Banking

Cloud

Volume 4

Altimeter

The great cloud

mainframe migration:

what banks need

to know

“While there are still banks that are hesitant about moving their core applications to the cloud, those that have made the decision are going all in. They’ve bought the business case and now they’re eager to reap the benefits.”

Michael Abbott

Senior Managing Director —

Global Banking Lead, Accenture

“Embracing the public cloud makes business sense. More and more, the public cloud is proving itself in financial services, especially when it comes to security and resiliency.”

Nicole Lanza

Managing Director —

Banking Cloud Lead, North America

FOREWORD

Mainframe operations are finally moving to the cloud

After years of saying it’s sure to happen, mainframe migration is finally here. Accenture's new survey confirms that banks are migrating their core functions to the cloud with a high level of commitment and the expectation of positive results.

Our survey of 150 banking executives across 16 countries focused on large banks that are planning to or are in the process of migrating their mainframe workloads to the cloud. The research found that tentative pilots and protracted rollouts are simply not in the playbook. In this fourth volume of the Banking Cloud Altimeter, we’ll explore this exciting push forward into a new beginning of core modernization, innovation and growth.

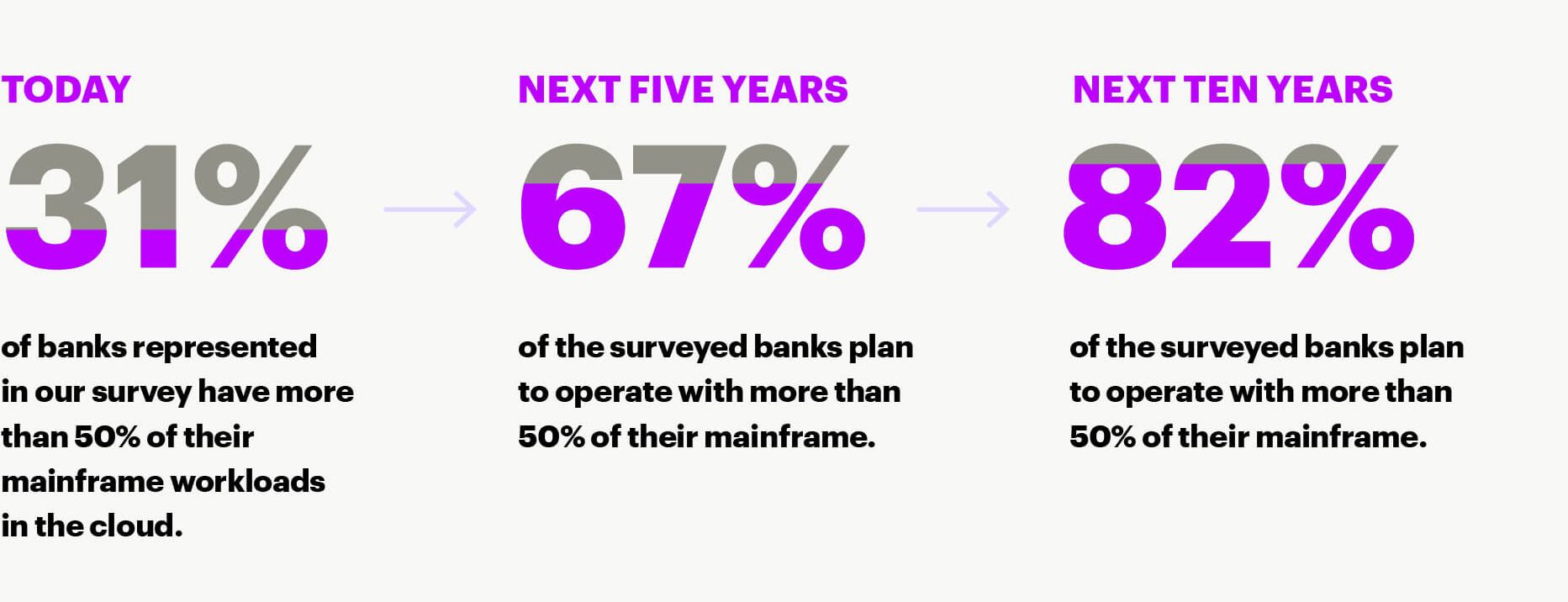

Eighty-two percent of the executives who participated in our survey said they plan to move more than half of their mainframe workloads to the public cloud. Almost 1 in 4 of the surveyed group aim to migrate more than three-quarters of their workloads. And the vast majority of these cloud disciples expect to achieve their targets in the next five years.

