For decades, commercial cards have provided card issuers with high fee income and strong P&Ls. The market is growing and evolving, with virtual cards as the primary driver. Virtual cards, which offer businesses an efficient and secure way to make payments without a physical card, are considered to be a value-added service by businesses who use them. In fact, our commercial payments study found that 43% of surveyed payments clients are highly likely to use virtual cards due to the benefits they provide. Given this growth and demand, and the new ways in which virtual cards are being delivered to businesses, issuers may need to adapt their approach and leverage different virtual card delivery channels to continue to satisfy customers and generate incremental spend. In this post, we will explore three primary channels for virtual card delivery and the key implications of these channels. But first, let’s take a closer look at the U.S. commercial card market.

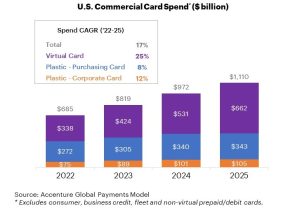

U.S. commercial card spend expected to exceed $1 trillion in 2025

U.S. commercial card spend has rebounded well since the pandemic and strong growth is expected going forward. Accenture estimates spend from U.S. organizations will exceed $1 trillion in 2025, primarily driven by continued business travel normalization and increased virtual card usage.

Figure 1: Virtual cards are leading the way in U.S. commercial card spend

Our Global Payments Model analysis also found that traditional physical plastic cards are still being used but usage is expected to decrease as more spend shifts to virtual cards.

-

- Plastic purchasing and plastic corporate card spend is expected to grow 9% annually through 2025 (8% purchasing card growth, 12% corporate card growth). With U.S. business travel spend expected to increase from $218 billion in 2022 to more than $275 billion in 2025, per the Global Business Travel Association, higher-than-average plastic card spend growth is expected in the near term before normalizing at inflation-level rates.

- Card-not-present transactions, in which a static card number is lodged at a key supplier to pay for indirect company expenses, are expected to drive steady growth for purchasing card spend. Some of that growth, however, is being cannibalized by virtual cards which offer more control, fewer fraud opportunities and additional flexibility.

- Commercial virtual cards are growing faster than other types of commercial cards, and this growth is expected to continue. Typically defined as unique, digital 16-digit account numbers used for business purchases (e.g., payables, travel bookings, e-commerce purchases), virtual cards are becoming more practical and accessible to a wider variety of end-users.

The benefits of virtual cards, such as heightened security, reduced fraud and improved data for reconciliation, are well documented. We believe those benefits will continue to be realized by a larger subset of commercial payments clients as the delivery of virtual cards becomes more streamlined.

How virtual cards are delivered

As demonstrated by Visa’s February announcement and Mastercard’s April announcement, today’s virtual cards can be instantly provisioned to anyone within a company (as opposed to the 10-20% of employees who typically have physical commercial cards) to make business purchases at the POS via a mobile wallet or through a digital channel, with spend details being tracked and integrated into popular financial systems (e.g., SAP, Oracle, Quickbooks) for reconciliation.

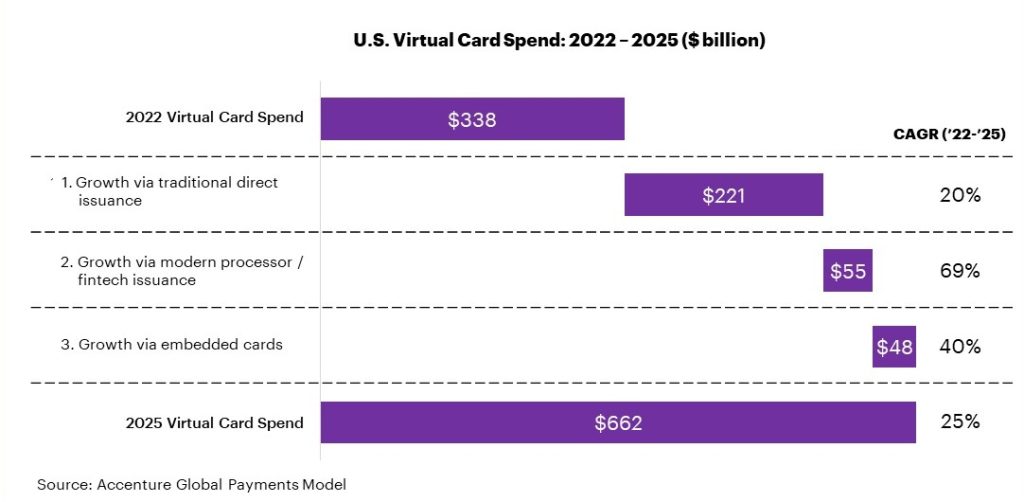

Delivery of virtual cards to end-users comes from three primary channels: traditional direct issuance, modern processor/fintech issuance and via embedded cards in software solutions.

