Banking

Cloud

Volume 3

Altimeter

Is your bank's

culture limiting the

value of cloud?

“Banks train people and tech companies hire them away.”

Mike Abbott

Senior Managing Director - Global Banking Lead

“It’s a talent issue from the

C-suite down.”

Dr. Bridie Fanning

Managing Director - Talent & Organization,

North America Banking Lead

FOREWORD

Is your bank’s culture limiting the value of cloud?

We know that more than 90% of banks have moved at least some of their workloads to the cloud. However, a new multi-sector survey by Accenture has found that 65% are failing to capture all the value they expect.

Why? The major roadblocks, it seems, are the people and change dimensions of cloud.

In the first two volumes of the Banking Cloud Altimeter, we talked about what it means for a bank to be operating in the cloud and the journey of choosing an end-state cloud environment. Like most banks, we focused on the technology. Without a doubt, this is a critical factor—but it’s certainly not the only one.

Dr. Bridie Fanning, Managing Director for Accenture Talent & Organization, sums it up neatly: “The banks that are getting cloud right are those that are prioritizing not only the technology but also focusing on their people, culture and skills.”

In recent years, and particularly during the pandemic, some banks have transformed themselves and become, essentially, technology companies. And yet capturing value from the cloud is not just a technology challenge. To operate effectively in the cloud, and to become the agile, innovative, high-speed organization that cloud enables, requires different skills and a different organizational culture.

This will become increasingly true as banks migrate more and more of their workloads to the cloud and as the cloud spectrum becomes increasingly complex.

One key to getting there is having a clear communication strategy. Take an honest look at your organization by answering this question:

To what extent do you agree that leaders in your organization set and clearly communicate strategies that support future business growth via cloud?

Employers of all descriptions are competing for cloud skills, and firms that can offer a conducive culture and work environment—like tech companies are known for—will have a decisive edge.

So, the key take-out from the survey’s findings is that successful banks put people at the center of their cloud transformation. Cloud skills are just as important as implementing the technology. Equally critical is a workplace culture that, as in many tech companies, fosters continuous learning and collaboration.

Our featured content in this third volume of the Banking Cloud Altimeter explores this issue in greater depth. We’ll hear from Accenture experts about the human-tech disconnect, why it’s such an important part of the cloud journey, and what can be done to remedy it.

We also look at what makes a Cloud Champion—companies which on average achieved 60% greater value from their investment in cloud than their peers. Specifically, we explore what these companies do differently to support and enable their people to maximize the impact of cloud.

In this volume’s industry Q&A, we sat down with Simon Cooper, digital transformation expert, and former CIO to discuss how banks are handling the transition to cloud, where they need to improve their culture, and why banks need to be moving even more quickly to cloud.

INDUSTRY Q&A

Simon Cooper is a digital transformation expert, previously the CIO of a leading global investment bank where he was responsible for a large reengineering program, driven by multiple mergers, that predominantly used cloud-based technologies. He is currently an independent consultant to Accenture and other companies.

Most legacy banks have a complex, very integrated technology architecture built up over the last 40 years. This is underpinned by many different technologies, designs and software development approaches. Challenger banks starting from scratch can leverage modern technology faster than established players. The challenge for legacy banks is: How do you change the parts on a moving vehicle when the moving vehicle is very complex and expensive to unpack? The people doing it successfully have figured out a cohabitating architecture that allows mature technology to interact with new technology.

Thinking about how you satisfy regulators is very tricky. Banks are subject to stringent conduct, security, data and privacy rules. The bigger and more global the bank, the harder it becomes. One of the big advantages of the cloud is that it gives you a global reach architecture where you can satisfy the highest bar in terms of those regulations.

I think we will get to less monolithic systems. The concept of service-oriented architecture—software as service providers—will come to the fore. We’re going to see banks with an overall orchestration layer that enables you to plug in many different services at the same time. In addition, banks will be able to expose their services digitally to their clients and other banks, further driving improvements in efficiency and client service.

