Point-of-sale (POS) financing is one of the most interesting and dynamic areas of payments innovation today. Disruptive new entrants and macroeconomic trends are driving real change across the market. The ‘buy now, pay later’ (BNPL) sector is of particular interest here.

The difference between BNPL and older POS credit offerings is that with BNPL the risk of the credit is absorbed entirely by the credit provider. It can only be offered through the application of innovative, data-intensive digital technologies and underwriting techniques.

But the payoff is a uniquely smooth checkout experience for the customer. This experience is undeniably popular.

The number of retailers in the UK using BNPL services has jumped in recent years. In 2021, BNPL payments here are projected to grow by 41.8% and reach $8.3 bn US in 2021. A survey at the end of last year concluded that the gross merchandise value of BNPL will surge by 42% over the 12 months to reach just under £6 billion in 2021, and will continue at a CAGR of 12% through to 2028. Globally, Adobe reports that BNPL experienced 215% year-over-year growth in the first two months of 2021.

Leading BNPL firms are attractive targets for acquisition. For example, Square announced an agreement to acquire Australian BNPL startup Afterpay to acquire Australian BNPL startup Afterpay for £21 billion. This would represent a 30% premium on Afterpay’s market cap.

Other payments players are now considering launching their own BNPL propositions in the market. PayPal recently did, for purchases over £2,000. Anyone planning such a launch should keep a close eye on key trends:

- Fintechs are currently winning the market. Klarna, a BNPL specialist, is now one of the the most valuable private fintechs in Europe with its recent post-money valuation of $45.6 billion.

- COVID-19 has tightened consumer wallets. The economic fallout of the pandemic will likely grow market demand for a line of credit that doesn’t require a credit check or increase basket costs.

- Regulator scrutiny is increasing. The UK’s Financial Conduct Authority announced its intent in February of 2021 to regulate BNPL with legislation “as soon as parliamentary time allows.”

Given these trends, one of the biggest risks for a traditional payments player launching a new BNPL experience is that it falls short of customer expectations. Fintechs like Klarna and Clearpay offer 0% interest, quick and easy onboarding, and full support for third-party branding. They also don’t require a credit check. Many incumbent offerings to date have variable interest, legacy banking onboarding, and require credit checks. They are also bank-branded.

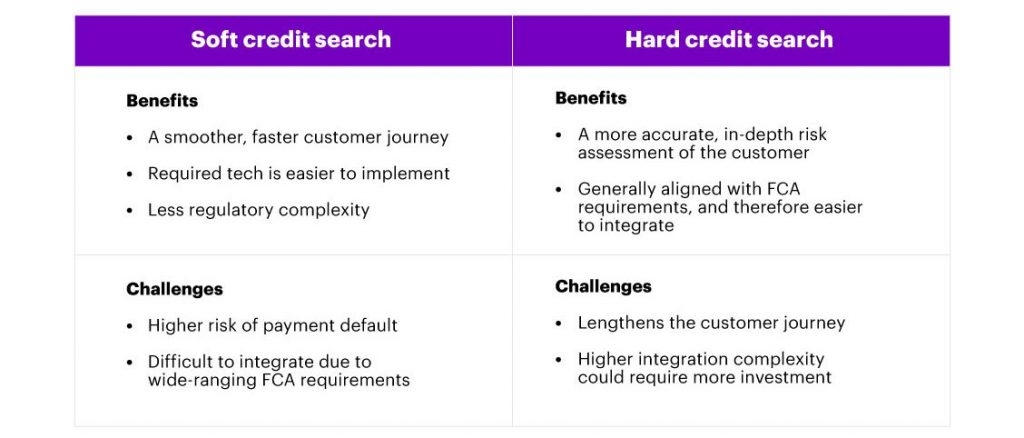

But one of the most important differences between BNPL fintechs and incumbents is their appetite for credit risk. Klarna uses a “soft” credit scoring approach for its “pay in 30 days” and “pay in 4 interest-free instalments” options—essentially taking on the risk of the customer’s financial viability in exchange for an improved customer experience.

The alternative is a “hard” credit scoring approach that comes with its own advantages and drawbacks from the perspective of an incumbent.

This is not to say that an incumbent bank cannot or should not jump into the BNPL space. But if it wants to build a product that can truly go head-to-head with the current market leaders, it will need to ask itself hard questions about its appetite for risk and investment.

The good news is that BNPL is not the only part of the POS financing world that provides opportunities. Incumbents may be better served by targeting the post-transaction instalment section of the value chain, or by building digital lending platforms.

If you’d like to talk about POS strategy at this exciting moment, I would love to hear from you on LinkedIn.