“While there are still banks that are hesitant about moving their core applications to the cloud, those that have made the decision are going all in,” says Michael Abbott. “They’ve bought the business case and now they’re eager to reap the benefits.”

Cloud delivers on its promise

At a time when banks are facing unprecedented competitive pressures, the cloud offers a means to respond forcefully. Banks are going all in on cloud mainframe migration because it gives them increased speed and agility, improved security and new capabilities that enable them to grow revenue. Seventy-three percent expect an internal rate of return of up to 15%, with 76% aiming to achieve this within 18 months.

In the first few volumes of the Banking Cloud Altimeter, we looked at what it means to be a bank in the cloud, explored different types of cloud environments, and discussed how banks can overcome the human-tech disconnect—a critical impediment to cloud success. In this volume we delve into “the what, the why and the who” of mainframe migration.

For many years, banks have been moving their operations to the cloud. They started with enterprise applications, data and analytics, and surrounds. Now that they have honed their abilities and dispelled their misgivings, they have their eyes firmly set on core functions.

As we explore the research findings, we reveal what banks believe are the biggest challenges—like finding workers with the right technical skills. We drill down into regional differences and the impacts of bank size, and help you assess your cloud plans against those of your peers.

Our Industry Q&A features Josh Glover, president and chief revenue officer of nCino. He shares how financial institutions are moving aggressively into the public cloud on an accelerated timeline—going live in months rather than years.