Cultural change absolutely is an imperative. Banks are generally nervous about the concept of public cloud because of financial regulations. You’re only increasing risks. That said, I think everybody recognizes the need to move to the public cloud. Challengers are doing it, and they can offer services at better price points. Cultural change will happen. We’re coming off an era where tech organizations were made up of lots of specialists—in programming, in business analysis. That old model doesn’t work in a modern engineering world of continuous integration, continuous delivery. You need people with a much broader range of capabilities. That’s the biggest cultural change, figuring out how to get people to embrace the new world of DevOps. They’ll feel more fulfilled seeing a faster time to market and growing their skill set.

The pool of people who have knowledge of the new tech paradigm but also have knowledge of the financial industry is pretty small. It’s imperative to find leaders who can draft people but also organically grow their own people. That’s what leaders are struggling with now: organically transforming the incumbents.

The speed needs to increase. Incumbent banks need to speed up their change so as not to lose market share. They still have global reach and huge scale on their side, but the onset of cloud and the associated software and engineering capabilities are really reducing the point of entry for new challenger banks.

I don’t 100% agree with the phrase: “We’re not a bank; we’re a technology company.” Everybody is focused on technology. Tech is the No. 1 enabler to bring business value. I think of it like this: I’m a bank, but I know that the way I grow revenue and increase my margins is through the intelligent implementation of technology solutions. Therefore, technology should be a much bigger part of business strategy than it has been in the past.

Blockchain and the whole concept of tokenization of assets will revolutionize the way banks operate. But to operate efficiently, blockchain is entirely dependent on cloud-based technology. We’re in the very early days. APIs—application programming interface software that allows applications to talk to each other—is an area that’s also in its nascent form. It will have a seismic impact in the future. For example, a customer could see their custody positions directly through an API, without calling up someone to send reports, or logging onto a portal. And third, the whole cloud-related artificial intelligence/automation space will help banks be more efficient and massively improve client services.

We’ve only just scratched the surface in terms of what’s possible. Figuring out how to organically transform from the old world to the new in a way that doesn’t grind organizations to a halt, that’s the thing that will make organizations really successful. That’s where companies like Accenture add value. They see successes and failures across wide-ranging landscapes and can help banks understand how to make that transition successfully and at pace.

FEATURED CONTENT

A successful cloud journey demands new digital skills and culture changes

As banks manage the transition to cloud, one thing is becoming abundantly clear: the most successful banks look more like technology companies every day. Digital transformation is taking center stage as traditional banks adapt to a new reality in which customers demand to be able to bank with ease, anytime and from any device. This is a world where banks are in constant competition with fintechs and tech-first companies, like Amazon and Apple, not only for scarce skills, but for customers too.

But while the most successful Silicon Valley technology companies enjoy the benefits of a culture of speed, agility and continuous learning, many banks are struggling to achieve similar results. The reason, as Accenture’s new cloud survey shows, is the difference in their people practices, and their approach to learning. This difference is apparent not only in comparisons between banks and tech companies, but also between leading adopters of cloud in the banking industry and those in industries that have progressed further in their journey to cloud.

The banks that will succeed in pulling away from the pack and realizing the full benefits of their migration to cloud are those that not only have a cloud strategy that is closely aligned with their business strategy but are also investing in talent and rethinking their workforce culture. As Dr. Bridie Fanning, Managing Director for Accenture Talent & Organization, explains: “A new approach to workforce practices is the catalyst that releases a wealth of cloud benefits that otherwise remain trapped and out of reach. It’s a game-changer.”

This is confirmed by survey findings. The research identified an elite group—comprising 25% of the banking and capital markets sample—that achieved consistently better outcomes from their cloud program. They reported the following compared to banking and capital markets firms as a whole:

- A much greater improvement in organizational agility and innovation (32% vs. 20%);

- More impressive cost savings (21% vs. 12%);

- Improved customer experiences (43% vs. 27%);

- And a greater acceleration in cloud migration (39% vs. 25%).

These Cloud Champions excel across five areas: talent, leadership, culture, operating model and governance. Each is a lever that helps them support human potential and unlock cloud value across the enterprise. In order to succeed in these areas, banks should adopt a three-pronged approach that we call the Three As, focusing on alignment, ability and adoption.

The three As

Alignment: Break down silos and collaborate

For many banks, the cloud environment which leaders believe they’ve created, and the daily reality experienced by employees are two separate things. To become a leader, banks need to first ensure that the C-suite is in agreement with regard to the company’s cloud ambition, strategy, priorities and trade-offs. They need to communicate these to everyone in the organization, fostering a culture that is more open, fluid, collaborative and innovative. In particular, they need to encourage collaboration between IT and the business to lead the cloud transformation.

