Other parts of this series:

In the first post in this series, we looked at the major trends driving disruption in payments today. This time, we’ll look at how these trends will actually impact the industry by geography and by payments instrument.

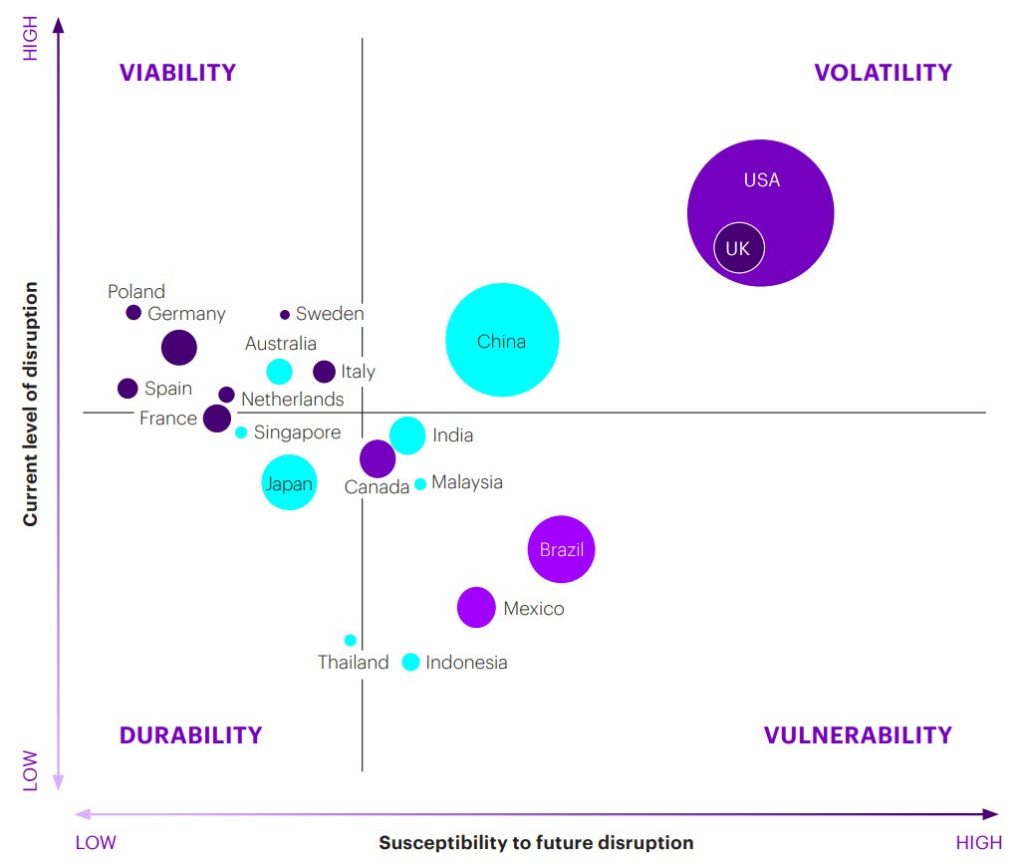

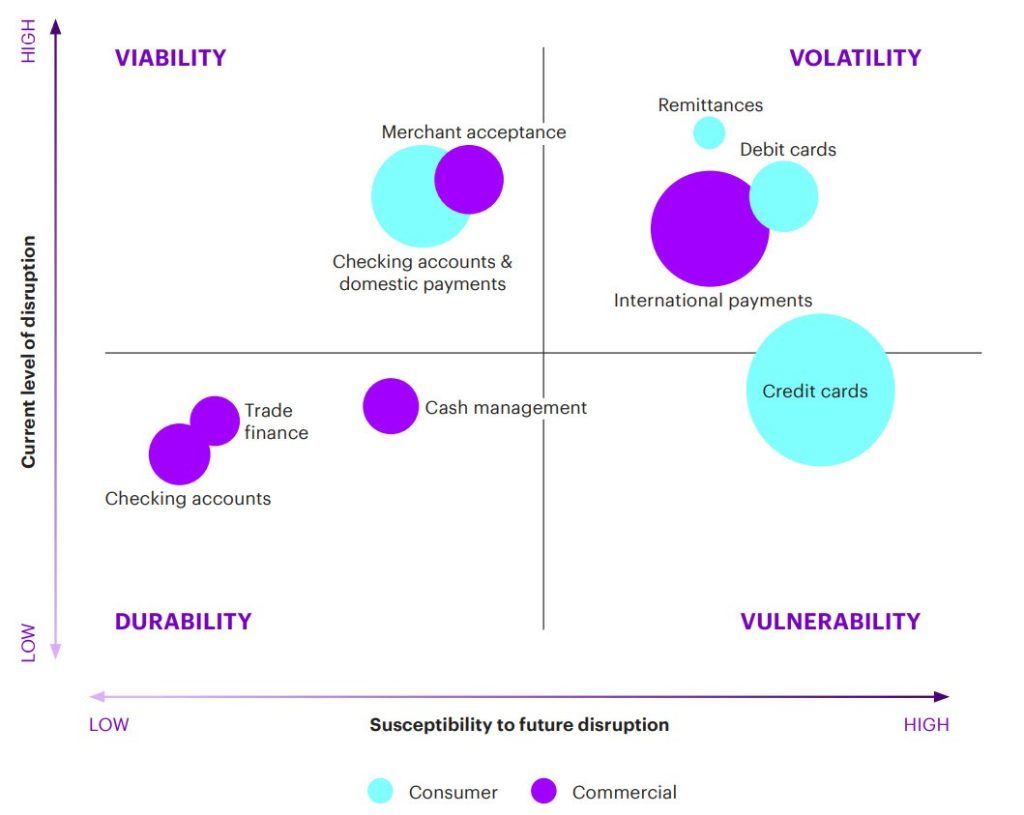

The findings presented here all come from the new Accenture Payments Disruptability Index, which was created through analysis of data from five pillars: the presence and penetration of disruptors; the performance of traditional players; customer readiness; the innovation ecosystem; and regulation and infrastructure.

The index gives every market and every payments instrument two scores: current level of disruption and susceptibility to future disruption. Plotting each market and each instrument makes comparisons between them simple and intuitive. These graphs illustrate the four categories of disruptability:

- Volatile markets and instruments are those that are experiencing significant disruption right now and are also highly susceptible to future disruption.

- Viable markets and instruments are those also experiencing significant disruption now, but which expect low levels of future disruption.

- Durable markets and instruments are those with low current disruption and little expected in the future. (As you might have guessed, there aren’t many of these.)

- Vulnerable markets and instruments are those experiencing little disruption right now and high susceptibility to future disruption.

We’ll look first at how this breaks down across geographies.

Disruption by geography

The immediate takeaway from this side of the index is that payments in the two biggest economies in the world—the US and China—are both in the Volatile category.

The UK’s high volatility, meanwhile, is partly explained by London’s strong, well-funded innovation ecosystem, which has enticed neobanks and fintechs to set up shop. There is also a favourable regulatory environment, with the Financial Conduct Authority driving initiatives like open banking and sandboxes.

Outside of the UK, it’s interesting to note that Europe’s mature markets are rapidly settling into viability. Banks in Sweden, Germany and Poland, for example, worked together to innovate and were successful in consolidating their market position and staving off would-be disruptors. The Polish bank BLIK reached an impressive 60 percent market share for e-commerce in Poland in 2020.

Another major theme is that the world’s biggest emerging markets—Brazil, India, and China again—are highly vulnerable to disruption in the future. This is generally driven by younger populations and more unbanked consumers, who are eager adopters of disruptive solutions. In India, which had about 190 million unbanked people in 2017, twice as many payments are already made via mobile wallets than by card.