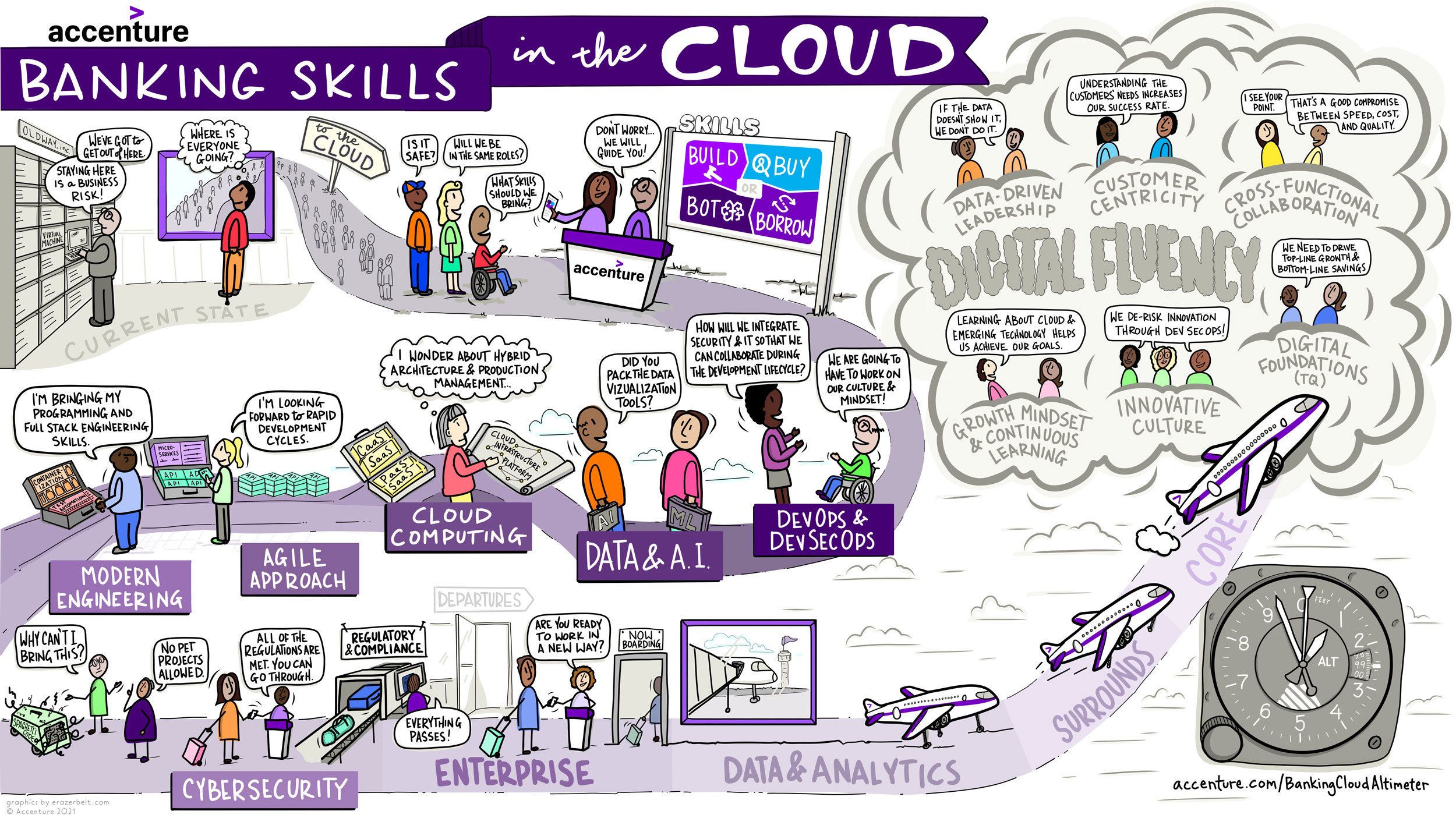

Finally, we offer a graphic illustration that delves into the banking skills your institution needs to gain cloud lift-off. Are your people ready to work in a new way?

As Josh points out, it wasn’t that long ago that banks were questioning whether they should even be considering the cloud; now they’re looking to migrate the very core of their business. The momentum just keeps on growing.

“Once banks solve the initial challenges, they become committed converts,” says Nicole Lanza. “Then the question shifts from ‘why move this to the cloud?’ to ‘why not move it?’”

Have you or are you planning to migrate your legacy mainframe systems to the cloud?

What share of your core systems are you planning to operate in the cloud?

When is your organization planning to reach its targeted mainframe migration to the cloud?

Planned mainframe migration to the cloud survey results. How does your organization compare?

INDUSTRY Q&A

Josh Glover is nCino's president and chief revenue officer, responsible for global sales, pre-sales, business development, channels and alliances, and marketing teams, in addition to leading nCino's business and operations.

Josh looks back at how banks’ perception of the cloud has changed since the early days and shares his view on what it means to them today:

-

Welcome, Josh. Can you first share a bit about nCino?We’re helping banks globally position themselves for a new future by digitizing and optimizing their critical operations in the cloud. When we started nCino in 2012, customers were still evaluating whether the cloud was something that the financial services industry would move towards.

-

Where are financial institutions in their cloud journey now?We see a real forced reckoning. Financial institutions began to understand that if they’ve been delaying digital transformation, they can’t continue to wait. And even if they’ve already begun the cloud journey, they’re figuring out ways to optimize and accelerate that. So today – we are not spending a lot of time talking to the market about why banks need to move to the cloud. We’re talking to them about how to move to the cloud. As partners, Accenture and nCino, have significant experience that has given us a proven point of view on that ‘how’ and we have jointly navigated great deployments with financial institutions who have been trailblazers. Those lessons learned position us to help others drive forward.

-

What has come as a surprise to business leaders navigating the cloud journey?

After the last two years, the benefits of the cloud are no longer hypothetical.

There will of course continue to be heavy market competition in how financial institutions engage with their customers, and how they compete for great talent. Two months before the pandemic, one of my customers told me that no self-respecting business would ever borrow money through the Internet. Fast forward a few months and almost every business in the country was scrambling for a Paycheck Protection Program loan, and the applications were submitted via mobile devices from people’s living rooms.If you’re in our space and you’re competing for technical talent, there’s never been more competition, and there’s never been more opportunity for employees.

