Reignite human connections

Creating value for your bank is at the heart of our partnership, so bringing you relevant thought leadership and research is important to us.

Our latest Banking Consumer Survey report draws on a survey of approximately 2,500 UK bank customers highlighting what today's customers look for in a bank. We found that digital channels are struggling to build strong relationships with customers—and that customers of all ages still see real value in physical branches and personal conversations. These touchpoints are particularly powerful in times of rising rates and persistent economic uncertainty.

With 95% of interactions now of a digital nature, convenience is a must, but delivering attractive, easy-to-use journeys through brilliant design is the differentiator. Nevertheless, many banks still struggle to bring great design principles and approaches to give consumers what they get from other brands.

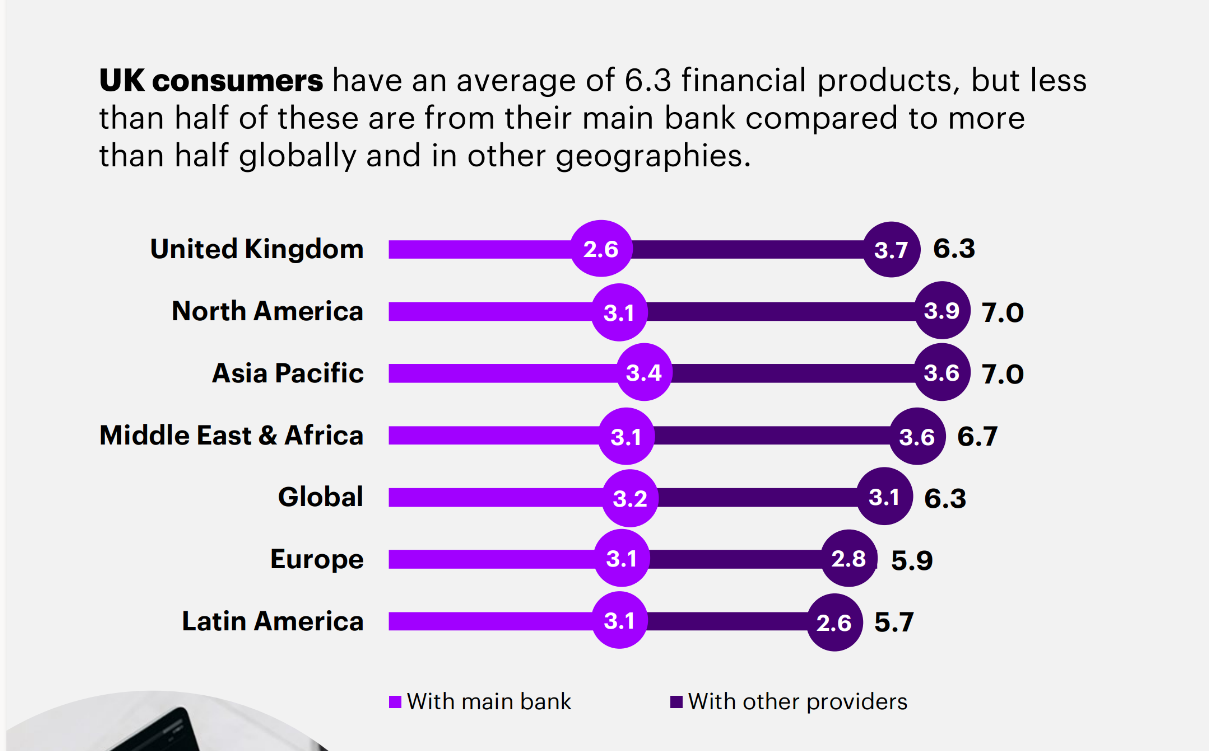

UK consumers have an average of 6.3 financial products. However, less than half of these are from their main bank compared to more than half globally and in other geographies.

Click here to download the infographic

The report also identifies how banks can capture untapped revenue by transforming their service channels to improve customer interactions and offering more relevant products and services to meet consumers’ evolving financial needs. Our modelling shows that this could boost revenue from primary customers by up to 21%.

Thank you.

Stuart

Stuart Chalmers

Managing Director, Financial Services & Co-Lead, Accenture Scotland

Get in touch to discuss what these findings mean for your bank.

You can find the full report here.

To discuss the report findings click here so we can arrange a meeting.

Discover more banking insights

Banking Technology Vision

In the next 3 to 5 years, banking executives anticipate dedicating 65% of their organisations' resources to AI.

Banking | Cloud Altimeter Volume 6

Banks have nearly doubled the percentage of their workloads in the cloud. For core functions, they have more than doubled.

Global Banking Top 10 Trends

In 2023, a confluence of factors, such as rising rates, is driving many banks to reconsider their core systems.

Finding success with BNPL: strategies for banks

One in 10 consumers would be more willing to adopt BNPL if their primary bank provided it.

Contact us to discuss the implications of any of these reports for your bank.