It also means dismantling some of the hierarchy that constrains interaction, empowering employees to take more risks, and using cross-functional teams to bring the strategy to fruition. Because banks operate in such a highly regulated environment, they are accustomed to reducing risk, double- and even triple-checking every crossed “t” and dotted “i”. They also create rigid silos, and sometimes silos within silos, which naturally limits information sharing across the organization and makes it less likely that employees will see and work together towards the big picture.

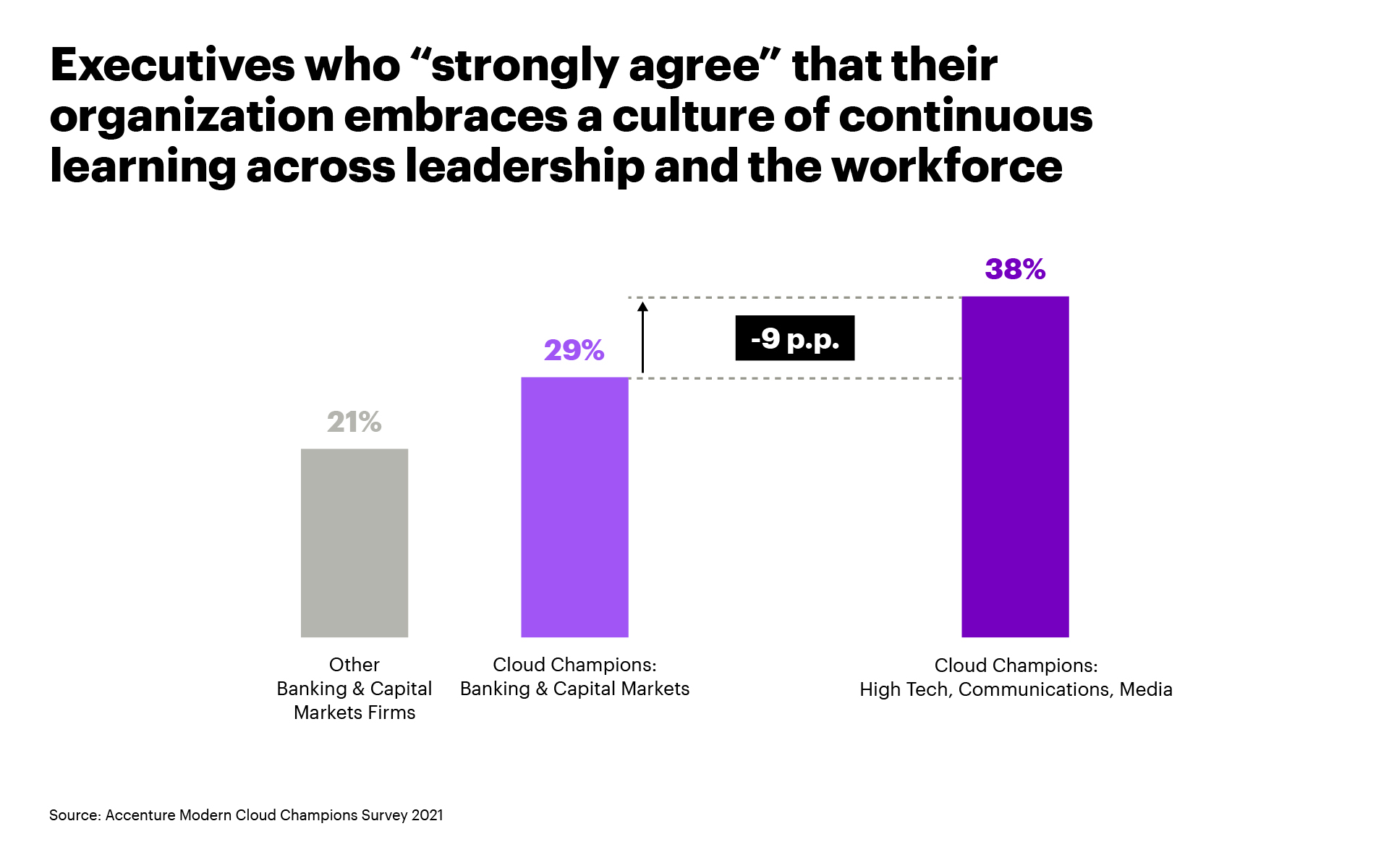

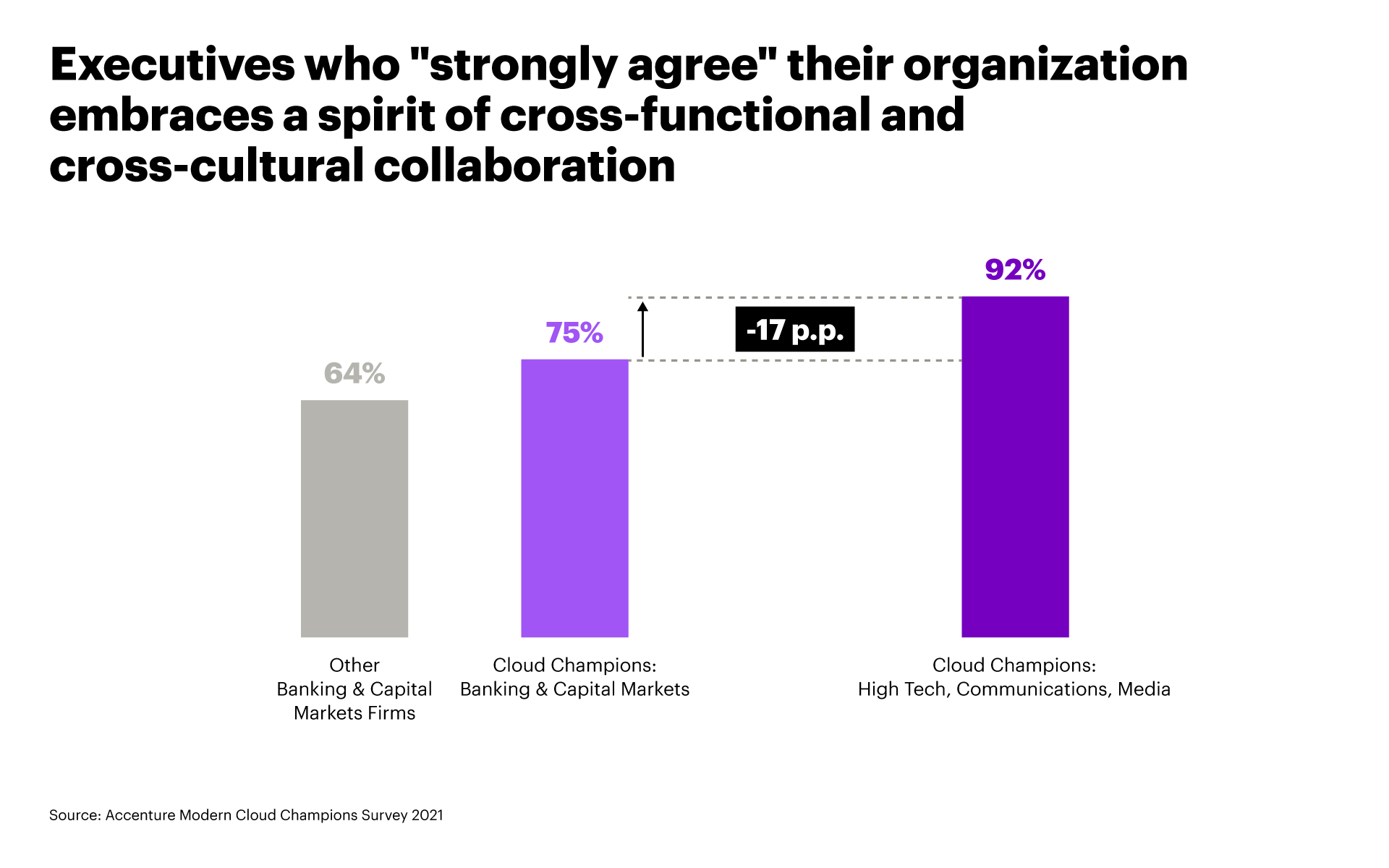

As illustrated by Figure 1 above, Banking Cloud Champions are ahead of other banks when it comes to a culture of collaboration, but they lag the Cloud Champions in most industries that are further along the cloud adoption curve.

