Other parts of this series:

Drawing from our Commercial Banking Top Trends for 2024, this series explores how banks can modernize their lending business and differentiate the customer experience by integrating AI, machine learning and other advanced tools. Previously, we touched on the disruptions in lending and analyzed the first of six shifts necessary to future-proof one’s business.

In this post, we will cover three more shifts to explain why lenders should embrace the data-driven ethos, embed finance into every touchpoint of the customer’s journey and integrate ESG practices.

Shift #2: Fuel data-driven lending with a digital brain

The data-driven philosophy has propelled the banking industry towards transformative growth over the past years and will continue to drive the industry forward. Harnessing data fuels better decision-making, empowers lending managers, automates processes and adds value for customers.

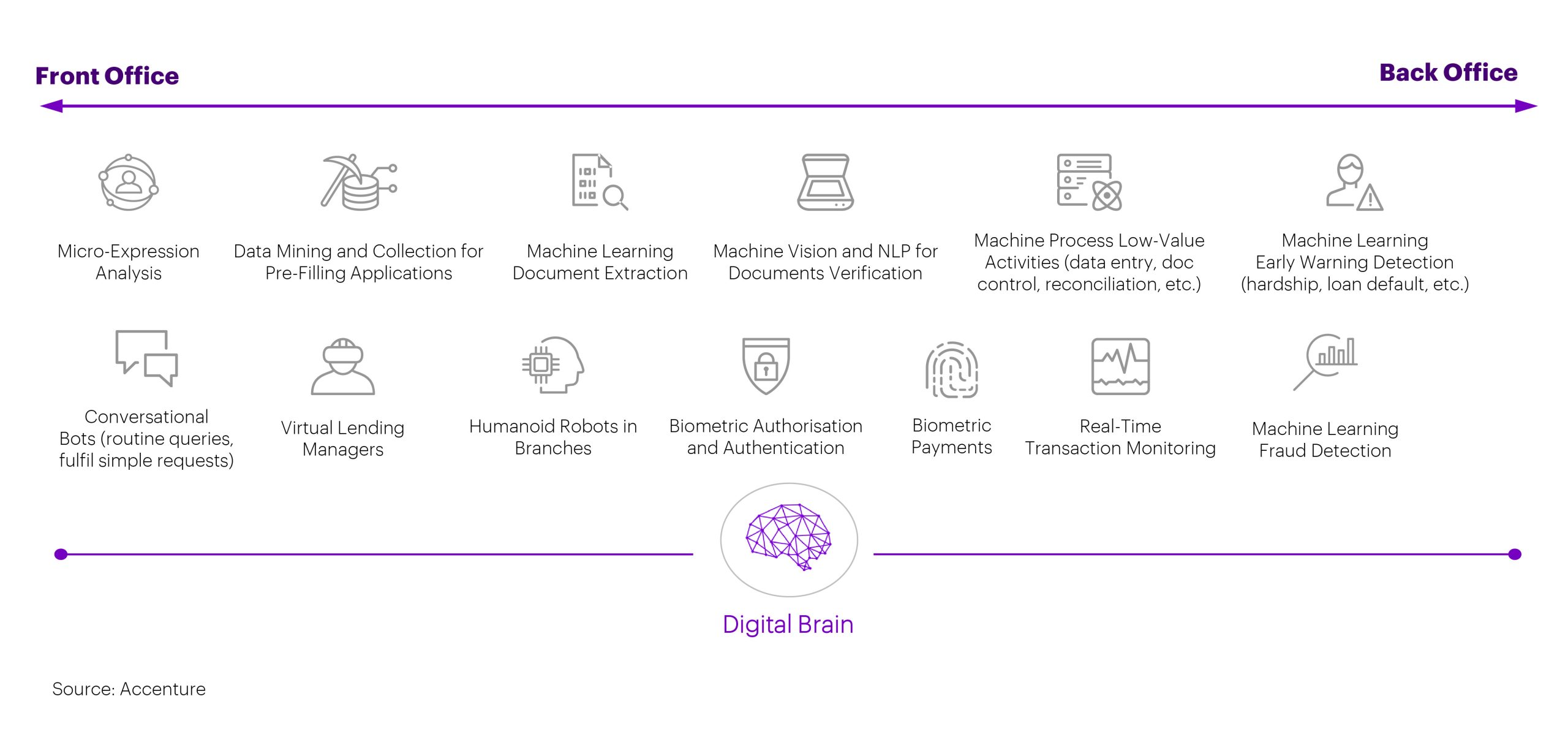

The banking sector is transforming the front, middle and back offices with advanced technology and AI (Figure 1).

