Banking

Cloud

Volume 2

Altimeter

Continuing the

banking journey

to cloud

FOREWORD

Continuing the banking journey to cloud

No question about it, banks recognize that the future of banking is in the cloud. But many banks are still struggling to figure out the right path. To help, in this second volume of the Banking Cloud Altimeter, an Accenture Cloud First publication, we’ll define five key characteristics of cloud computing and explore the different types of cloud environments. Moving to cloud is a journey that can look different for each bank as it weighs private, public or hybrid cloud options and which functions to move in sequence. There are also tradeoffs that banks need to consider as they evolve their cloud capabilities.

This volume’s Industry Q&A introduces Accenture newcomer and seasoned cloud strategist, Nicole Lanza. In our Featured Content section, we address strategies banks are implementing to deal with the complexities that arise along the journey to cloud. In related, cross-industry research, The Cloud Continuum, Accenture Cloud First recently explored how companies, dubbed Continuum Competitors, treat cloud as a new operating model to continuously reinvent their businesses using innovative multi-cloud capabilities.

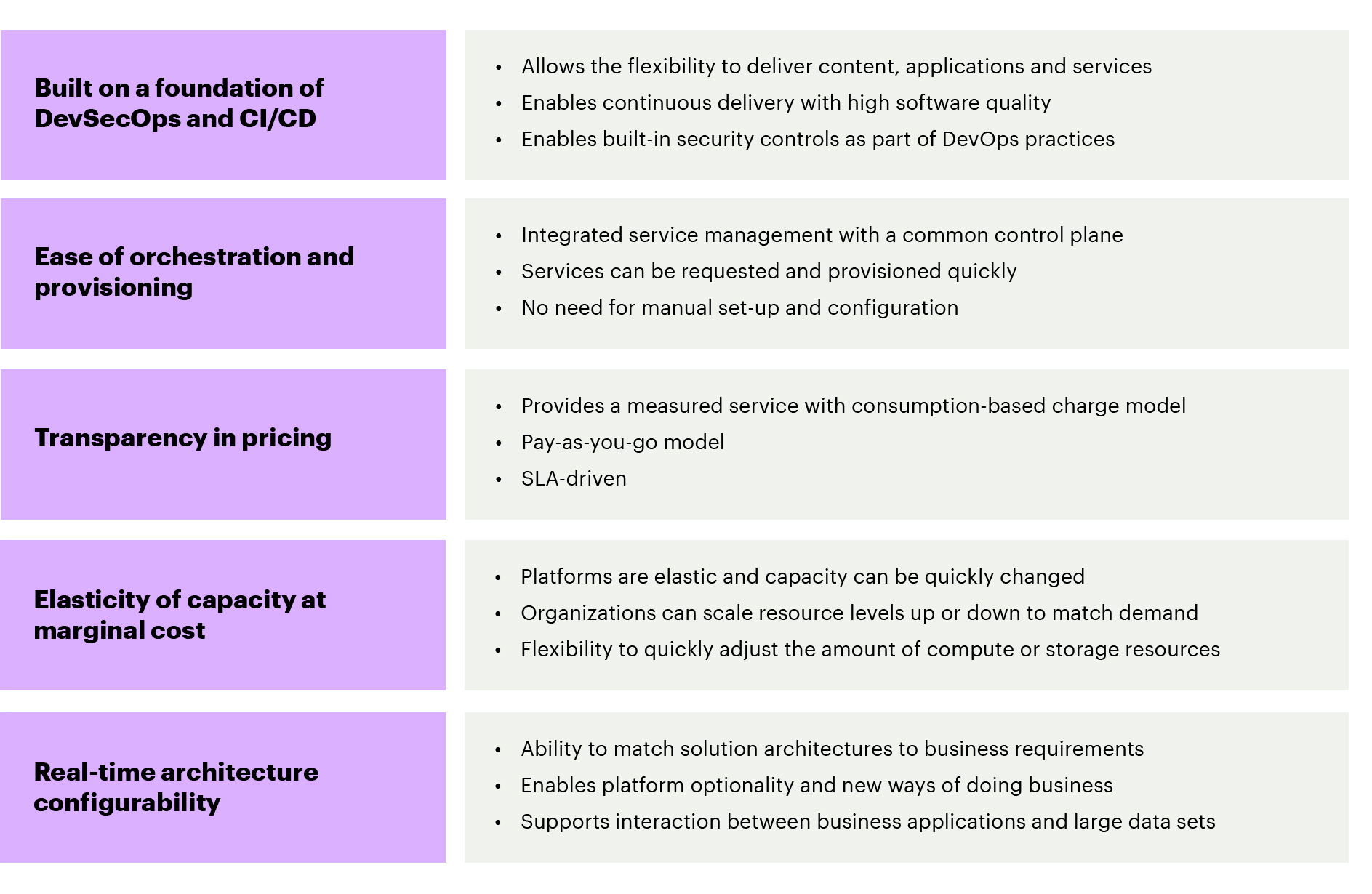

But first, let’s briefly revisit Volume 1 of the Banking Cloud Altimeter where we asked: “what does it mean to be a bank in the cloud?” While there is no definitive answer, one way to look at it is to back into the definition and think through these five key characteristics of a bank’s cloud computing environment:

- Do we have an IT foundation that allows for secure, continuous delivery of content, applications and services?

- Do we have ease of orchestration—i.e., no need for manual set-up?

- Do we have transparency of pricing, such as a pay-as-you-go model?

- Do we have true elasticity, including the ability to scale up or down to match demand?

- And finally, do we have data decoupled from applications and available for any business process or service which may need to consume it?

You need all five characteristics to be in the cloud, no matter which cloud environment you choose.

Cloud Characteristics

Ask our Cloud Crowd a question on these five characteristics.