The survey confirms that Banking Cloud Champions are significantly more committed to collaboration throughout the organization than other banks. However, compared to the Cloud Champions in those industries which have attained greater cloud maturity, they have some way to go in achieving effective cross-functional and cross-cultural collaboration.

New operating models combine cloud-based digital technology with agile ways of working. These models are based on frequent interaction between tech and product development leaders—all working together as one team. Banks that get the collaborative operating model right will realize the value of their cloud investments—faster.

It’s really important that leaders at all levels work to create this new environment. “It’s a talent issue from the C-suite down,” Fanning says.

Ability: Address the war on talent

The most significant driver of value from cloud is ability. This is confirmed by the survey finding that a lack of skills is one of the top three challenges impeding banks’ adoption of cloud.

The problem lies not with employees—50% say they are highly enthusiastic about acquiring cloud skills and 52% believe it would add value to their job. Executives are convinced they are tackling the problem—67% “agree” or “strongly agree” that their organization embraces a culture of continuous learning, and 53% say it has become “very” or “completely mature” in its ability to develop future talent at scale. And yet a shortage of skills continues to impede the ability of banks and capital markets firms to benefit fully from the potential of cloud.

As is the case with collaboration, Cloud Champions in industries that are more advanced than banking in their adoption of cloud generally have higher levels of “strong agreement” regarding the importance of a cross-enterprise culture of continuous learning, while those that lag in cloud adoption are less likely to prioritize learning. The correlation between cloud maturity and powerful workforce practices is a strong one.

Is your workforce ready and equipped to take advantage of all that cloud offers? Banks that hope to realize the full potential of their cloud journey must develop a strategy that explicitly tackles the current and future shortage of talent.

Banks that want to move forward in their cloud journey must address the reality that right now, there is a battle for talent with cloud skills. They’re attracted to the tech-first culture that is more appealing than what banks can typically offer. “Banks train people and tech companies hire them away,” says Mike Abbott, global banking leader at Accenture. “It’s a pressure cooker building up.”

Banks are especially vulnerable to losing the talent they have. The sectors that have been slower to adopt cloud are gaining fast. When they look to hire, they’ll look to the banking industry to poach skilled workers.

The skills shortage can be especially acute for banks still at an early stage of cloud adoption. To make things worse, it extends beyond cloud to data, security, automation and all emerging technologies that depend on the cloud. It not only causes cloud projects to be delayed, but also makes it difficult for banks to derive the full benefit from those projects that are completed.

How can banks close the gap? According to Fanning, the most successful banks create a constant pipeline of skilled workers by rethinking how they train employees. They offer one-on-one coaching, online classes, and virtual discussions to develop new technology skills. More importantly, they encourage employees’ innate curiosity and desire to grow, giving them the time, space, and support to seek out these growth opportunities on their own. This produces a workforce that not only has the requisite cloud skills but is also is generally more digitally savvy.

Figure 2. As with collaboration, Banking Cloud Champions are more committed to learning than other banks, but less so than the Cloud Champions in High Tech, Communications, Media companies.

Adoption: Embrace continuous change and a growth mindset

Some banks are making slower progress on their cloud journey than they had hoped. In many cases, this is because their traditional ways of thinking and doing business are not well suited to the rapidly evolving world of cloud.

“Banks, like most long-standing companies, have established practices that were designed to reinforce rather than transform the status quo,” says Nicole Crowder, Managing Director, Banking, Accenture Strategy & Consulting. “The challenge they now face is to change the way they work at the core.”

Most banks sincerely want to encourage a culture of continuous learning and a growth mindset. They provide tools such as the upskilling platform Degreed, but rarely use it to its full effect. Nor are they effectively using the data and technology they have at their disposal. Successful leaders not only embrace these opportunities, but also encourage knowledge sharing and data exchanges between team members, and they promote a commitment to personal growth. That means ensuring workers learn continuously on the job. There should always be easy opportunities to learn more and advance, so that those with the right ambition can grow—and recognize the value of staying with the organization.

