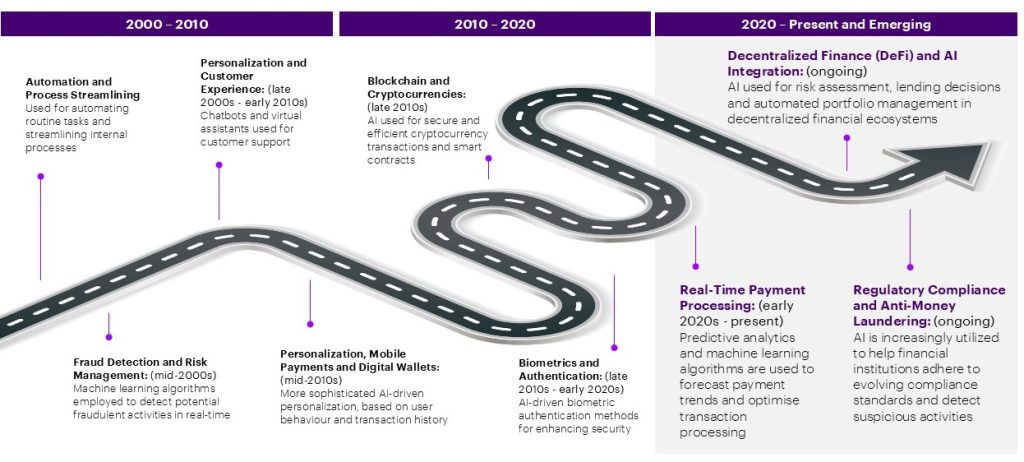

The use of AI in the payments industry is not a new phenomenon. In fact, Accenture’s recent Payments Technology Reinvention Study shows that leading banks are already investing significantly in AI and generative AI and have managed to automate 40% of manual tasks in their payments business. Advancements in speech recognition, image generation and machine learning have allowed AI to support innovation across a range of payment use cases (figure 1). The introduction of generative AI represents an inflection point in this journey, at which the technology begins to surpass human capability. This results in optimizing operational tasks, augmenting human capabilities and changing how people and organizations work. According to our findings, the top three areas banks are using generative AI in payments are for improving fraud detection, securing payments data and authentic chat.

Figure 1: AI has advanced over the years and is supporting the payments industry with increasingly complex use cases

The commercial payments industry is ripe for disruption

Growing competition from digital challengers, client impatience with traditional payments pain points and dependency on legacy technologies are constraining incumbent payment providers from keeping pace with an evolving market. Our commercial payments research reveals that many corporate clients are dissatisfied with various elements of the services and products they receive from their banks. The dissatisfaction is highest in trade finance, liquidity management and AR/AP due to weak fraud prevention solutions and difficulty of using these payment solutions. A lack of value-added services around payments and the difficulty of adding new payment methods also contribute to higher levels dissatisfaction.

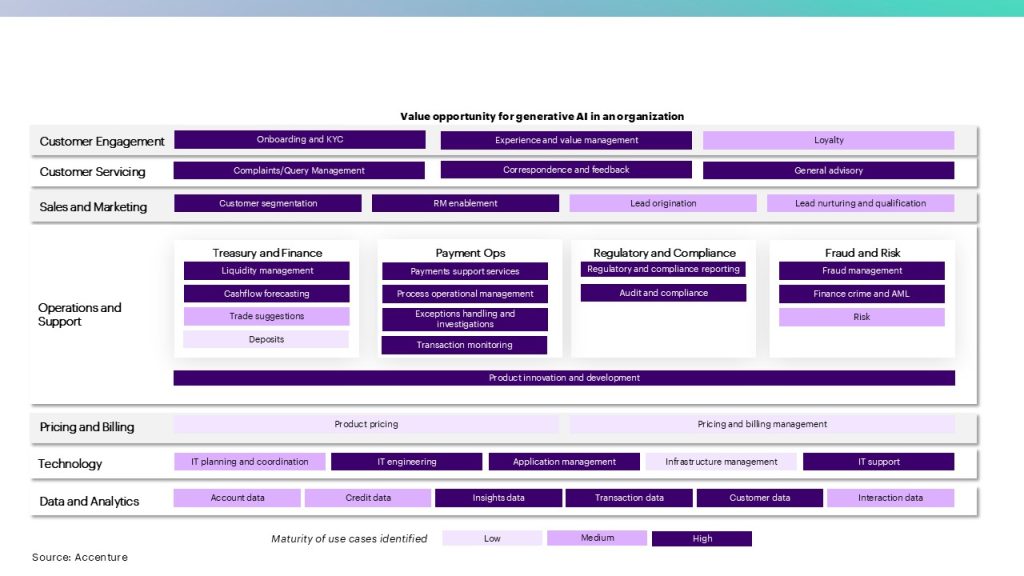

Today, innovations in generative AI present a unique opportunity for addressing some of these pain points. They have the ability to drive truly personalized client experiences and rewire existing, complex payment processes to be simpler and more efficient. Generative AI can be applied across multiple functions in commercial payments (figure 2), with use cases ranging from early-stage innovations like automated document processing to more mature applications such as enhanced fraud detection and tailored client interactions.