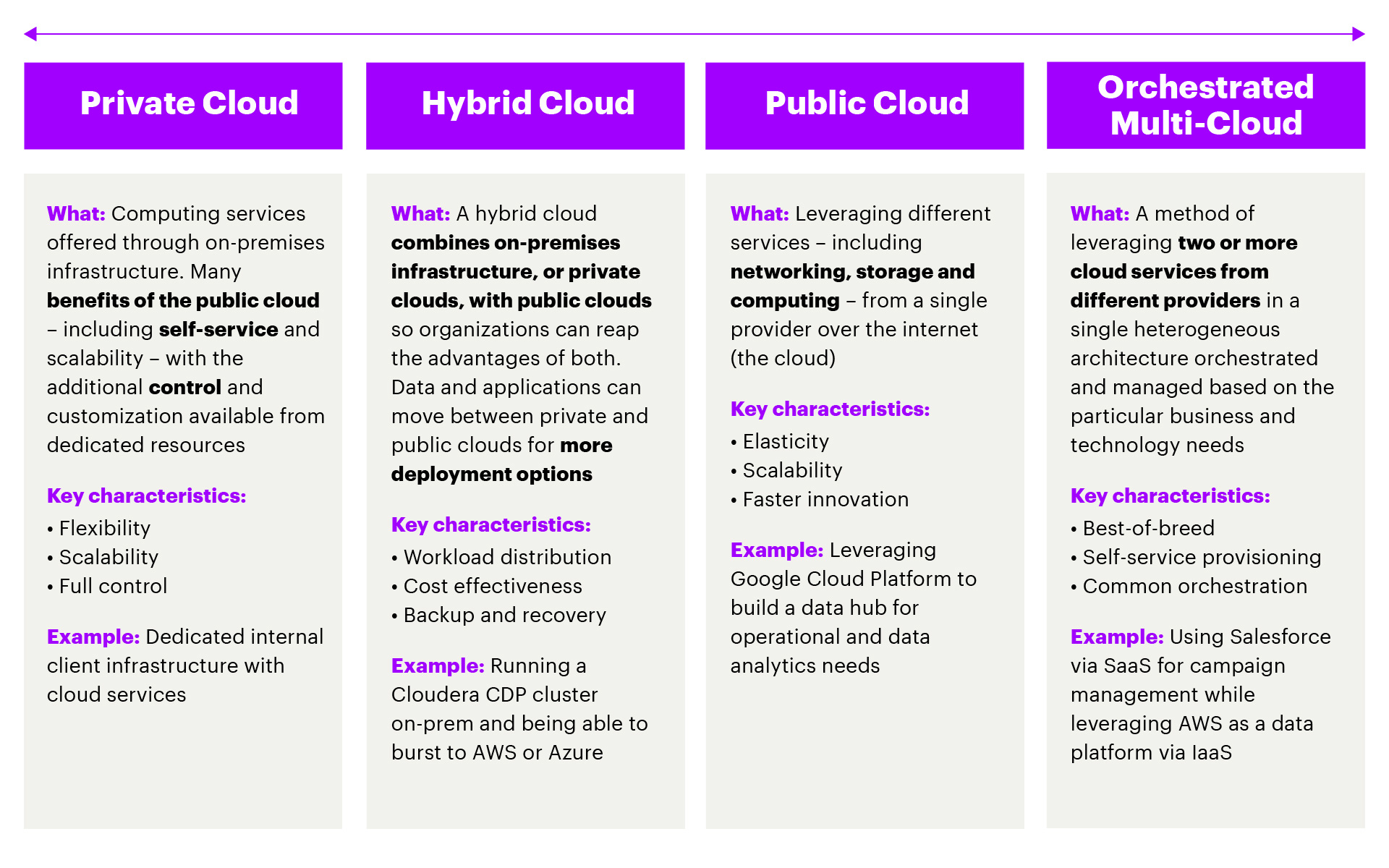

Cloud adoption has evolved to include various models or types of cloud environments: private cloud, hybrid cloud, public cloud and multi-cloud. Banks are building capabilities across that spectrum.

With private cloud, an organization runs its own self-contained data center with cloud services. You’re the only tenant. Private cloud is flexible, scalable and provides banks with full control.

With public cloud, by contrast, workloads are fully in an off-premises environment through a global cloud provider. Public cloud comes with a set of integrated services as part of the cloud platform offerings from global providers. There’s elasticity and room for faster innovation and, potentially, a more simplified operating environment and platform.

Hybrid cloud, the dominant model in use by banks today, combines the private (on-premises) and public (off-premises) models. Data and applications can move between the two environments, so banks can take advantage of the features of both. Hybrid cloud can be cost effective; it helps with workload distribution; and it offers backup and recovery options. Today, most banks are moving towards hybrid cloud because it gives them the greatest flexibility. But building, maintaining and operating in hybrid mode is not easy.

Another model is multi-cloud. With this option, banks leverage two or more cloud providers with a common orchestration / management overlay. That lets banks choose best-of-breed cloud services, depending on their business and technology needs and avoid the risk of “lock-in” with any one vendor.

Choose the Right Model

The key is figuring out the right model and roadmap for your enterprise. Many banks that are in hybrid cloud are looking to move 100% public to simplify their environment. Others are seeking more flexibility, so a hybrid multi-cloud solution provides this option. However, hybrid cloud can be extremely complex, so banks need to make sure they have the knowledge to manage that complexity.

Read on for advice from Accenture on how to manage your cloud journey, and how competitive banks are expanding their use of cloud for rapid innovation and business growth.

-

Welcome Nicole! Can we start off with you telling us a bit about your role and experience?