In many banks today, policies and practices get in the way of the recruitment and retention of hard-to-find technical specialists such as full-stack developers, data engineers and cloud-security engineers. They often rely on dated job evaluation systems that are structured around job families and look at factors such as the number of direct reports, rather than focusing on expertise and skills—which are the new currency.

Banks today need to shift from a rigid talent management system to one that adapts continuously to work activities. Clusters of skills should be bundled and unbundled as work evolves. This shift will enhance business agility by facilitating the re-deployment of talent as the organization continuously evolves.

Successful banks are challenging every aspect of their workforce policy, from learning to performance management, as the world changes around them. “People practices at most banks have fallen out of step with the way the world works today,” Fanning says.

Crowder adds that banks that recognize they need to modernize and be more like tech companies will quickly outpace their competitors. “It’s like having a Tesla but not knowing how to use all of its bells and whistles. How much would productivity increase if they knew the car could drive itself? Banks say they have the modern tech they need, but their work practices must also change and grow along with cloud technology.”

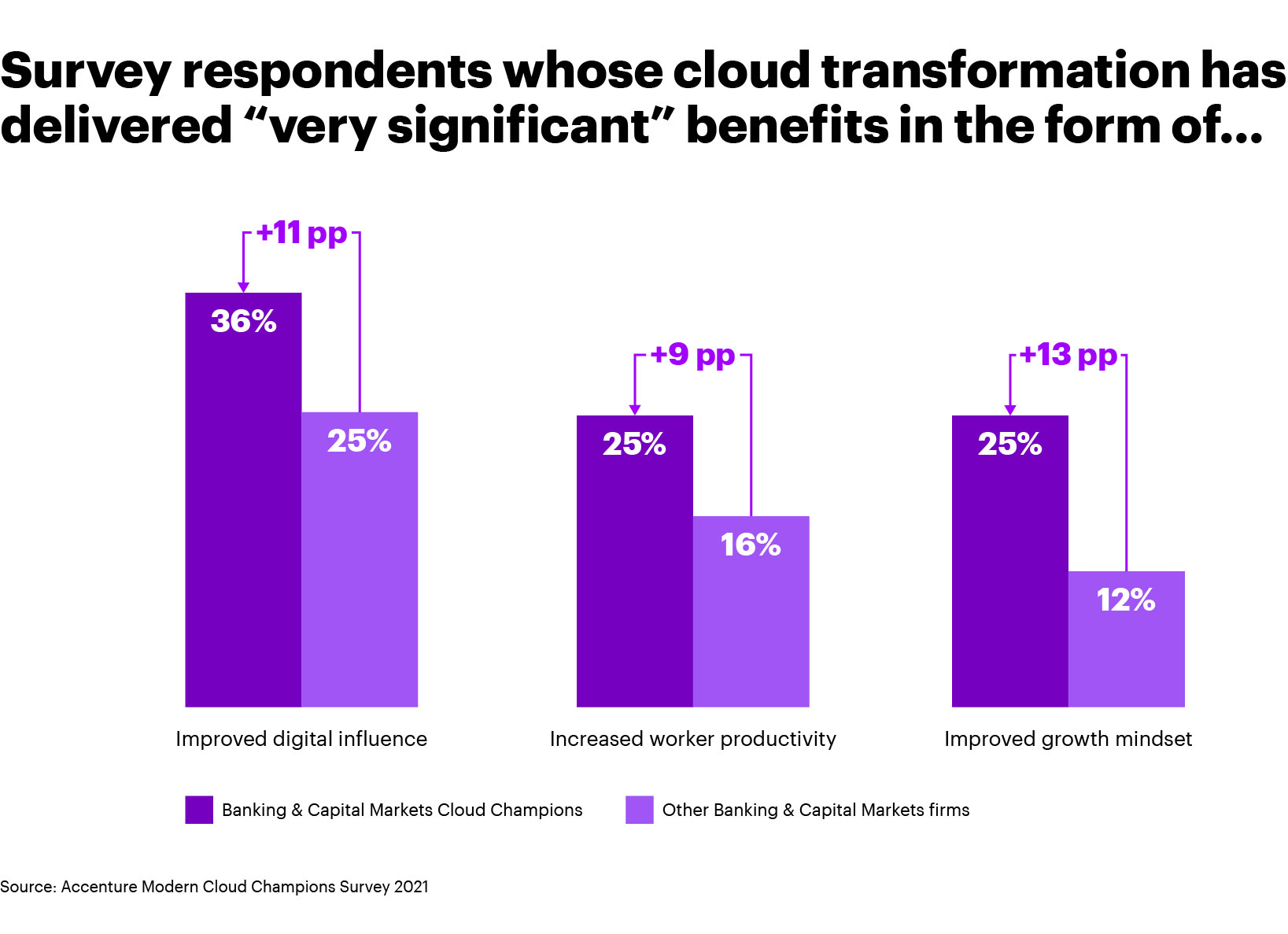

The business case for investing in people

There’s a strong business case for banks to invest in people throughout the cloud journey. Banks that do this effectively see greater workforce benefits compared to the overall industry, as highlighted earlier and illustrated by Figure 3.

Figure 3. Banking Cloud Champions enjoy greater workforce benefits from their people investments than other banks.

A good example of getting it right

Accenture recently helped a global financial services client unlock the true value of cloud by focusing on its people and culture. The company, with some 20,000 people within its technology function alone, embarked on a multi-year transformation program with cloud at its heart. There was a clear focus on the technology, but the firm lacked the necessary skills and culture for a successful transformation.

“Many companies are investing heavily in their technology capabilities, but they aren’t able to realize the return on this investment because there isn’t enough of a focus on their people and culture,” said Cengiz Besim, an Accenture consultant who led the program’s Culture & Behaviors workstream.

The company’s leaders thought they were doing well. However, when we carried out a culture diagnostic, it showed their employees disagreed. Although there was a sense of a “family-like” culture, with an intention to do the right thing, there were rumblings within the ranks that it was difficult to get decisions approved quickly. People were afraid to be proactive and there was a feeling that “death-by-consensus” was a prevalent barrier to getting things done. Departments were siloed and there was a fear of stepping out and speaking up. Ben Tulloh, an Accenture consultant and leadership subject-matter expert on the project, summed up the problem: “You can implement technology successfully, but if your people aren’t motivated and capable of applying the right behaviors to adopt it, you won’t unlock its true value. This is especially true when it comes to cloud.”

