Other parts of this series:

In the first post in this series on data-driven mastery in banking Four ways data can improve banks’ bottom line, I discussed the many ways that data can help a bank’s bottom line. But for data-driven insights to propel growth for commercial banks, the data needs to be analyzed using machine learning or AI, and the insights that emerge need to be put to use in support of the bank’s business goals. Data that sits trapped in monolithic databases or organizational silos has limited value. Releasing that data to be used across the business as part of a larger strategy can unleash its full value and its transformative power.

When that transformative power is made directly available to all of your business units, rather than being filtered through data specialists and stalled in data-servicing bottlenecks, growth can accelerate. This requires that you implement tools that make your data easy to access and draw insights from, and empower your employees in various business units to master those tools to become sophisticated “citizen data practitioners.”

Commercial Banking Top Trends in 2023: Explore the 6 critical trends every commercial banker should consider as they plan for the year ahead.

LEARN MOREWhere is your data hiding?

Banks collect a huge amount of data about their customers, but they may not be tapping into all of these resources and using them to drive the business. Data strategies that encompass a broad range of data sources from within the bank and from third parties can offer the greatest insights and the most value.

Here are some of the sources that banks can draw from to support their business strategy:

|

Firmographics |  |

Dormant and little-used accounts |

|

Customer transactions |  |

Web crawling data |

|

Credit histories |  |

Wallet share insights |

|

Customer retention and engagement |  |

Customer satisfaction surveys |

|

Uptake of new or bundled products and services |  |

Purchased third-party data |

|

Subscriptions and unsubscriptions |  |

Open data |

50% of banks rank accessing data from multiple sources as one of the top three challenges to implementing their AI strategy.

Accenture: Data-driven mastery in commercial banking

How do you make your data work for you?

Some banks make the mistake of thinking that data-driven analysis is a technical project, unconnected to their core business. But to really put data to work, banks should do more than simply gather the data and then try to figure out how to use it—they should be driven by their business strategy and innovative thinking. Business strategies should determine which new AI and data platforms are deployed to create added value—the technology shouldn’t be built first in the hope that adoption will follow and generate useful applications.

Banks that evolve their data strategy and data culture will benefit the most. When data from all sources can be gathered, accessed and analyzed, it will create a complete and accurate view of the customer. This view can only emerge by breaking down the silos that make the generation of data-powered insights slow, expensive and inefficient. Unfortunately, siloed ownership of data is still common, and data is often handled mainly by engineers who specialize in technology, not business strategy.