Thanks for the opportunity to talk with you today. I work with our banking clients on cloud transformation. Regulated industries present special challenges when adopting new technologies. I was fortunate to work for a large systemic bank in the US which was an early adopter of public cloud. We solved for the security, risk, and compliance requirements unique to banking, and unlocked big data, burst compute, and native development on public cloud. I now bring that experience to banks across North America. My job couldn’t be more fun.

-

As we move toward 2025, some say it will be really difficult for banks, even the largest ones, to justify maintaining an on-premises mainframe. Why?

There’s a special place in my heart for the mainframe. I have fond memories of connecting an ODBC driver to an AS400 at one of my first jobs out of college. But I digress… The mainframe has been at the core of banking for generations, but now it is having a “senior moment”. As banks are finding their path to cloud, the mainframe’s messy web of self-referential stored procedures and its use of unpopular programming languages appear to render it insufficiently agile for the speed of business today. Mainframe engineering talent becomes more difficult to hire with every passing year. With rare exceptions, high value talent is simply drawn to cloud—but we’re going to cover the people aspect of cloud migration for banks in Volume 3 of this publication in September, so definitely much more to come. As the major cloud providers begin to offer services purpose-built for the mainframe (in some cases with built-in banking controls), the business case for retaining the mainframe on-prem begins to erode. Working with one bank,

we are moving them closer to a 40% savings opportunity by migrating their mainframe workloads to cloud. -

In Volume 1 of this publication, our Banking Cloud Rotation Index profile of 100 global banks showed a mere 8% of workloads had, on average, been migrated. The core was identified as the most challenging and therefore would be one of the last key functional areas to migrate. Has anything changed in the way banks are approaching these functional areas since that survey in Feb/March 2021?

