Other parts of this series:

In May of 2024, the Aurora Borealis, also known as the Northern Lights were on full display for the largest proportion of the United States in decades. The Northern Lights are caused by geomagnetic flairs or “solar storms” from the sun, which can lead to extremely disruptive events on Earth. In 2003, an extreme solar storm knocked out power in parts of Sweden and damaged electrical transformers in South Africa. It is easy to be distracted by the Northern Lights and not prepare for the potential harm the underlying conditions could create.

In one of my previous blog posts, I wrote about the rare opportunity for banks to benefit from rising rates, to boost their Net Interest Income (NII) before other macroeconomic forces began to compress margins. This once-in-a-generation opportunity was akin to Halley’s Comet passing through the nights sky. Fast forward 18 months and we’ve seen increasingly stubborn inflation, extended elevated rates, declining credit quality, commercial real estate concerns and challenges in deposit management take front and center stage. In this blog, I will explore how the macroeconomic events resemble a solar storm, with the banking industry’s response mirroring the Northern Lights. I may need to reevaluate my previous perspective on the rate cycle increase as a ‘once-in-a-generation event’, as now it is apparent it will become far more frequent and more disruptive. Banks will need to take specific actions to remedy present challenges and prepare for accelerated future disruption, rather than merely observing the problem.

Aurora Borealis in full display: Navigating disruption and transformation

Retail banking has arguably not experienced as much disruption since the financial crisis of 2007–2008. For more than a decade, a prolonged low-interest rate environment flooded the market with inexpensive capital and the acceleration of technology led to a proliferation of fintechs and neobanks that disrupted the traditional value chain. Over the past 18 months, banks have adopted various transformation strategies. Some found themselves stuck in analysis paralysis, bracing for a recession that was yet to materialize. Others implemented incremental changes, while some seized the opportunity presented by rising rates to take transformative steps forward.

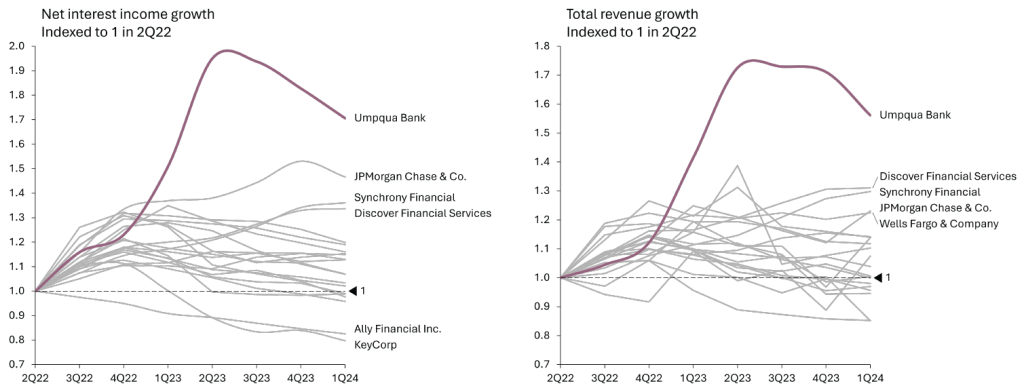

Consider Umpqua Bank as an example. Their corporate strategy, known as “Umpqua Next Gen,” is designed to modernize the bank, drive revenue growth, streamline processes and improve efficiency. Following a successful merger with Columbia Bank, Umpqua’s ongoing investment during economic uncertainty has allowed it to outperform even the top banks in the US (see charts below.)

Umpqua has focused on their enhanced digital services by improving user experience and expanding functionality for both their personal and business banking customers. Some specifics include advancing their “Go-To” banking model, which connects customers directly with dedicated personal bankers to drive personalization and deeper relationships. They have also expanded their banking features and financial wellness services, providing tailored advice. Overall, Umpqua Bank’s strategy aims to combine the efficiency of digital banking with the personalized service of traditional banking, thereby improving the overall customer experience while meeting modern banking needs.

Umpqua’s success is also being recognized within the industry. Global Finance named Umpqua as the “Best U.S. Regional Bank in the Far West”.

Today’s macro-economic signals—characterized by elevated interest rates, stubborn inflation, deteriorating credit quality—is presenting a complex challenge for retail banks, not unlike navigating a solar storm. This version of a solar storm has created its own “Northern Lights,” which while captivating, pose the risk of distracting banks from necessary transformation. It’s critical that banks be careful of getting distracted by the display and delaying additional transformation or preparatory actions. Lack of action could compound challenges in a disruptive market.