Figure 2: Spend volumes and expected growth rates vary by virtual card delivery channel

- Traditional Direct Issuance

Accenture estimates a 20% annual growth in virtual card spending through traditional direct issuance through 2025. This method, in which cards offered by leading commercial card issuers are deployed directly to end-users via issuer, network and processor solutions, is currently the most common channel used, and is expected to remain the largest channel as providers continue to streamline and enhance their offerings.

The growth in traditional direct issuance is driven by market leaders who have developed extensive programs over the years, catering to a wide range of clients and use cases. For instance, Corpay and WEX have seen corporate payments volume increases of 25% and 38%, respectively, from 2022 to 2023, primarily through direct issuance virtual card-led strategies[1]. The market continues to evolve, however, and virtual cards are now also being delivered through additional channels.

2. Modern Processor / Fintech Issuance

New, digitally-oriented commercial card providers (e.g., Divvy, Ramp) are revolutionizing the virtual card customer experience. As described in our recent commercial payments study, these new players are gaining ground leading to incumbents experiencing intensifying disruption. Traditional banks recognize this, and half (49%) of payments incumbents said that engaging in an ecosystem strategy to grow in partnership with digital players is among their top three priorities for the next three years. Powered by modern processors (e.g., Marqeta, Nium) who can provide increased flexibility and facilitate the real-time funding of card accounts, these providers are driving growth in virtual card usage by supporting facilitation for use cases well beyond the traditional invoice-based purchase made by a large organization.

Modern processor-led solutions give businesses of all sizes the ability to launch programs and begin spending in days without ever leaving their office or picking up the phone. These solutions are often bundled with the actual card (typically virtually oriented with physical card options) serving as just one component of a broader spend management proposition which can provide process automation across the full procure-to-pay journey through intuitive, consumer-like interfaces. Providers leveraging the technology have experienced rapid spend growth – spend on Divvy corporate cards, for example, which are powered by Marqeta’s modern processing technology, grew 65% to more than $13 billion from 2022 to 2023[2]. The agile nature of modern processing will continue to push virtual card usage forward, with growth rates from these solutions expected to be more than three times those of traditional direct issuance solutions (albeit from a much smaller base).

3. Embedded Cards

The third primary channel through which virtual cards are delivered is via partner software solutions. Commercial payments providers are seeking to further embed their virtual card capabilities into the systems and solutions that corporates use every day. Leading providers across the ecosystem are establishing partnerships which make virtual cards more accessible to end-user organizations and reduce the time needed to reconcile transactions across different systems. Many of these partnerships have been formed over the last 2-5 years, but in the last 12 months alone, numerous leading networks and banks have established new partnerships to embed their virtual card offerings directly within the financial systems frequently used by their clients. Recent examples include Visa partnering with Worldline to integrate virtual cards into online travel agency solutions and American Express embedding its corporate payment solutions into Emburse Spend.

Our analysis suggests that the spend on cards embedded in partner systems will grow 40% annually through 2025, about two times the spend growth of traditional direct issuance solutions. As more organizations face ‘portal fatigue’ and seek to limit the number of systems used to manage their business, embedded virtual cards will likely gain even more popularity.

Key implications

Commercial payments are becoming more agile, with clients expecting consumer-like experiences with products that provide the right data in the right systems, all in real time. As commercial payments providers evaluate their commercial card strategies, it is important to consider the use cases which drive their clients’ card usage and the channels through which they deliver their offerings. The size of the business, the financial systems a business uses and the types of payments a business makes are all relevant considerations into determining the best product offering and associated delivery model.

As an example, construction organizations highly value the ability for payments to be integrated directly into construction-tailored ERP systems. Properly serving that segment is dependent upon the ability to seamlessly integrate card payments into those construction-specific workflows and systems.

As noted earlier, virtual card growth rates differ significantly by channel. The most successful commercial card issuers will be those who use multiple channels and ultimately meet their clients in the environments in which they spend majority of their time.

There is a significant opportunity in the growing commercial card market, and success will depend on leveraging the right channels and capabilities. Issuers need to actively seek new partners and channels to integrate their virtual card products into client systems. Those who succeed in this will stay ahead in the competitive landscape.

If you would like to learn more about value-added services in commercial payments, we recommend downloading our report: Commercial payments, reinvented. We’d like to thank our colleagues, Brian Rutland and Tom Skomba, for their contribution.

[1] Spend figures as reported by Corpay and WEX in public quarterly earnings releases. WEX figures exclude purchases on WEX issued accounts as well as purchases issued by others using the WEX platform.

[2] As reported in Bill.com’s public filings.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.