The pair worked with global and regional leadership teams to develop interventions that addressed the cultural pain-points they had uncovered. They focused primarily on leadership, working to address the perception gap between them and their employees. They also helped remove hierarchies so employees could be more proactive and accountable. One example included a UK-based executive with a team that was overwhelmed with weekly tasks and activities. Besim and Tulloh applied behavioral science methodologies to co-create new team habits and behaviors—many of which were simple but effective, such as a prioritization exercise where leadership and their team members would agree to a maximum of three primary tasks each week to be completed before three more tasks were taken on. The leaders said that their teams became more productive. Through other interventions, workers—once fearful of disapproval—started speaking up with ideas and solutions, using all the technology at their disposal.

The banks that are getting cloud right—the Cloud Champions—are focusing not only on technology, but also on the people who make the technology work. They’re doing this to speed up product innovation and improve the customer experience—to further the strategic goals of the organization.

Related blogs

Banking’s cloud imperative: Succeeding in an altered landscape

Although Asia-Pacific banks have outperformed global peers in recent years, they’re dealing today with challenges including an uncertain economy, under-pressure balance sheets, competition from digital attackers, declining cost-income ratios and a low interest-rate environment.

People will help banks

win the race to the cloud

Bank leaders with successful cloud migration, recognize that people and ways of working will either be catalysts or obstacles for any tech transformation.

Just as the cloud is the answer to unlocking value in your business, your people are the answer to unlocking value in the cloud.

Introducing Banking Cloud Altimeter, an inside guide to banking in the cloud

Accenture’s global banking industry lead, Mike Abbott previews The Banking Cloud Altimeter. Volume 1 profiles 100 global banks and provides a snapshot of where they are in their journey to cloud across four key functional areas: Enterprise, Data & Analytics, Surrounds and Core.

OTHER VOLUMES

Banking Cloud Altimeter

Our digital magazine compiles the latest developments in cloud banking.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 624,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities.

Visit us at www.accenture.com.

For more information on Accenture Banking Cloud Services visit: www.accenture.com/BankingCloud

Have your own question?