The growing threat of climate change has spurred banks and other financial services companies to step up efforts to become sustainable. Many have pledged to fight climate change and reduce their greenhouse gas emissions to net zero. Far fewer firms, however, have begun the vital task of arresting the destruction of our natural environment.

Without a healthy natural environment, and its many diverse ecosystems, efforts to combat climate change will be of little value.

Right now, financial services firms have an opportunity to move to the forefront of global efforts to protect and restore nature. Those firms that have begun their journey to net zero should look to expand their sustainability strategies by also aligning their businesses with initiatives that safeguard nature. Furthermore, financial institutions that have started using their influence, resources and expertise to encourage their customers and suppliers to become carbon neutral (see our Rising to the Challenge of Net Zero Banking report) could use similar approaches to prompt these parties to become nature-friendly.

Banks, insurers and wealth managers that move quickly to address the needs of nature as well as the changes in climate will likely establish themselves as champions of sustainability in the eyes of their customers and investors, as well as among regulators and environmental agencies.

While efforts to combat climate change are important, it’s imperative that businesses also start taking action to stop the destruction of our natural environment—the forests, rivers and seas that sustain life and underpin our economies.

“More than half the world’s annual economic output depends on our planet’s natural resources.”

World Economic Forum, 2020

Around US$44 trillion, more than half the world’s annual economic output, is at risk because of the continued depletion of our planet’s natural resources, according to the World Economic Forum. The UN Convention to Combat Desertification (UNCCD) found that humans have already degraded up to 40% of the earth’s land surface and altered 87% of the oceans.

The populations of mammals, birds, amphibians, reptiles and fish dropped by an average of close to 70% between 1970 and 2016, reports the UNCCD. Highlighting the close ties between climate change and the wellbeing of nature, the UN’s Intergovernmental Panel on Climate Change estimates that one in ten terrestrial and freshwater species is likely to face a high risk of extinction if global temperatures rise a further 2C°—the limit set by the Paris Agreement.

Environmental agencies, governments and regulators are increasingly raising the alarm about the rapid degradation of our natural environment. And they’re looking to businesses in all sectors to help halt the destruction of nature.

As yet, few companies have risen to the challenge.