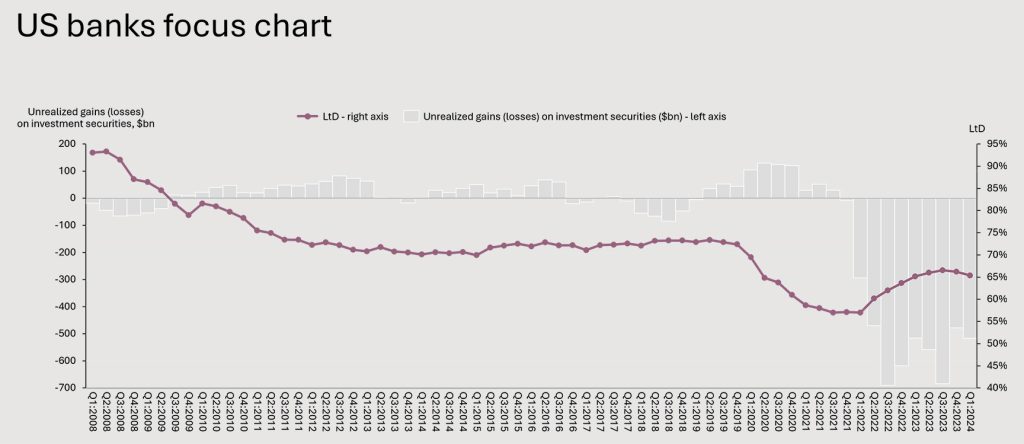

Consider the regional bank crisis in 2023; this was a wake-up call to all banks who were focused on liquidity and deposits but failed to anticipate exposure to unrealized losses, particularly those that were over-indexed on time-based deposits or market to maturity assets (see details below.) Despite the Federal Open Market Committee’s revised forecast for a single rate cut in 2024, nearly two-thirds of economists are still expecting cuts this year. If this is the case, banks should be ahead of deposit management now to avoid balance sheet imbalance.

No longer Halley’s Comet: How banks can navigate the new landscape of continuous disruption

While it’s true that retail banks are navigating a prolonged environment of high interest rates for the first time in a generation, the initial surge in NII that seemed like a golden opportunity for transformation has turned out to be just the beginning of a series of more complex challenges. Much like the unpredictable duration of the Northern Lights, the persistence of inflation and elevated rates remains uncertain. The landscape of retail banking is set to face continued disruption due to frequent macroeconomic shifts, unstable bank balance sheets, the survival of fintechs and neobanks and an evolving regulatory framework.

Customers, not just banks, are also subject to distraction caused by the metaphorical Northern Lights. Faced with an abundance of choices and the ease of switching providers, customers are more likely than ever to change banks for even the slightest financial benefits. With such a wide array of options and minimal barriers to switching, banks must stay attuned to the changing expectations of their customers. To prevent relationships from becoming merely transactional, banks will need to focus on delivering value, ensuring they meet the evolving needs and preferences of their customers.

Behavioral economics

While industry leaders generally understand the specific root causes of the regional bank crisis of 2023, the average retail bank customer does not. The failure of several prominent brands triggered economic behaviors among customers, leading to either a flight to yield or a flight to safety. More specifically, banks that did not appear at the top of bankrate.com or were not considered ‘too big to fail’ experienced significant and tangible deposit withdrawals in 2023. To counteract this, many banks quickly increased deposit expenses as a strategy to retain and regain market share. Although this approach serves an immediate transactional purpose, it lacks long-term sustainability and contributes to increased margin compression.

Primacy

According to Accenture’s Global Banking Consumer Survey, 82% of customers aged 18-24 have acquired a financial services product in from a new provider in the past 12 months. Given the proliferation of new capabilities from fintechs and neobanks as well as significant teaser offers on products the North American customer has ~7 products, however only 3 of them are with the bank they identify as their ‘main bank’. There are several considerations for primacy, including:

- Rewarding total value of customer relationship (loyalty > rewards)

- Payroll / Direct Deposit / Early Wage Access

- Trust / Brand Reputation

- Digital Capabilities (onboarding, money movement, servicing)

- Dodd-Frank 1033*

Mandates that financial services providers make available to consumers the financial data in their control in a form that is usable and portable.

So how might Retail Banks avoid admiring the “Northern Lights” and avoid analysis paralysis? In the next post of this two-part series, I’ll discuss specific actions for banks to consider now, near and far to ensure they are focused on the RIGHT constellation.

In the meantime, read our Banking Top 10 Trends for 2024.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.