-

What’s the biggest value proposition for banks in moving to the cloud?

Years ago, if you wanted to get on the cloud to do commercial lending, you would’ve had to potentially build something in-house. Now you can come to the table and get a packaged offering with nCino and go live in months, not years. That is a real paradigm shift. The benefits of the normalization of cloud are huge: overall flexibility and accessibility to integrate various solutions that streamline business processes and reduce risk.

Beyond the business processes, there’s a lot of untapped data that financial institutions have in the cloud. As they continue their journey, now they’re realizing that having all that data in one place gives them opportunities within their market that they didn’t know were there. It’s given them a lot more transparency into how their institution is running and where they can go forward.

-

Are banks and financial institutions moving through the cloud at the right speed?You have to take an aggressive but realistic view about how you can continue your business operations but achieve the business lift you want. Even at nCino, as we continue to grow, we modify our technical systems pretty quickly. If you don’t have the right experience and the right team that’s really strategizing how to drive the business change, you might not get the lift you want.

FEATURED CONTENT

What banks need to know about migrating their mainframe

Shifting core systems to the cloud is the new reality for banks

“After years of saying it’s sure to happen, it’s finally happening,” says Michael Abbott. “What we’re seeing is a paradigm shift.”

For decades, the financial services industry was a bastion for mainframe computing. Big iron offered not only the capacity and speed to handle the exceptional volumes associated with core processes, but also the resilience demanded by an essential service such as banking. However, as MIPS outpaced revenue growth and as mainframe architects and engineers became endangered species, these proprietary platforms became increasingly difficult and costly to sustain.

At the same time, banks were changing their stripes. These venerable institutions that were known for their prudence and conservatism were having to become agile, innovative, responsive and efficient. To an ever-increasing degree, their mainframes were starting to feel like millstones.

The uncomfortable reality is that mainframes’ highly complex, interdependent and tightly coupled architectures cannot address today’s business challenges—a fact that more and more banks recognize. The proof is in the research. Our recent survey of 150 executives at large banks that either plan to or are in the process of migrating their core functions to the cloud reveals that more than 8 out of 10 intend to move the majority of their mainframe workloads to the cloud. Within this group, 22% said they plan to move at least 75% of their mainframe workloads to the cloud.

Banks are clear and resolute in their planning: 82% of both groups are determined to meet their targets in the next two to five years.

Banks are planning to move an increasing share of their

mainframe workloads to the cloud.