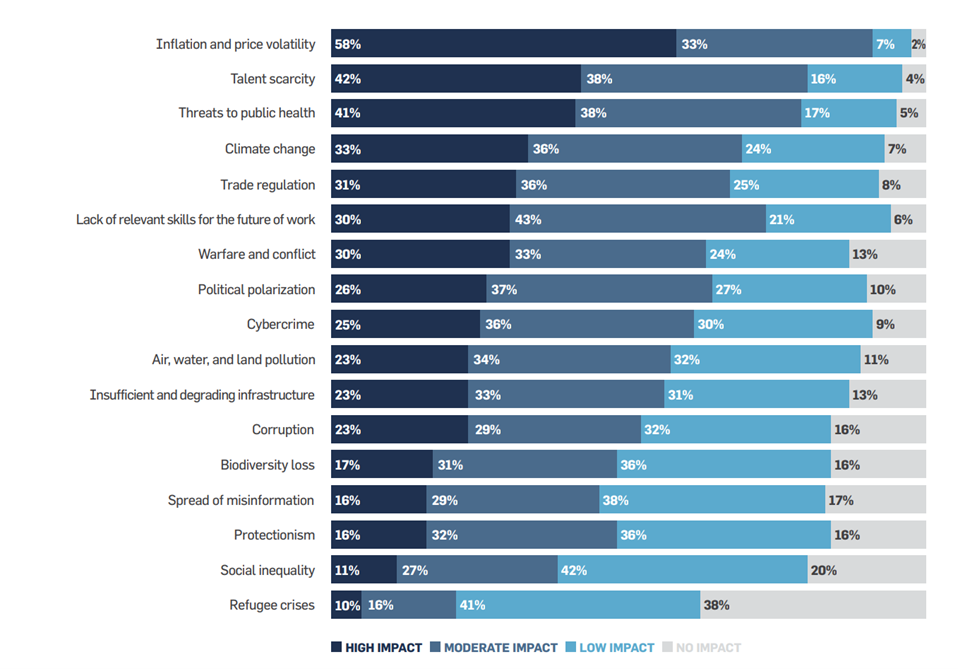

Our research shows that nearly all CEOs now believe tackling sustainability is key to their jobs. However, only 17% acknowledge their companies’ dependence on nature and see biodiversity loss as a serious threat to their businesses. Similarly, in a study with the UN Global Compact, we found that 80% of CEOs recognize that their businesses impact biodiversity. Yet just 35% are attempting to remedy potential damage to the environment by embarking on projects to protect or restore nature.

Top challenges facing CEOs in 2023

Click/tap on image to enlarge. Source: United Nations Global Compact-Accenture CEO Study

Financial services firms are ideal candidates to become standard-bearers in a global campaign to protect nature and ensure the wellbeing of our planet. Not only do they possess substantial economic influence and significant resources. They also have considerable risk exposure to nature because of their funding of nature-dependent industries such as agriculture, transport and food processing.

To expand their sustainability strategies, so they can become nature-positive as well as net zero, financial institutions need to embark on initiatives that encourage both biodiversity and bio-abundance. Risk controls and frameworks that already monitor their impact on the climate should be extended to accommodate factors related to nature. Furthermore, methodologies and incentives used to encourage the funding of climate-friendly companies and projects could be adapted to promote the allocation of capital to nature-positive enterprises.

The Task Force on Nature-related Financial Disclosures (TNFD) is currently drafting a framework that will help providers of finance identify nature-related risks and opportunities. Similar to the framework devised by the Task Force on Climate-related Financial Disclosures (TCFD), the TNFD document is intended to encourage the flow of global capital away from applications that threaten the environment towards investments that support nature.

The TNFD framework could become the blueprint for nature-related financial disclosures

The TNFD is due to release the first version of its nature-focused framework in September. This will, among other things, help companies align their biodiversity reporting with best practices and assist them in identifying nature-related dependencies, risks and opportunities. It will also provide companies with a guide to incorporating factors related to nature into their governance, strategy and risk management as well as their credit and investment decision-making.

Disclosure of nature-related risk is yet to become mandatory. However, regulators and government agencies are likely to require such disclosure soon. The TNFD framework may follow the example of its TCFD counterpart and become the blueprint for nature-related financial disclosures.

Already, the French government has included biodiversity disclosure in its climate legislation. Article 29 of France’s energy and climate law compels financial institutions to show how their businesses impact biodiversity and to disclose their exposure to risk related to nature.

The European Union’s recent Corporate Sustainability Reporting Directive (CSRD) now requires companies in member states to audit information they report about biodiversity initiatives that address, for example, land and water resources. The mandate moreover includes details of climate action as well as social initiatives, diversity programmes, anti-corruption measures and human rights projects. The Kunming-Montreal Global Biodiversity Framework, drafted in December at the UN’s COP15 conference in Canada, is also likely to spur further biodiversity regulation. As many as 150 financial services companies called on governments around the world to adopt the framework which comprises, among other things, biodiversity conservation and restoration targets.

Financial services firms shouldn’t wait for regulators to prompt them to incorporate nature-related exposure into their sustainability initiatives. The time to act is now. Banks, insurance companies, wealth managers and other allocators of capital have a critical role in safeguarding our planet for the benefit of all its inhabitants.

I would like to thank Jay Barrymore, Global Sustainable Investment Lead at Accenture, for his contribution to this blog post.

If you’d like to learn more about how banks can expand their sustainability strategies to encompass nature-positive initiatives as well as net-zero goals, I’m keen to hear from you. You can reach me here or on LinkedIn.