In just the few months since the publication of this survey, I’d say that 8% is probably now over 10%. The majority of banking clients I’m working with this quarter have enabled artificial intelligence/machine learning (artificial intelligence markup language) services for their firms, or are aggressively solving for this right now. Banks vary widely on the migration of surrounds. We are finding that once banks get comfortable with managing the risk of data in the cloud through their flagship data/artificial intelligence/machine learning use case, they consider the business case for migration of the core to cloud. The risk posture in banking wisely mandates caution. SaaS solutions for core banking are proving themselves worthy, and tools that ensure resiliency of core workloads through the migration are now available. It’s worth a close look.

-

Where do you think banks should focus their efforts right now?

As cloud data centers fill up, the window will close on the generous incentives offered by cloud service providers (the MAGs as we call them in Accenture cloudspeak). The business case for a move to cloud starting this year is likely to be more compelling than it will be a few years hence.

FEATURED CONTENT

Managing the complexities of operating in the cloud

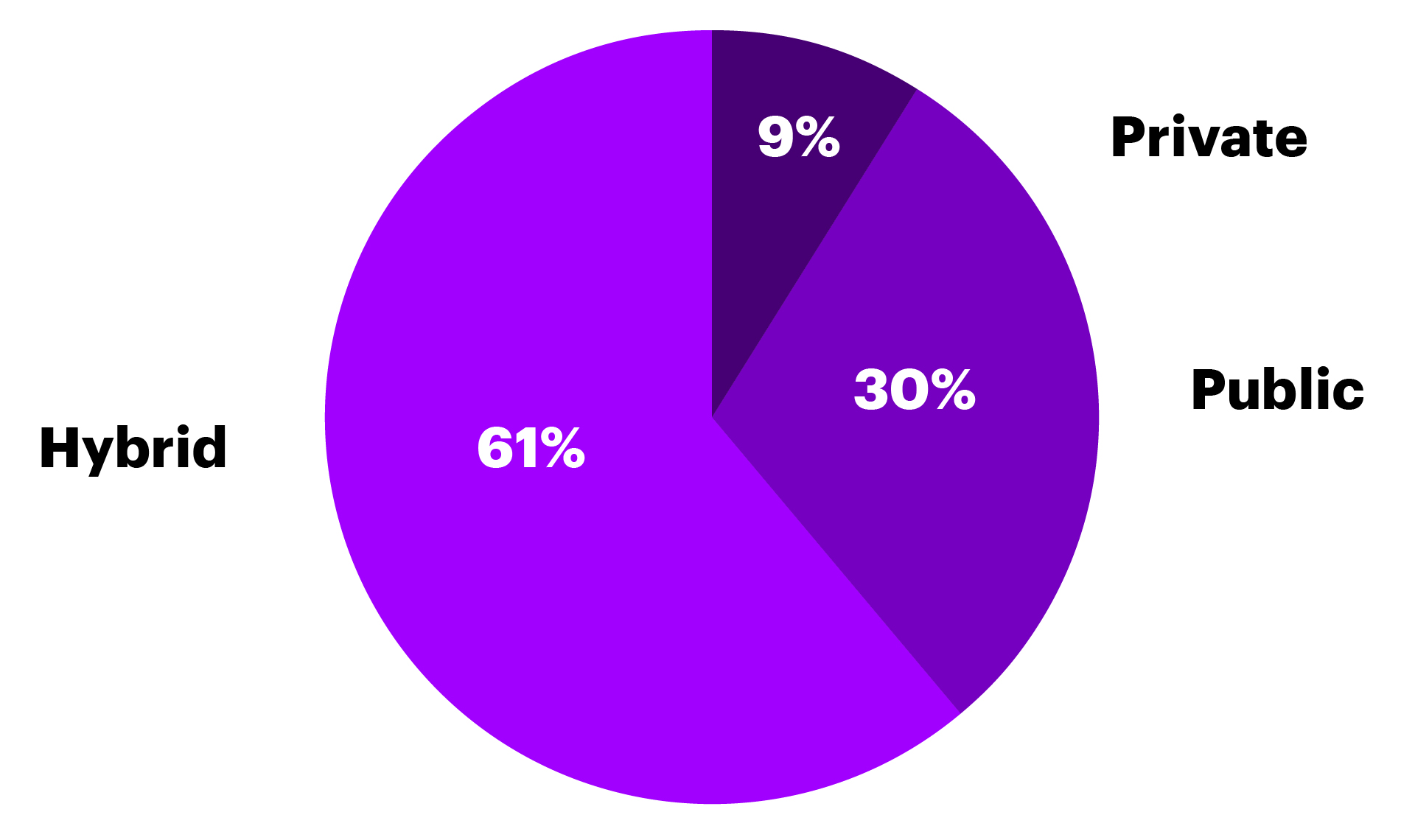

Banks recognize the transformative power of the cloud and the capabilities that come along with it. They’ve established cloud programs and selected their cloud service partners, and most are targeting their primary end-state environment as hybrid, with public gaining momentum.