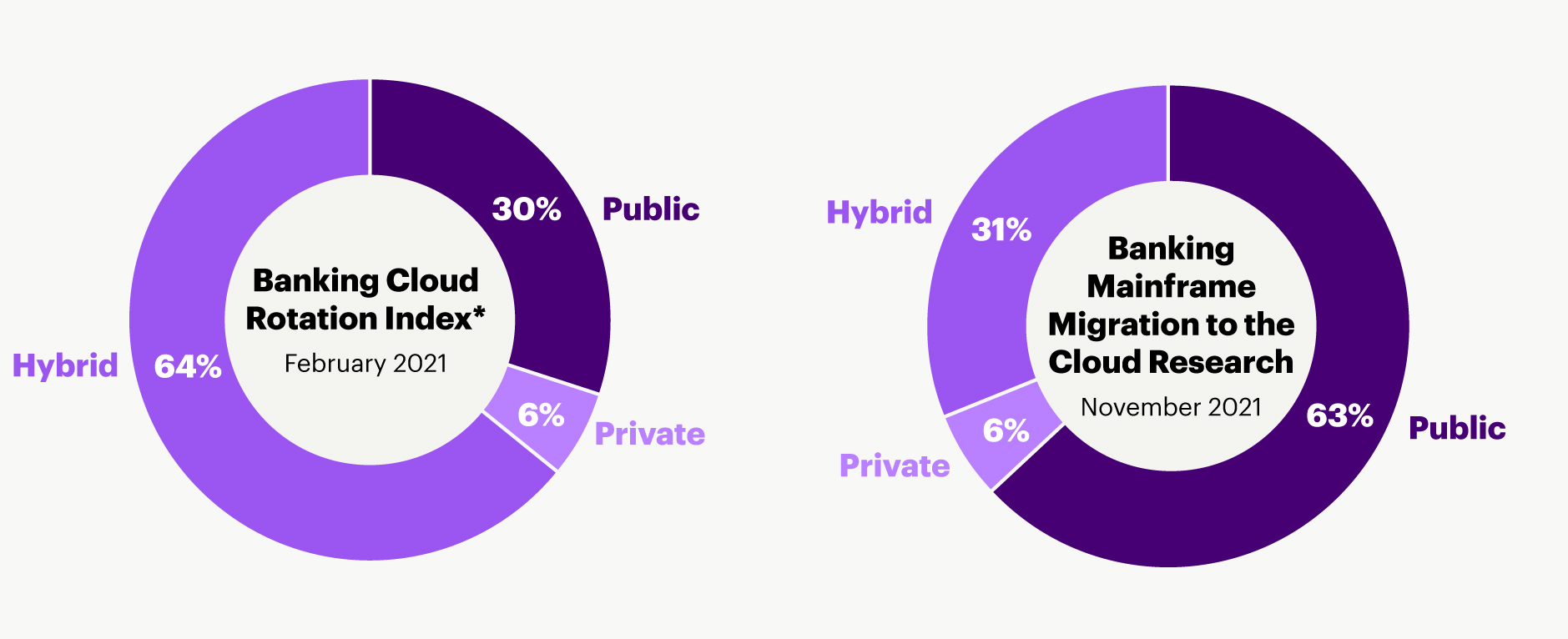

Banks go all in by opting for public cloud

The cost-efficiency, flexibility and regulatory compliance of modern public clouds, along with their experience of migrating non-core functions make it harder for bank leaders to justify keeping on-premise mainframes.

It’s no surprise, then, that as banks change their position on mainframes, public cloud has become the preferred option—63% of the executives surveyed said they planned to use primarily public cloud services, compared to 31% for hybrid cloud and 6% for private cloud.

According to our research, the preference for public cloud adoption has more than doubled in less than a year.

Preference for public cloud varies by region.

Percentage of respondents whose organization would primarily use the public cloud.

Embracing the public cloud makes business sense. “More and more, the public cloud is proving itself in financial services,” says Nicole Lanza. “Especially when it comes to security and resiliency.”

In recent years, to accommodate banks’ particular requirements, public cloud service providers have built many custom solutions for the industry—like AWS control tower, a compliance framework that monitors the cloud environment and helps banks achieve regulatory compliance.

They have also built resiliency into their public clouds and are able to offer banks unprecedented scalability.

In this video, Nicole Lanza discusses moving core functions to the cloud with Keri Smith, Accenture’s applied intelligence lead for financial services.

“Instead of having employees build and maintain the infrastructure and the whole stack, banks can rent ‘boxes’ as and when they need them,” says Lanza. “There’s a whole suite of services they can just tap into and use, in the same way that you’ve got a bunch of apps on your phone. This gives banks far more scalability and elasticity than they ever had with their mainframe.”

