Other parts of this series:

- Core banking modernization: Unlocking legacy code with generative AI

- Solving the puzzle: How interoperability eases banks' core modernization dilemma

- Core banking transformation: strategies for modernization and value creation

- Key strategies and approaches for mainframe and core banking modernization

If it wasn’t already apparent, the sudden emergence of generative AI has certainly confirmed it: the ability to quickly respond to new challenges and opportunities is a critical attribute of any successful organization, including banks. The agility that allows an organization to respond effectively is influenced by several factors, such as skills, culture and corporate structure. But a critical enabler is a modern digital core.

Most banks know all about the constraints of an inflexible, monolithic core. Fortunately, new core system architectures are easing these constraints. These architectures allow a hybrid approach in which legacy and new core systems are integrated seamlessly. They coexist not only with each other but also with technologies from various vendors across different hosting models. This approach significantly reduces the risk that inevitably accompanies the challenging task of retiring the bank’s legacy core.

Several emerging concepts underpin this approach: ‘interoperability’, ‘composability’ and ‘coreless banking.’ These extend beyond technology, enabling new ways to develop business models, products, services and experiences by leveraging the best capabilities available in-house, within the banking industry and in the broader technology ecosystem. The result is an organization whose structure and component parts allow it to evolve relatively effortlessly with market changes. Together, these three concepts make the age-old aspiration of a ‘bank of one’ attainable.

What do these terms mean?

A composable core architecture consists of smaller, self-contained components. These components can be built, tested, and deployed on their own, and they can be quickly and easily assembled in various configurations to meet different use cases. This avoids the cost and risk of changing the entire core system.

Interoperability is the ease with which the various parts of the architecture can connect and communicate with each other. Examples include data exchange and collaboration.

A composable / interoperable architecture reduces technical debt and improves organizational agility. Instead of relying on a single monolithic system it enables a decoupled, orchestrated configuration of best-of-breed solutions that can be sourced both internally and externally. It affects much more than just the bank’s IT systems, enhancing its operating model, products, experiences and talent management—including even its business model.

Gartner in 2021 researched more than 2,300 organizations. In its paper titled Composable Applications Accelerate Digital Business, it said those firms characterized by high interoperability and composability reported significantly greater business performance and revenue, and lower risk and cost, than their peers.

For banks to embrace interoperability and composability and to adopt this hybrid approach, they must:

-

- Re-visit their organizations, the principles underpinning their talent and culture, and their operating models.

- Define the North Star for their quest for interoperability and composability. They should think big and then start small, building the minimum foundational architecture for interoperability.

- Create a pipeline of prioritized initiatives, aligned with their North Star, to minimize regrettable steps and ensure the timely delivery of targeted business outcomes.

Building blocks of an interoperable / composable IT architecture

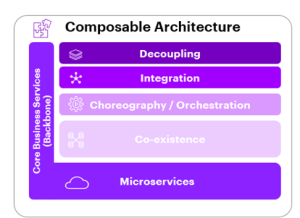

To understand the interoperable/composable IT architecture, we must consider its various aspects. It starts with decoupling, which involves separating the different front-end, middleware and back-end engines through specific abstraction layers and patterns. This separation allows for easier movement and scaling of processes, domains, products and/or packages.

However, the approach extends beyond decoupling. It also includes technical integration, which means connecting diverse technologies that may come from a variety of sources, both in-house and third-party. These technologies may use different protocols, operate on different hosting models (such as on-premise and cloud), and function under different commercial models (including custom-built, licensed, subscription-based, and XaaS).

This integration is crucial, but the concept of an interoperable and composable architecture goes even further than this. Orchestration and choreography are other important factors. So too is the need to coordinate and sequence the journeys and IT processes where many different components and technologies play together under synchronous and asynchronous patterns to support every different business service.

But the main enabler of interoperability and composability is less obvious than all of these other elements. It is a structural coexistence architecture. This concept includes all the logical and technical cross-product components that should be abstracted from the specific domain / product engines. This includes functional domains, capabilities and data such as the customer information file, product factory, pricing engine, statements and reports engine and pooling and sweeping capabilities. These cross-product functions will be ingested as required and retro-fed by all product processing engines regardless of their nature or source, but they should not be hosted in the core of any of them.

From the technical point of view, we also need cross-product capabilities such as single sign-on, sessions handling, identity management, logs, network management, observability, saga patterns, errors handling and catching capabilities. The devil is in the details, and performance and reliability depend greatly on having answers to all these technical challenges. While there is no single solution, the most important lesson we have learned is that flexibility and fit-for-purpose will always be the critical attributes.

A successful transformation journey does not require having all these architecture components in place as a starting point. However, it is essential that you have a clear high-level vision of your target IT model and architecture—that you think big.

It’s also advisable that you begin with the minimum foundational architecture components that will create the path to your North Star. Starting small in this way avoids regrettable moves and other waste. As you add other on-going initiatives to this journey, you will be able to prioritize your migration roadmap and construct additional lanes in your interoperable / composable architecture. Together, these will ensure that at the same time as modernizing your core, you also enable the business, reduce your TCO and mitigate your IT risk.

The benefits of interoperability / composability for banks

Interoperability and composability enable banks to side-step the longstanding dilemma of either moving their core systems from their mainframe to a modern platform at significant risk and expense, or retaining their legacy infrastructure at the cost of flexibility, innovation and competitiveness. Because interoperability ensures new systems can work alongside on-premise mainframe systems, accessing vital data as and when required, there is less pressure to replace older systems. This coexistence allows the gradual evolution of the bank’s core systems, as they could be maintained either indefinitely or for a planned duration leading up to a pivot.

While the technology behind interoperability and composability may be difficult to grasp, the benefits are more obvious. Our own work with a large number of leading organizations has revealed improvements in the performance of their IT enterprise. We found that, on average, firms that embrace interoperability and composability can cut their time to market for new products by 15% and lower the effort and cost of integration by 20%. They can increase asset reusability by 10% by making them more observable, and they can increase component standardization by 20%*.

It’s no surprise that the adoption of interoperability is regarded by many—including rating agencies and many banking clients—as a turning point in business performance.

Real solutions for core banking modernization

In a sector that has seen more than its fair share of false dawns, there is bound to be some scepticism. What is it about this approach that should give banks real hope that core modernization can be achieved at an acceptable speed, risk and cost?

Three key trends have combined to unlock the promise of interoperable and composable technology solutions: the growing appeal of cloud, the proliferation of APIs and the maturity of open architectures. This includes hyper-scaled computing at both the core and the edge, and the roll-out of high-speed networks. It is characterized by mature, efficient and resilient architectures in which microservices and APIs play a key role. It embraces cloud, open source and market standards, ensuring versatility and coexistence with on-premise and SaaS components. And it offers a variety of modernization roadmaps to suit every bank’s requirements.

An outdated, under-performing digital core has long been a thorn in the side of most banks. This new approach to core modernization changes everything. If you would like to find out more about how your organization could become interoperable and composable, and how it might benefit, we would be happy to talk to you—simply get in touch with me here.

In the meantime, you may be interested in our recent report on banking transformation and the importance of a modern digital core in capitalizing on opportunities such as generative AI. In addition, our Top 10 Trends for Banking in 2024 explores this topic in the section The Key to the Core.

* Source: Accenture experience working with leading global clients.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.