-

- Client Servicing: Enhancing customer support through virtual assistants, providing personalized recommendations based on payment transaction history and knowledge management.

- Sales and Marketing: AI-driven customer segmentation, targeted marketing and cross-sell opportunities (e.g., additional banking services like personalized wealth advisory).

- Treasury and Finance: Optimizing finance and accounting functions (e.g., payment process and cashflow management) and predictive analytics for forecasting.

- Fraud Prevention: Preventing fraud, especially in cross-border payments, and generating synthetic data for fraud scenarios.

- Operations: Automating tasks like data entry, reporting and customer actions (e.g., for payment investigations and payments ops monitoring) to reduce costs and improve efficiency.

- Regulatory and Compliance: Enhancing compliance by better interpreting and monitoring regulatory requirements and documentation (e.g., ISO messaging and scheme rules tracking and interpretation)

- Product Development and Technology: AI-led code generation can accelerate the modernization of legacy payment systems and improve transaction risk ratings.

Figure 2: Generative AI offers a compelling opportunity to address industry challenges and corporate paint points

The gap between need and readiness

Accenture research found that 95% of executives agree that making technology more human will massively expand the opportunities of every industry. But despite the recognized importance of AI, there is a gap between the need for AI integration and the readiness of organizations to implement these technologies. A new report, A new legacy of payments growth: How banks can reinvent payments with a strong digital core, revealed that only 20% of banks possess the necessary foundations to quickly capitalize on new payment opportunities. Having a seamless data and AI backbone and a secure technical foundation is an essential enabler for generative AI to achieve its full potential. Our analysis indicates that, of the market-leading banks, 75% benefit from an advanced digital core which enables them to deploy new payment features in response to market demand and make rapid adjustments based on product and service feedback.

The adoption of generative AI also raises several ethical considerations. There is a risk of propagating bias from training data, which could lead to biased outcomes for payments use cases. For example, this could materialize as demographic bias in credit scoring and lending, in fraud detection or in dynamic pricing strategies. The rapidly evolving regulatory environment poses additional challenges, as organizations must ensure that their AI implementations are compliant with current and future regulations to avoid legal and financial risks. For example, the EU’s Artificial Intelligence Act, currently under negotiation, will introduce a risk-based classification for AI-systems in finance and payments and include measures to mitigate bias, particularly in high-risk areas like credit decisions, payments, and lending. The introduction of generative AI will also lead to significant workforce changes, requiring organizations to have strategies in place for reskilling and training existing workers for AI-specific roles. Areas like trade finance that have been slower to automate could see roles that focus on manual payment processing and data entry decrease, leading to a demand for workers with skills in AI oversight, system integration and data analysis.

Where to begin?

Despite the advanced capabilities of generative AI, it is not truly creative and cannot generate novel insights without human input. By combining AI with human creativity, organizations can unlock new possibilities that would otherwise be out of reach for commercial payments. We believe the journey to realize the potential of generative AI starts with these steps:

- Engage your bank, technology and consultancy partners for best-in-class insights and best practices

- Reimagine your business processes with generative AI, embed in existing processes and drive behavior change

- Deploy a generative AI team, taking your best creative people from all parts of the business

Generative AI presents a transformative opportunity for the commercial payments industry. It can help organizations address long-standing inefficiencies, prevent fraud and give customers personalized experiences. However, to fully unlock its value, organizations must overcome readiness challenges, navigate evolving regulations and combine AI’s capabilities with human creativity to reimagine business processes and ensure responsible implementation.

“By harnessing the power of AI, we’re not just streamlining transactions but transforming them into intelligent interactions. This is setting a new standard for innovation in payments.”

Amit Mallick | Digital Payments Lead, Europe, Accenture

To learn more about generative AI in commercial payments, read HSBC’s report, Navigating the AI Wave: Innovations in Commercial Payments, and please reach out to us directly if you have any questions.

Read Accenture’s report, A new legacy of payments growth: How banks can reinvent payments with a strong digital core, for more details on how leading banks shape their payments modernization strategy and technology investments. Reach out if you are interested in completing our Payments Digital Core Maturity Diagnostic, which will tell you the current state of your payments business and technology.

Thank you to Chet Patel, Sandra Lam, Richard Adams and Shauna McLean for their contribution to this blog post.