The business case is becoming irresistible

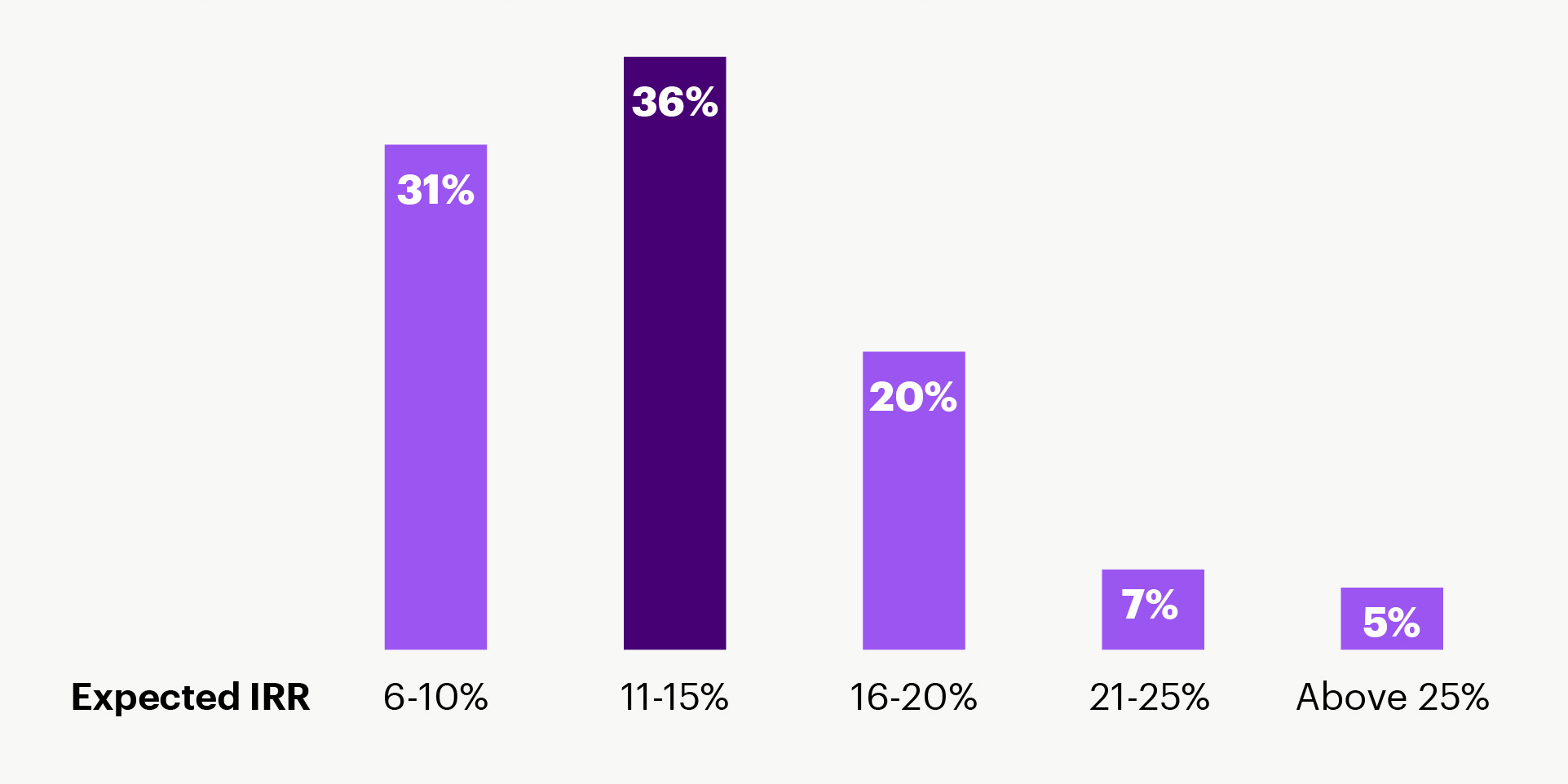

The argument for mainframe migration relies on public cloud’s technologies. The most important benefit is speed and agility—43% of the surveyed executives said this was a strong motivator. Security (41%), new capabilities for revenue growth (37%) and cost savings (31%) are other critical factors.

“The business case works; just look at the numbers,” says Rick Balon, Accenture's global lead for cloud migration and modernization design. “Work that we’ve done with a large international client in a different sector showed that instead of spending $50 million a year on a mainframe, they could get the same compute in the cloud for just $10 million.”

Numbers like these are making banking executives a lot more comfortable with the idea of moving their core functions to the public cloud. Of those who highlighted new capabilities for revenue growth as a strong motivator, 36% expect an internal rate of return of between 11% and 15%, while 32% are even more optimistic. And they’re looking to achieve their goals quickly—71% said they aim to recover their investment within 18 months.

Percentage of respondents who selected new capabilities for revenue growth as a strong motivator for adopting cloud.