China’s susceptibility is mostly driven by low penetration of credit cards. This created an opportunity for bigtech to leapfrog cards with convenient mobile payments solutions designed for e-commerce—for example, Alibaba’s Alipay. Young, tech-savvy consumers soon started using these mobile solutions in-store as well. Incumbent banks have yet to respond effectively.

Disruption by product

The headline takeaway here is that debit cards, remittances, and international payments—pillars of the payments industry—have all already seen significant disruption. Yet they remain susceptible to more in the future. This is mostly because they face serious competitive threats in the marketplace. Stored-value accounts, account-to-account (A2A) payments, and mobile wallets from big techs and fintech players are growing at the expense of debit cards, for instance.

These solutions are attractive to consumers because they eliminate the requirement to insert a long card number to make a payment or remove the need for a card. PayPal was a pioneer with stored-value accounts, while A2A payments providers like Swish in Sweden and iDEAL in the Netherlands are displacing cards and account for the majority of consumer transactions in these markets. Further disruption is likely to be driven by open banking, PSD2 regulation and similar regulations around the world.

Credit cards, meanwhile, straddle the line between Vulnerability and Volatility. Disruptors are challenging traditional models with credit at point of sale (POS) products that offer payments in instalments. This more transparent alternative is finding favour among younger and more cautious consumers. Also, compression of interchange in many markets is making it harder to fund the generous reward and cashback programmes that can make credit cards so attractive to consumers.

The three instruments in the Durability quadrant all have interesting common attributes. Banks have, so far, fended off challengers seeking to disrupt these markets with products such as blockchain in trade finance.

Unlike retail e-commerce, trade finance has yet to be digitised with many transactions still being predominantly paper-based, and until that happens, there is limited scope for digitising payments. The incumbents’ success is also explained by their strong customer relationships and the complexity of the market, which make the barriers to entry higher for prospective competitors.

Finally, the Viability section of this graph is occupied by instruments from which incumbent banks may be said to have tactically retreated. For example, non-bank players have achieved a global market share of around 60-70 percent in merchant acquiring because many banks shed this business to focus on markets they considered to be more core and strategic.

So what’s next?

In conjunction, these graphs point to an industry in the midst of sustained turmoil. For most of the world of payments, the only thing we can say with certainty is that tomorrow is unlikely to be like today.

In the final post in this series, we’ll go over three plays for the future of payments.

I invite you to read the full Payment Disruption report to find out more.