-

- In the front office, banks enhance customer interactions with tailored insights for better engagement.

- Efficiency in the middle office is boosted by automating tasks like KYC, AML, document verification and credit assessments, which streamlines workflows.

- In the back office, AI-powered algorithms improve risk management and fraud detection, by automating compliance checks, monitoring transactions and handling regulatory reporting to ensure banks meet industry regulations and operate smoothly.

Figure 1: AI applications across front, middle and back offices

Commercial banks are starting to explore how a “digital brain” can enhance customer and banker experiences and process efficiency by finding and fixing bottlenecks and exceptions, continuously learning from vast amounts of data.

For example, rules engines are commonly used in the loan application process, with exceptions handled by human experts. If a business owner applied for a loan and their application fell outside predefined criteria (such as having a unique revenue model or an unusual cash flow pattern), a loan officer with deep expertise would manually review the case and get it approved. A digital brain enables the system to learn from these exceptions, identify intervention patterns and codify new rules. Over time, the digital brain evolves, adjusting the rules engine to handle a wider variety of scenarios, democratizing knowledge over a wider base of bankers and enabling better and faster customer outcomes.

And how does the digital brain come into play? Banks can establish a digital brain comprising a “data lake of one” for each customer. This will allow the bank to optimize data availability and scale its services, achieving both efficiency and more personalized, meaningful experiences. It will use bank transaction data to identify the next best conversation, seamlessly integrating with technology like advanced AI algorithms to streamline front, middle and back-office functions.

Shift #3 Embed finance in the customer journey

Embedded finance is the seamless integration of financial services by non-financial institutions at the point of customer need. This tech-enabled approach incorporates lending into non-financial settings, moments and journeys to meet customers where they are, at their convenience and on their own terms. Embedded finance is in its early stages and hasn’t fully taken off yet, but the potential is enormous. The embedded finance market has been experiencing rapid growth in recent years and is projected to continue expanding. By 2030, it is expected to represent a $7.2 trillion addressable market opportunity.

The mantra of the future is clear: reimagining both the distribution and manufacturing of lending products is not just beneficial but essential to seize the expanding opportunities presented by embedding finance and lending. As we delve into this journey, it becomes evident that the convergence of lending with non-financial platforms is vital for unlocking remarkable growth and innovation.

For example, a North American payment-processing platform for small and medium businesses (SMBs) has introduced embedded finance to their customers. This feature provides SMBs access to loans directly within the payments platform. It leverages their transaction data and historical performance to evaluate risk, repayment capacity and extend personalized loans that match cash flow needs based on transaction history. This has made it easier for SMBs to get loans, saving time and effort, and helping those who struggled to obtain financing through traditional methods.

Shift #4: Take full advantage of sustainable finance and green loans

Sustainable finance involves integrating Environmental, Social and Governance (ESG) considerations into financial services to promote economic growth, environmental stewardship and social responsibility. ESG scoring methods are essential in evaluating the sustainability and ethical impact of investments and lending decisions. By adjusting credit products and policies towards sustainability, banks can make more informed decisions. Relationship managers need enhanced ESG knowledge, and banks should integrate digital standards and establish a robust ESG data platform. Adopting ESG scoring for listed companies and leveraging technology for data on non-listed entities is crucial. A centralized ESG data utility can streamline data access, validation and management, enabling informed and sustainable lending decisions. This approach allows banks to fully harness the potential of ESG integration in their lending practices.

For example, a European bank committed to sustainability faced the challenge of overhauling its performance management models to align with its goal of becoming a sustainable bank. This overhaul resulted in a unified ESG data model, optimized data analysis and integrated ESG-focused performance metrics. It not only ensured regulatory compliance but also helped the bank track its ESG strategies, make informed decisions towards achieving its Net Zero targets and determine green lending growth strategies and related pricing incentives.

In the final post of this series, we will dive into the last two strategic shifts and share what banks can do to move from defending market share to targeting real growth. To learn more about the forces shaping the future of commercial banking, download Commercial Banking Top Trends for 2024. If you would like to chat about any aspect of this topic, please get in touch.

Special thanks to Gustavo Pintado for his contribution to this post. Gustavo has been working closely with a number of our financial services clients as they design and implement their lending strategies.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.