In this video, Nicole Lanza and Keri Smith discuss how banks can get a strong return on investment with cloud transformation.

The barriers to migration are still significant

For those banks that are hesitant to move all of their core functions to the cloud, the two main concerns are the risk of disruption to the business and the complexity of the operational changes (which includes an inadequate understanding of the legacy core code). Forty-four percent and 42% of the respondents, respectively, rated these as significant or very significant barriers to moving their legacy mainframe systems completely to the cloud.

That’s not a huge surprise. Banking executives are risk-averse and moving the core business applications comes with risk.

“It’s complex stuff; it must be done right,” says Lanza. “But it’s a risk that needs to be taken. Banks that don’t make the switch face not only the risk, but the certainty of losing their competitive edge.”

There is a correlation between this risk and the complexity of the bank’s mainframe environment. The biggest contributors to this complexity are the lack of necessary skills and how core applications are integrated with other systems.

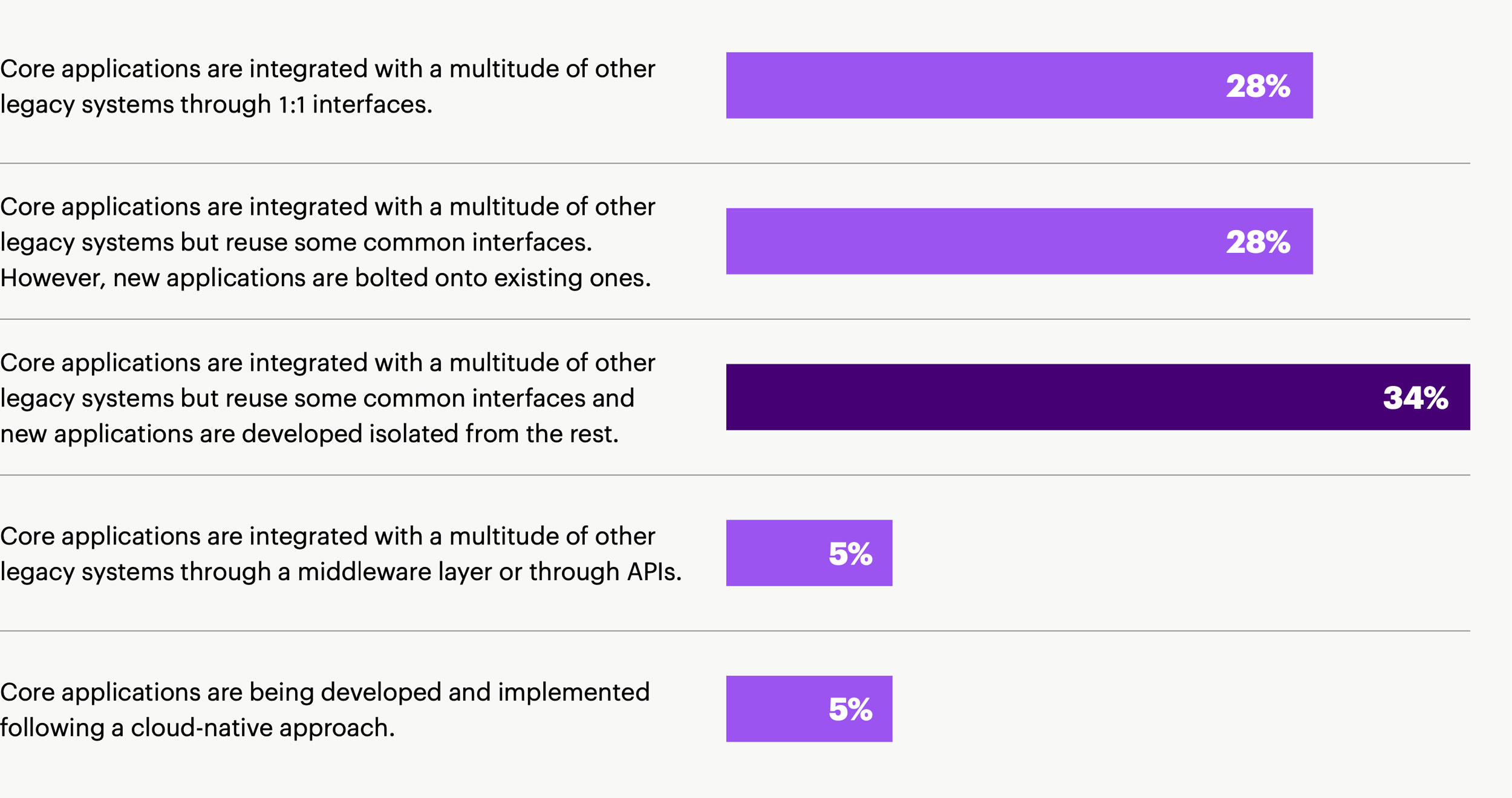

The way banks’ core applications are integrated with other systems can increase complexity.

Question: Which of the following statements best describes your organization’s core banking applications?

Almost 40% of the banking executives in our survey said their mainframes are more than 10 years old, and 41% are running 100 or more applications on their mainframes. Only 9% have stabilized their mainframe maintenance costs in the last few years; most have seen these costs increase, while none have seen them drop.

“This is not surprising, applications running on the mainframe are often old, have been maintained by numerous developers over the years, and are fragile,” says Balon. “One client estimated $1M every time they wanted to make the simplest of changes due to this fragility.”

Talent to the rescue

One of the main drivers of the shift to cloud is the imminent talent crisis confronting banks: most of the institutional knowledge required to keep their mainframes up and running resides within the heads of their tenured legacy code experts, many of whom are contemplating their retirement. The flip side of this is that to successfully navigate the barriers to migration and realize the full potential benefit of cloud, they also need specialized talent—which they lack. While the demand for both cloud technologists and cloud fluency across the organization is rising in banking and beyond, it can be addressed by hiring new workers, ‘borrowing’ them from consultancies and implementation partners, and reskilling and upskilling existing workforces. Replacing legacy skills presents much more of a challenge.