But for most banks, migration to their end-state is still in early stages. Our research found that less than 10% of total workloads have moved to cloud, which means the heavy lifting has yet to occur. Given the intricacies around moving the core, this isn’t surprising, and if your target environment is public cloud, your degree of complexity just went up.

61% of banks have chosen the hybrid cloud as their primary end-state cloud environment.

% Respondents

Source: Accenture Banking Cloud Rotation Index 2021

Face the complexity head on

Why are banks struggling with the move to public cloud? There are two things standing in the way. First, there’s architectural complexity. For large banks, their legacy technology—the applications they’ve built up over many years—makes it difficult to untangle these complex systems and execute a large-scale move to public cloud.

Second, many senior technology executives believe it’s more cost effective to deliver services on private cloud. That’s true in many cases, but to compete against fintech providers, it’s increasingly important for large banks to move ahead fast. Early movers to the cloud are able to gain the speed to innovative services offered by public cloud providers.

Banks make decisions based on risk—and smart banks will consider the risk of moving to the cloud too slowly. Big banks are seeking to become much more agile. Fintechs are gaining market share in payments and mortgages because they’re innovating at a faster rate than legacy banks. Public cloud gives large banks access to a greater set of services and allows their development teams to move quickly. That’s going to mean choosing some applications and moving them rapidly into public cloud, while keeping everything else in a private environment under more cost-effective management.

While we expect to see larger banks in the hybrid environment for a long time, smaller and mid-size banks should be thinking of public cloud as the end goal—and soon. They don’t have the same drag as the big banks with their large, monolithic systems. They should try to buy, as opposed to build, wherever they can. For smaller banks, a wholesale move into public cloud has a strong business case.

Choose your hybrid operating model carefully

For banks operating in the hybrid environment, there are various potential operating models. Multi-cloud involves different independent operating teams on disparate platforms, operating in private cloud and in public cloud. The optimal model integrates everything with a single set of technology and a single set of processes under a cloud management orchestration leader. It gives you the advantage of an integrated system, but it’s much more difficult to get right. Building and managing the orchestration layer demands a lot of complex integration work. Most banks choose the multi-cloud option as it’s easier to get up and running quickly, and they simply live with its awkwardness.

Supercharge your cloud program

It’s good to be ambitious, but you also need to be practical. So how can you supercharge your cloud program? Start with two basic questions:

- Where can you adopt software as a service (SaaS)?

- Where can you move data decoupled from applications?

Figure out where your friction points are so you can move some workloads more quickly. Once you make progress, you can tap into the innovation of cloud providers to create more momentum and move over more workloads.

Also, in this new environment, tech executives will be managing a portfolio of applications that have different architectural characteristics and “readiness” to move to cloud. This requires the right infrastructure, so data can be delivered in a multi-cloud environment. The team needs to build out the management and orchestration layer to manage different platforms off a “single pane of glass” and upskill developers on the team.

Focus your build on driving business value

The story of banking in the cloud is shifting towards a value story—how can you monetize your data and provide more end-to-end value for your customers? Corporate strategists for large and mid-size banks recognize that to drive growth, they have to realize competitive advantage by monetizing and building intelligence from their massive store of data about their customers. Hence the rush to move data and analytics to public cloud. If banks integrate data on the cloud, apply analytics, and look at customers in a 360° view across large data sets, they’ll find it easier to gain customer insight, and generate value down the road.

Think of cloud as an ongoing story

Services in the cloud are going to be continuously evolving, and banks will want to capitalize on the advances. That will drive continuous work. Pure private cloud will ultimately fade. Banks will continue to run some applications on private cloud as a portfolio play as they transition over time. But public cloud offers the promise of innovation, scalability, and elasticity. Therefore, there will be an ongoing need to decouple and move core systems over time to public cloud.

There is no end point. This is a new way of working and a new way of operating that all banks will have to embrace.

OTHER VOLUMES

Banking Cloud Altimeter

Our digital magazine compiles the latest developments in cloud banking.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world's largest network of Advanced Technology and Intelligent Operations centers. Our 569,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities.

Visit us at www.accenture.com.

For more information on Accenture Banking Cloud Services visit: www.accenture.com/BankingCloud

Have your own question?