiator in a world of compressed margins and intense competition for lending and deposits, will be the ability to combine the right channels, products, processes and policy permutations for Micro, SME, Commercial and Corporate customers.

So now what?

Lenders that prioritize customer-centricity and leverage AI and advanced analytics for personalization and instant decision-making are poised to lead the market. By emphasizing collaborative ecosystem partnerships, composable technology and fragmented digital banking models, banks can shift their focus from merely defending market share to actively pursuing real growth.

To embark on this transformation, we recommend these actions:

-

- Determine which trends will have the largest impact on customers and the industry.

- Plan scenarios for the different possible futures for the lending landscape.

- Agree on a “North Star” vision, priority segments and the underlying value proposition to drive competitive differentiation.

- Define what big organizational shifts are required for the future across product, process, policy, people and technology.

- Define a portfolio of initiatives, backed by tangible proofs of concept, to quickly demonstrate value, build momentum and secure buy-in for larger, more strategic funding requests.

If you would like to chat about any aspect of this topic, please get in touch—we’d welcome the opportunity to discuss your bank’s journey to the future of lending.

We would like to thank our colleague, Gustavo Pintado, for his contribution to this blog series.