Our survey respondents said cybersecurity and cloud expertise are the technical skills most in demand. But the solution is not to clean house, bringing in only new talent. The veterans who have been working on the mainframe for years—many of whom are thankfully still around—play a crucial role in the migration and need reassurance that they are not about to be discarded. “Banks must bring these experts along on the journey,” says Lanza. “They’ll need their help with the transformation, and there’s a place for them once the cloud has been mastered.”

The banks that are getting cloud transformation right are focusing equally on the technology and the people who make it work—people with different levels of mastery of different aspects of cloud. Recent industry cloud research conducted by Accenture found that leaders who transformed their people along with their technology achieved an average 60% higher ROI on their cloud investments than those that focused solely on the technology. Dr. Bridie Fanning, Managing Director for Accenture Talent & Organization, explains:

“To get the most out of the cloud, a bank doesn’t need to turn every staff member into a software engineer. But it does need to build a network of cloud evangelists that extends across the organization, and that understands how the cloud can be leveraged to increase agility and competitive advantage. How it can drive value.”

The sketch below provides a visual summary of the technical and digital fluency skills required by the organization to realize the full benefits of migration to the cloud. You can also read more on this topic in Volume 3 of the Banking Cloud Altimeter: Is your bank's culture limiting the value of cloud?

In this video, Nicole Lanza and Keri Smith discuss how a bank's culture can be both a challenge and an opportunity for cloud adoption.

There’s plenty at stake for banks in this tectonic shift. But the benefits will be clear once the dust has settled. Banks that have already started to make the move to public cloud are now beginning to reap the rewards.

Source: Accenture’s Mainframe Migration to the Cloud in Banking research, based on 150 respondents across 16 countries

Source: Accenture Industry Cloud research

OTHER VOLUMES

Banking Cloud Altimeter

Our digital magazine compiles the latest developments in cloud banking.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world's largest network of Advanced Technology and Intelligent Operations centers. Our 674,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities.

Visit us at www.accenture.com.

For more information on Accenture Banking Cloud Services visit: www.accenture.com/BankingCloud.

Have your own question?