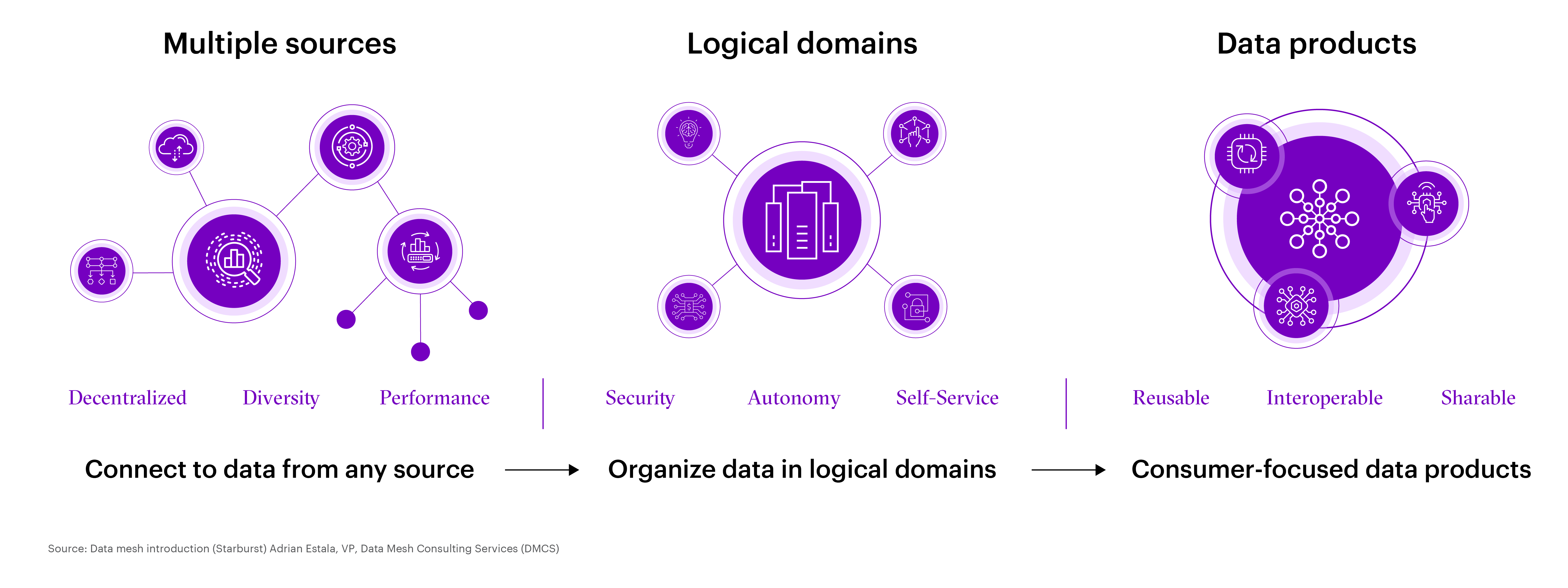

Instead of relying on centralized data pools, banks can implement a “data mesh” that lets their employees connect to data from multiple sources. The data can be organized into logical domains that reflect the bank’s business needs rather than technical categories. Once a defined governance and access control structure is in place, banks can “democratize” their data by allowing each business unit to access the data mesh and take greater ownership of the quality and value of the data relevant to their domain.

The potential value of democratized, ready-to-use, trusted data products is tremendous and compounds with time. The hours saved by not having to find and transform data for a specific need can instead be channeled into solving the actual problem. Business models created out of the data by one business unit can then be used to solve related problems in other areas of the business. This saves time, money and brainpower by not duplicating efforts or trying to reinvent the wheel within each business unit.

What opportunities are hidden in your data?

Unleashing the power of your data can provide value in almost limitless ways. The only barriers, then, are the mindset of your employees and the data culture at your bank. If data is put to work in support of innovative, growth-focused business models, it can unlock opportunities and help ambitious plans to succeed. Here are just a few of the things that democratizing data can help a bank to do:

- Find new prospects and focus on promising leads

- Predict customers’ needs before they even realize they need something

- Discover pain points where customers are slipping away

- Assess risk early to avoid sunken costs and bad debt

- Pinpoint optimal pricing for products and services

Banks that have progressed further in terms of data maturity are achieving a 61% average return on investment.

Accenture: Data-driven mastery in commercial banking

How can every banker become a data scientist?

A well-designed data mesh can turn a bank’s immense pool of data into a kind of self-service hub that functions as a data marketplace. Users within the bank can then access the data they need to create insights and solutions that support their business goals.

To build this user-friendly framework, banks need to think modularly and embrace APIs and federated governance. The bank’s technology infrastructure should be separated from its data infrastructure. Using this modular framework can accelerate the adoption of a data-driven culture—different tools can be plugged into the framework to help users leverage the data products and models as they tackle their specific business problems.

The users trying to create new business solutions no longer need to be bogged down by heavy coding and complex processes for acquiring and using the data they need. Using low-code or no-code (autoML) platforms, citizen data practitioners (such as relationship managers, credit decision-makers and other bank employees) can create their own machine learning models, leveraging their domain knowledge to solve a business need. With these citizen data practitioners empowered to build high-value, low-complexity machine learning solutions, the bank’s expert data scientists will be free to focus on the most complex and impactful solutions. Banks that adopt this type of data-driven culture can harness the transformative power of data and machine learning at scale.

To learn how to set your data free, contact me here. To learn more, read the full report, Data-driven mastery in commercial banking:

Read reportThank you to Robert Atuahene for contributions he made to this blog post.